By Taylor Williams

If inflation was the story of 2022, then basic economic theory dictates that interest rate hikes and their subsequent impacts will be the featured issue of 2023.

For when it comes to whipping inflation, the Federal Reserve only has so many tools in its kit. The nation’s central bank can raise reserve requirements for lenders and sell Treasury notes all day long, but nothing has as direct and powerful of an effect on the monetary supply as movement in short-term interest rates.

Simply put, higher interest rates discourage borrowing activity, which reduces the amount of money circulating in the system. In the past 12 months, the U.S. economy has seen no fewer than seven rate hikes totaling 425 basis points, with the Fed indicating that more increases are on the docket for 2023.

Much like severe inflation itself, the rate hikes that inevitably follow rampant price escalation tend to touch nearly every facet of commercial real estate. Developers and investors respectively face higher interest rates on construction and acquisition loans. Brokers must adjust prices on properties they’re listing for sale or rent in response to these variables. End users tend to be somewhat insulated from these impacts, but their own operating and occupancy costs remain stressed, as a year’s worth of rate hikes has yet to bring the rate of inflation under 7 percent. In normal economic times, the Fed typically targets an annual inflation rate of 1 to 2 percent.

Though it tends to be a lagging indicator, commercial real estate is nonetheless a bellwether for broader economic performance. So for all the aforementioned reasons, commercial real estate professionals of all walks and backgrounds who participated in Texas Real Estate Business’ annual forecast survey believe that the impacts of interest rate hikes will influence deal volume and project activity more than anything else in 2023.

The survey was broken down into separate questionnaires for brokers and developers/owners. The initiative also included a third survey for lenders (see pages 18-19 for a detailed synopsis on the findings of the this survey).

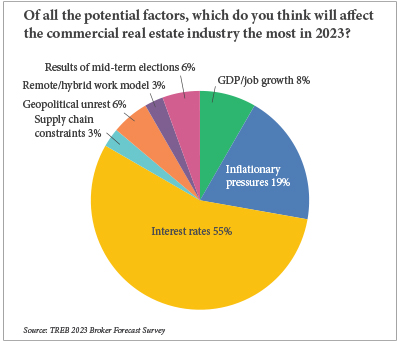

In each survey, participants answered a question in which they were asked to identify the macroeconomic variable that was likely to have the greatest impact — whether positive or negative — on the industry in 2023. Respondents were given a choice between GDP/job growth, inflationary pressures, interest rates, supply chain constraints, geopolitical unrest, remote/hybrid work and the results of the 2022 mid-term election.

Of the brokers who completed the survey, more than half cited interest rates as the most influential factor. In a follow-up question, 58 percent of this group indicated that they expected the U.S. economy to tip into recession in 2023 — though according to the traditional definition of two consecutive quarters of negative GDP growth, that outcome already materialized in 2022.

For the first time in more than five years, the majority of broker participants (50 percent) said that they expected their firm’s total leasing and investment sales volumes for 2023 to be lower than those of 2022. About 40 percent went the other way, projecting higher forecasts for the new year.

Given how inflation continues to harshly impact tenants’ operating costs, thereby narrowing the margin by which owners can expect to push rents on their occupants, this finding reflects a sliver of optimism for tenants in an otherwise dismal outlook. This piece of data is also surprising due to the fact that brokers are a traditionally optimistic bunch.

It all adds up to a sobering reality for the state of the industry: The net effect of interest rate hikes in response to inflation will likely ripple through the industry strongly enough to dismantle it.

Why Interest Rates?

Participants in both surveys were also invited to share written analysis of what they viewed as the biggest source of challenge and/or opportunity for the industry in 2023. A response from Connor Lee-Wen, an acquisitions associate at Austin-based development and investment firm Casoro Group, shed light on why interest rates and their impacts are more concerning that other macroeconomic factors.

“As a multifamily owner-operator, we’re aware of the effects of inflation and supply chain issues, but we feel that the impacts of those factors are smaller than those of interest rates,” he wrote. “Rising costs and delays related to supplies for renovations, other capital expenditures and development have certainly affected business plans, but the rising cost of debt changes the ability to get the deal done in the first place.”

In other words, interest rates represent the first obstacle that must be overcome on the lengthy list of challenges that come with building, owning or buying commercial property in the current market. If that first domino fails to fall, the deal or project likely dies on the spot.

Conrad Madsen, co-founder and partner at Dallas-based brokerage firm Paladin Partners, noted that the unprecedented surge in interest rate hikes has generated major uncertainty throughout the industry. This uncertainty extends to all property types and across all levels of the business, making it the most impactful economic force on the horizon in 2023, he said.

“We have never seen interest rates hikes to this extent in a calendar year. As a result of this uncertainty, nobody can underwrite deals, as [parameters] seem to change monthly, if not weekly,” Madsen wrote. “The Fed needs to be very careful about how long it allows interest rates to sit this high. Real estate markets, especially residential, are getting crushed right now, and the longer rates sit at these levels, the more severe a recession will be.”

Madsen padded his initial analysis with the widely accepted notion that “cash is king” during recessionary times, noting that owners that have maintained the greatest levels of liquidity heading into 2023 will have a strong advantage in winning new deals.

“There is an adjustment in pricing that is occurring due to increased borrowing costs, and the challenge is that we don’t know how far the Fed will raise rates in order to see the results they are looking for in inflation and job numbers,” concurred Bob Moorhead, managing partner at Secure Net Lease, a brokerage firm with offices in Dallas and Los Angeles. “This uncertainty is causing many to sit on the sidelines until they have a better sense of the market.”

In their free-response commentary, some brokers were quick to invoke the notion that the interest-rate factors not only start, but also end with the lending side of the business. That is to say, rate hikes of this magnitude, which not only discourage new borrowing, are likely to create more defaults on existing loans held by commercial owners.

“In terms of investment properties, the biggest challenge involves loans that are coming due and were originated at 3 to 4 percent interest rates and that must now be refinanced at 6 to 8 percent,” wrote Jennifer Pierson, managing partner at Dallas-based brokerage firm STRIVE.

“Lenders will require significant paydowns of those loans, as values of properties will have decreased and debt coverage ratios will be lower,” Pierson continued. “Borrowers will face capital calls and diminished cash flows, but the big question centers on what lenders will do if capital calls cannot be met.”

Developers and owners were even more candid about their assessment of the ramifications of interest rate hikes, with 37 of 49 respondents (75 percent) selecting this option as the most impactful variable on the industry in 2023. Almost all commercial owners carry debt that, even with fixed-rate loans, will be more expensive to refinance.

Owners in the merchant development business, in which the successful business model hinges on selling after stabilization, face a double whammy. These developers are contending with both elevated pricing on new construction loans and ever-fluctuating costs of key materials and labor for new projects. These added costs of development are of course factored into sales prices, which are in turn coming down in response to higher borrowing costs and general fears of recession. Something has to give in that equation.

Not All Bad

As always, within disruption lies opportunity. The drawbacks of the aggressive runup in interest rates are plain to see, but recognizing the potential upshots of this macroeconomic trend requires a more nuanced perspective.

As the saying goes, “selling a property is optional, refinancing it is not.” Owners whose debt loads would otherwise be refinanced in 2023, as well as landlords with balloon payments coming due this year, may no longer be able to hold their assets in the current financial climate. Depending on the type of asset(s) they hold, these owners may be forced to sell at discounted prices — an opportunity for savvy, well-capitalized buyers.

“There will be more opportunities to buy properties at lower price points than we have seen in recent years,” wrote DeLea Becker, owner and founder of Austin-based Beck-Reit Commercial Real Estate and a participant in the develop/owner survey. “To that end, we plan on buying properties with no more than 50 percent debt, which should make obtaining financing less difficult. Also, having cash set aside in order to close with cash and then finance after closing [is important in this market].”

“The greatest opportunity in 2023 will stem from deals that were done between 2019 and 2022 and that have debt structures that will cause some potential dislocation,” added Jon Siegel, partner and chief investment officer of Railfield Realty, a Maryland-based firm that is active in Texas.

That type of logic could explain why more than 60 percent of developers/owners who participated in the survey said that they plan to be net buyers in 2023. Further, 32 percent of respondents to this question stated that they were either uncertain or expected to essentially break even, but only 8 percent viewed themselves as net sellers in 2023.

Other Findings

The surveys explored several other topics outside the macroeconomic arena, with a handful of questions dedicated to the relative performances of various commercial property types.

As has been the case in recent years, brokers overwhelmingly cited multifamily and industrial as the top-performing asset classes. More than half (61 percent) of brokers selected multifamily as the property type most likely to experience a high velocity of sales in 2023. With this question, respondents were permitted to select multiple answers, and another 48 percent of broker participants picked industrial. These leasing and investment sales agents also cited industrial and multifamily as the two property types that would likely see the greatest increases in valuations in 2023.

Brokers were considerably more bearish on office properties. In response to a question on which asset classes would see the lowest velocity of sales in the new year — another query to which multiple answers were allowed — office easily led the pack with 75 percent of the vote.

Brokers also weighed in on how long it would likely take for office buildings to return to pre-pandemic levels of occupancy and utilization. While the results of last year’s survey indicated more optimism for a rebound in this sector, brokers now appear resigned to the notion that remote and hybrid work routines are here to stay and that some office buildings are dead where they stand.

The most common responses to this question were “two years” and “never,” both of which garnered 19 percent of the vote. Only 11 percent of respondents expressed faith that office buildings would return to pre-pandemic usage levels within the next 12 months.

For their part, developers and owners seemed to think that 2023 would be a tenants’ market across all commercial property types, judging by their responses to a question on whether or not their negotiating leverage would be stronger, weaker or the same relative to 2022. Across the office, retail, industrial and multifamily sectors, the consensus was that landlords would have a diminished ability to push rents on tenants, despite the fact that surging job and population growth in Texas will likely keep supplies of in-demand assets below levels of demand.

Developers also tackled the question of when office buildings might truly rebound to pre-COVID levels, displaying similar levels of apprehension on this subject. About 35 percent of respondents said that they were uncertain as to if/when this outcome would come to fruition, but only 2 percent of participants indicated that the scenario would occur within the next year.

— This article originally appeared in the January 2023 issue of Texas Real Estate Business magazine.