The high quality of life and relatively low cost of living in Richmond, coupled with sustained investment in live-work-play infrastructure, has led to population growth and a surge in investor interest in the city. The job market is showing strong signs of recovery with an unemployment rate of 3.2 percent, which is 40 basis points below the national average.

Although office-using employment remains elevated at 3 percent from pre-pandemic levels, office vacancy rates remain relatively stable at 11.2 percent.

Live-work-play rules the day

Richmond has become a hot spot for millennials, boasting a low cost of living, high quality of life and amenity-rich neighborhoods. While the broader Richmond market has recorded 10 percent population growth since 2010, key submarkets in the urban core are growing at a faster pace, with Scott’s Addition recording 23 percent population growth during the same period.

Developers have capitalized on this increased demand for city living, building out the urban core with multifamily and mixed-use developments in trendy submarkets. Scott’s Addition and Manchester — which have more breweries per capita than any other neighborhood — have added a combined 3,000 apartment units in the last five years, with an additional 1,300 units currently under construction.

Given the influx of talent to the area, office developers have chosen these neighborhoods as the locations for the few recent office deliveries in the market. Sauer Properties’ renovation of 2220 W. Broad St. delivered 123,000 square feet of creative office space to Scott’s Addition in 2021 and was quickly leased by Carmax, which will use the site as its “Innovation Hub.”

Bordering Scott’s Addition, The Kinsale Building delivered at 2035 Maywill St. in 2020. Kimley-Horn recently moved into the second floor, while Kinsale Capital occupies the remainder of the property.

In Manchester, Lynx Ventures’ mixed-use project at 400 Hull St. delivered in January 2022, providing 66,000 square feet of office space, 14,000 square feet of retail space and more than 200 apartment units. Koalifi (formerly West Creek Financial) preleased 35,000 square feet at the development, with plans to relocate and expand from suburban Innsbrook.

Additionally, 1802 Semmes Avenue, a 35,000-square-foot adaptive reuse project, is scheduled to deliver this quarter in the Manchester-adjacent Hull Street Corridor. The development will serve as the new headquarters for Vytal Studios, a virtual reality education tech company relocating from Austin.

Foreign investors

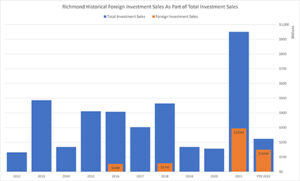

The lack of speculative development in Richmond has contributed to record-breaking investment sales. Last year, Richmond recorded a record-high $950 million in investment sales, nearly doubling the previous record that was set in 2013.

Of note, foreign investors have accounted for 38 percent ($445 million) of total investment sales since 2021. Given the city’s economic resilience and growing appeal with millennials, foreign investors have seized the opportunity to purchase stabilized trophy assets in a market that has seen increased flight-to-quality since the pandemic.

Notable sales include Gulf Islamic Investments’ $87 million purchase of the Glen Forest Office portfolio from Brookfield Properties; an 11-building portfolio of Class A, B and medical office properties in the Glenside/Broad submarket that is 86 percent leased; and Qatar First National Bank’s $150 million purchase of Gateway Plaza for $456.51 per square foot. Located at 800 E. Canal St., the LEED Gold-certified building is situated in the heart of downtown and is 96 percent occupied.

On the horizon

Sustained demand for mixed-use, amenity-rich environments will continue to fuel Richmond’s development plans over the next five years. The city is expected to select a redevelopment plan for the Diamond District in the coming months, setting the stage for a new baseball stadium and greenways, in addition to office, retail and residential space.

Henrico County has approved Green City, which could break ground as early as next year. At completion, the environmentally sustainable “eco-district” will include 2 million square feet of office space, 2,400 housing units, two hotels, a $250 million arena and a network of trails and green spaces.

Additionally, existing tenants in Richmond are expanding their footprints and developing new mixed-use space. CoStar Group will build a new office tower and a multi-use building as part of its research and technology campus in downtown Richmond, expanding its current footprint by 750,000 square feet. The new mixed-use hub will bring more than 2,000 new jobs and a slew of amenities to the market. Genworth also plans to replace its 46-acre campus at 6620 W. Broad St. with a revamped mixed-use campus, which is anticipated to complete by 2025.

With a recession looming, Richmond and the rest of the country will likely face near-term economic challenges. However, the city’s historic resilience and mixed-use approach to development and new infrastructure should allow for stability in the market. Richmond will remain an attractive market for investment capital as it continues to transform its urban core into a live-work-play environment in the coming years.

— By Chris Wallace, Senior Vice President, and Michael Roberts, Analyst, CBRE. This article was originally published in the August 2022 issue of Southeast Real Estate Business.