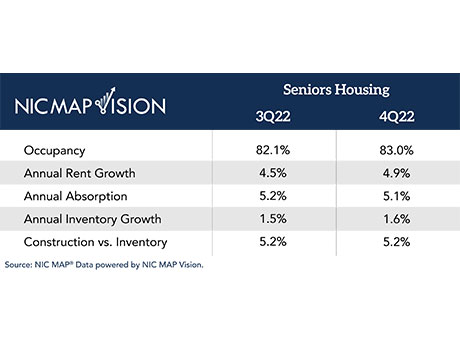

ANNAPOLIS, Md. — The national occupancy rate for private-pay seniors housing increased 90 basis points from 82.1 percent in the third quarter of 2022 to 83 percent in the fourth quarter of 2022, according to data from NIC MAP Vision. The occupancy rate has increased 520 basis points from a pandemic low of 77.8 percent in the second quarter of 2021.

NIC MAP Vision is a product of the National Investment Center for Seniors Housing & Care (NIC), an Annapolis-based nonprofit firm that tracks industry data gathered from 31 primary metropolitan markets. Private-pay seniors housing comprises independent living, assisted living and memory care.

The seniors housing occupancy rate increased for the sixth consecutive quarter due to continued strong demand that outpaced inventory growth. Because new inventory has been added during the pandemic, however, the occupancy rate has not yet reached pre-pandemic levels, according to NIC.

On the inventory side, about 3,300 units were added within the 31 NIC MAP Primary Markets during this quarter, while more than 8,600 units were absorbed on a net basis. This robust demand led to a new record high total number of occupied units: within the NIC MAP Primary Markets, the total number of occupied units exceeded 574,900, surpassing its pre-pandemic first-quarter 2020 level by nearly 7,000 units.

“More older adults than ever before are now residents in seniors housing properties, which speaks to the tremendous need for seniors housing and care services,” says Chuck Harry, NIC’s chief operating officer. “The demand from aging adults seeking seniors housing and care is on the rise, and the industry continues to meet that need.”

The trend of high demand and slow inventory growth has been consistent throughout 2022. Fewer than 11,000 units were added within the NIC MAP Primary Markets last year, the weakest inventory growth since 2014. This contrasted with robust demand, with net absorption for the year registering a record 27,845 units. Combined, these conditions allowed the occupancy rate to rise 260 basis points since the beginning of 2022.

Construction starts were relatively weak at 3,013 units in the fourth quarter, continuing the slower pace seen in the third quarter. Total units under construction equaled 35,719 units, the fewest units under construction since 2015. For 2022, starts totaled 14,665 units, weaker than in 2021, but stronger than in 2020.

“Development activity slowed sharply in the second half of 2022 as the rise in interest rates and a more stringent lending environment slowed loan issuance,” says Beth Burnham Mace, NIC’s chief economist. “With higher interest rates expected in the early months of 2023, slower development pipelines are likely to continue, which could continue to impact inventory growth and therefore positively affect occupancy rates.”

To read the entire quarterly report, click here.