ATLANTA — One of the central questions of the investment panel at InterFace Seniors Housing Southeast was: Will transaction activity return in the fourth quarter?

When Brooks Blackmon, panel moderator and executive managing director of Blueprint Healthcare Real Estate Advisors, asked the question, there was a quick response from the panel — “no.”

“Return to what?” asked Kelly Sheehy senior managing director of Artemis Real Estate Partners. “Higher than today? Yes. Compared to 2019? No, it’s going to take time.”

InterFace Seniors Housing Southeast is an annual conference hosted by France Media’s InterFace Conference Group, Seniors Housing Business and Southeast Real Estate Business. The event was held on Wednesday, Aug. 16 at the Westin Buckhead Atlanta hotel. Blackmon moderated the discussion.

The panelists agreed that the fly in the ointment that has stifled investment sales the past few quarters has been the rapid runup in interest rates. The 10-year Treasury yield was at 4.3 percent at the time of this writing, which is the highest level since 2007. The secured overnight financing rate (SOFR) and federal funds rate, two short-term benchmark interest rates, have risen by more than 500 basis points in roughly 16 months.

“Until debt markets improve, you’re not going to see a significant uptick in transaction activity,” said Curtis King, executive vice president of HJ Sims.

Blackmon said valuations are tough to pin down as well because of how fast interest rates can rise.

“When trying to price a deal in the past 12 months, you may have been right in October but it’s wrong by December,” he said.

“Value can change during the sale process,” added Sheehy.

What needs to change?

Panelists agreed that sellers are now starting to meet the market in a way they haven’t previously. Instead of holding onto “yesterday’s prices,” owners are doing their due diligence before bringing their assets to market. The result is that the proverbial bid-ask spread between buyers and sellers is narrowing.

“The bid-ask spread has collapsed significantly, if you’re a seller,” said Sheehy. “If there’s an asset out on the market, [the seller] has gotten a number of BOVs (broker’s opinion of values). They’ve heard about the market, they’ve seen recent comps and they’ve adjusted expectations.”

Steve Blazejewski, managing director of PGIM Real Estate and portfolio manager of the company’s seniors housing strategies, used the term “submission” when characterizing how sellers are viewing the current landscape.

“There’s now been a submission in the market,” said Blazejewski. “They’re realizing this whole ‘higher for longer’ [for interest rates] is legitimate.”

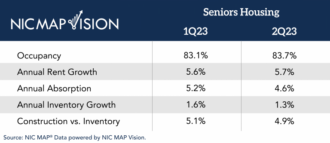

In order for more deals to transact, property-level performance needs to improve to attract the requisite stable of potential buyers. According to data from NIC MAP Vision, seniors housing occupancy is at 83.7 percent in the second quarter. While below the larger multifamily sector in terms of occupancy, this represents a 60-basis-point improvement from the previous quarter and a 500-basis-point rise from two years ago.

When looking at subsectors of the seniors housing continuum, the occupancy rate for assisted living increased by 80 basis points quarter-over-quarter, independent living grew by 30 basis points and nursing care properties improved by 60 basis points.

With improving occupancy, landlords are also able to push rents. Annual rent growth sat at 5.7 percent in the second quarter, according to NIC MAP Vision.

“We see 6 to 10 percent rent growth on average,” said Scott Corbin vice president of AEW Capital Management. “We may be able to return to pre-pandemic margins with one or two more years of 5 to 7 percent rent growth.”

“We’ll be able to drive rate increases for Class A properties over the next 12 to 24 months,” added King. “That’s a better time to go out and sell. The underlying operating performance will be better, and hopefully the capital markets will be better as well.”

Blazejewski said that tying rental rates to inflation is a practical way that seniors housing landlords have been able to improve their net operating income the past few quarters.

“The ability to raise rents will be softer so we need to strike while the iron is hot with respect to inflation,” he said. “A 9 percent rate increase is easier to sell to an adult child when inflation is at 9 percent because it makes sense. If inflation is at 3 percent, it’s going to be a lot harder to do that.”

Besides better fundamentals and realistic pricing, the panelists said the No. 1 factor will be that capital markets need to settle to remove uncertainty for buyers and sellers alike. Additionally, lenders, namely banks, need to come off the sidelines.

Corbin said that banks have largely excused themselves from the equation due to the seniors housing industry’s exposure during the COVID-19 pandemic and its relatively poor property-level performance recently.

“Banks have kicked the can [down the road] the past three years,” said Corbin. “We’re starting to get more calls from our banking relationships wanting to essentially get out of their assets and see what value is there.”

Sheehy said right now that banks view the seniors housing asset class as a “pimple” on their balance sheets.

“Something is going to have to happen to shake them loose on the banking side,” said Sheehy.

Investors look ahead

The panelists took a long-term view when assessing the health of the seniors housing real estate market. Since the COVID-19 pandemic and the recovery, the sector has taken a few years to heal and will take a few more years to normalize once interest rates plateau.

“’Survive til ’25’ is what we’re saying internally,” said Corbin. “We won’t’ find the bottom of the market until rates flatten out.”

Blazejewski said that PGIM Real Estate has a two- to three-year outlook on when seniors housing will turn the corner.

“You’ll see the market changing but it’s going to take a while,” he said.

Blazejewski also said that the health of the sector may not come around until the office market improves.

“The office market is dragging our sector down,” said Blazejewski. “Institutional investors have liquidity issues because of the office sector, which is in far worse shape than ours, to be fair. Until that settles, we’re going to be pressured for a while.”

King said that the theory among seniors housing operators is that 2024 and 2025 will represent a golden age of seniors housing investment because construction has been limited in recent years and demand will rebound.

For what it’s worth, Blazejewski said that 2023 is a far cry from the sector’s golden age.

“People are probably going to hate to hear this, but I’ve been telling our investors internally that now is the absolute worst time in my career to be selling seniors housing assets,” said Blazejewski.

— John Nelson