As someone who has closely observed retail trends in the Southeastern United States for decades, I’ve witnessed the inevitable ebb and flow of the industry. From periods of rapid expansion to challenging market corrections, and of course, global pandemics that disrupted every sector of real estate, it often feels as though I’ve ‘seen it all.’ Once again, I find myself watching the market adjust, particularly among big-box retailers, in high-growth areas like Raleigh. This ongoing shift signals both challenges and opportunities, reminding me of the resilience and adaptability required to thrive in this dynamic environment.

When news broke in September that Big Lots Inc. had filed for Chapter 11 bankruptcy protection and that it would be closing more than 300 stores across the country, it wasn’t all that shocking, given the sheer number of Big Lots that one comes across just driving across their own towns. The Big Lots announcement follows similar moves by companies such as rue21, Express, The Body Shop, 99 Cents Only Stores, LL Flooring, Conn’s, and Red Lobster. Retailers like Rite Aid and Bed Bath & Beyond, which filed for bankruptcy last year, have closed hundreds of stores, causing vacancies in the retail real estate market.

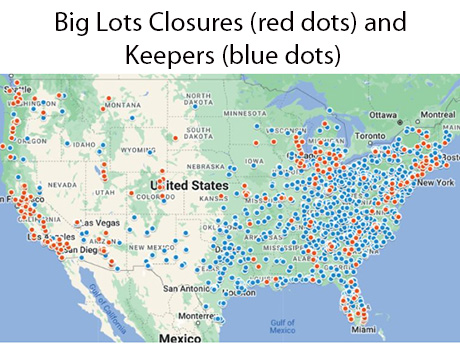

But instead of feeling a sense of gloom over the latest big-box retailer to announce store closings, I couldn’t help but ponder that maybe this is just another example of the market “right-sizing” alongside current consumer demand. A LinkedIn contact noted a similar sentiment, and shared a graphical representation of the footprint that Big Lots (see graphic above) had secured over time (red dots), overlayed by those stores that they — at least presently — planned to keep open moving into the future (blue dots).

It’s not difficult to conclude that Big Lots had oversupplied the market. As one can see, there are still plenty of remaining blue dots where consumers can get their bargain shopping fix.

From the perspective of a retail broker who has watched vacancy in my market tighten as population growth and urban development are on the rise, the added supply being left by vacated Big Lots stores is welcome news. According to Costar, the average retail vacancy rate has fallen to about 4 percent, one of the tightest positions on record. For our Foundry Raleigh Retail team’s current local listings, we only have one anchor space available and that was due to Sam Ash Music bankruptcy.

It has become commonplace that there are multiple competitive offers for new retail vacancies in our market. I know that’s not the case in every market across the country, but particularly in Sun Belt markets where Foundry operates, our retail brokers are coming up against this challenge regularly.

The Chapter 11 filing of Big Lots and a wave of retail bankruptcies have signaled a shift in the U.S. retail landscape, particularly in oversaturated markets where competition and economic pressures are forcing many retailers to reevaluate their footprints.

However, in Raleigh, the retail environment tells a different story. With limited vacancies and a highly competitive market for retail spaces, the area has remained a hub of demand, attracting retailers eager to secure prime locations. For retailers and developers, the key to thriving in this evolving landscape lies in flexibility, right-sizing operations and conducting thorough market research.

The availability of prime leases, such as those left by Big Lots, presents a unique opportunity for retailers seeking expansion into high-growth areas. Retailers looking to enter the Raleigh market should prepare for fierce competition but can benefit from the strong consumer base. Developers, in turn, can capitalize on the scarcity of retail space by crafting adaptable, multi-use properties that cater to the evolving needs of both retailers and consumers.

In conclusion, the larger retail market across the Southeastern United States appears to be undergoing a necessary right sizing, with the recent bankruptcy filing by Big Lots serving as the latest indicator of this trend. As the region continues to evolve, retailers are reassessing their footprints, and those unable to adapt are facing challenges.

However, the demand for well-located retail space in high-growth markets remains strong, signaling opportunities for businesses that are flexible and forward-thinking.

— By Julie Augustyn, senior vice president of Foundry Commercial. This article was originally published in the October 2024 issue of Southeast Real Estate Business.