By Hayden Spiess

First comes inflation, then come interest rate hikes. The fact that this sequence is a predictable one does not temper the discomfort of reckoning with it, and the commercial real estate industry is as familiar with this pain as any.

This familiarity was made clear in the results of an exclusive survey by Northeast Real Estate Business, which was conducted via email toward the end of 2022. Two groups, one comprising brokers and the other consisting of developers, owners and managers, were asked to assess the state of commercial real estate in the region with both retro- and forward-looking perspectives.

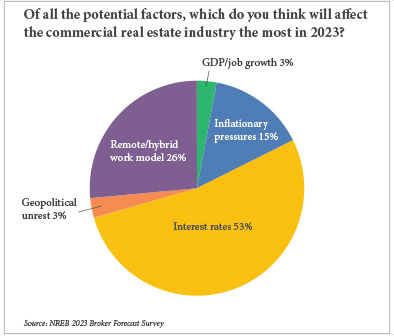

Of the brokers questioned, approximately 53 percent believed that interest rates would be the factor to affect their industry the most in 2023 (see chart). These individuals selected this option from a list that included other factors such as remote/hybrid work models, inflationary pressures and GDP/job growth, which received 26.5, 14.7 and 2.9 percent of the vote, respectively. The other two options — supply chain constraints and election results — received no votes.

Developers likewise identified interest rates as the demographic, political or economic factor likely to cause the most disruption within the industry. An even greater portion of this group — 68.6 percent, to be exact — responded accordingly.

Though the Federal Reserve’s raising of short-term interest rates has been going on nearly a year, resulting in 450 basis points of increases across eight hikes, the industry is still bracing for a rough 2023. A majority (47 percent) of participating brokers anticipate that their transaction value by dollar amount would be lower in 2023 than in 2022.

By comparison, in 2022, among Northeast brokers participating in the survey, 95 percent said that they expected their firms to do the same or an even greater volume of business in 2022 relative to 2021. Within that 95 percent, 65 percent expected to do more business, and 30 percent expected to do approximately the same amount.

Of the respondents who forecasted lower transaction values in 2023, there was a tie between those who expect that decrease to be in the range of 16 to 20 percent and those who expect the decrease to be a more modest 5 to 10

percent.

Specifically, 31.3 percent of the answering parties predicted the former, and 31.3 percent chose the latter. Another 18.8 percent said they expect the downturn in transaction volume to be in the neighborhood of 11 to 15 percent.

Slight variations aside, the survey results reflected a region and industry united in a wariness toward the prospects for 2023. In addition, these findings speak to an awareness that commercial real estate will bear the consequences attendant upon elevated interested rates.

High interest rates adversely affect not only the cost of capital on acquisitions and refinancings, but also on new construction projects, which are already subject to high degrees of volatility in terms of cost of materials and supply of labor. Following the inception of the Secured Overnight Financing Rate (SOFR), which replaced the London Interbank Offered Rate (LIBOR) index in 2022, interest rates on construction loans in 2023 will necessarily be at least 3 percentage points higher than they were in the year prior.

At the time of writing, SOFR — which is the index by which loans with short repayment periods, including construction and bridge loans, are priced — sat at 4.6 percent. This marks a year-over-year increase of 450 basis points.

Accordingly, developer, owner and manager respondents shared similarly tempered expectations for the coming year. Though 30.3 percent expressed “moderate confidence” that their firms would do more development in 2023 than in 2022, 18.2 percent had low confidence that this would be the case, with a comparable 15.2 percent responding that they had “no confidence” in that prospect.

A Reckoning

Of course, these high interest rates and their subsequent consequences do not exist in a vacuum. They are rather the unsurprising follow-up to the recent struggle with inflation, which was the most pressing concern for survey participants in the year prior.

Those concerns were well-founded. The Consumer Price Index, a measure of the year-over-year increase in the cost of the same collection of goods and services, reached a 40-year high of 9.1 percent in June. Though inflation has since cooled a bit, clocking in at 6.5 percent in December 2022, 70.6 percent of brokers surveyed said that they expect inflation to have “some negative impact” on the industry over the next 12 to 18 months.

Government action can be at least partially blamed for the record inflation seen in 2022. Fiscal policy over the past two presidential administrations has included some $5 trillion in pandemic stimulus spending, a $1.2 trillion infrastructure bill and a $1.7 trillion omnibus appropriations bill.

Now, it is once again a form of government intervention that has led into what is currently — at least by the account of survey participants in the Northeast — the most pressing concern for the commercial real estate industry.

In a free response section of the survey, one unnamed participant wrote that the greatest challenge facing the industry is “increased government intervention.” Much like inflation itself, the interest rate hikes over the course of the past 12 months have been meteoric in their ascension.

Other participants expressed similar concerns in the free response section of the survey.

“The greatest challenge I see for the commercial real estate industry in 2023 is rising interest rates due to the Fed’s actions to control inflation,” wrote Bob Moorhead of Secure Net Lease, a brokerage firm with offices in Dallas and Los Angeles that specializes in

net-leased properties.

“There is an adjustment in pricing that is occurring due to increased borrowing costs, and the challenge is that we don’t know how far the Fed will raise rates in order to see the results they are looking for in the inflation and job numbers,” Moorhead continued. “This uncertainty is causing many to sit on the sidelines until they have a better sense of the market.”

The first jobs report of the new year revealed that the U.S. economy had added 517,000 new positions in January, and that the unemployment rate had fallen to 3.4 percent. This data, though likely to be revised, seemingly only muddies the waters further.

Not Created Equal

Though owners across all asset classes feel the pain of high borrowing costs, some commercial property types are disproportionately backed by healthier levels of tenant and investment demand. One asset class that fits that category — and arguably has even been bolstered by upward movement in interest rates — is multifamily.

Costs to borrow and the general strain of a recessionary economy have only served to further depress purchasing power and sales volumes of single-family homes, which were already prohibitively expensive for many would-be buyers leading into the pandemic.

Renting has become a more attractive and feasible alternative by comparison, with the multifamily industry offering residence for those who might otherwise, in rosier economic times, be homeowners. Unsurprisingly, this sector, already a steady performer among commercial asset classes, has reached a particularly privileged position of late, according to survey results.

One anonymous source noted that, in addition to facing greater barriers to entry in the housing market, “people want to live in more population-dense areas that provide immediate-neighborhood indoor and outdoor conveniences. All of these factors bode well for the tenant pipeline and, by association, apartments with historically stabilized occupancies put this asset category in highest investment demand.”

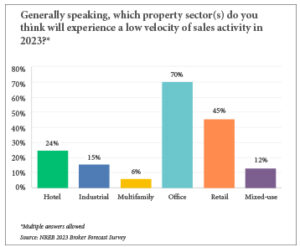

Perhaps that is why multifamily is the property type that brokers responding to the survey expect to experience the highest velocity of sales activity this year. Developers, owners and managers are likewise bullish on the prospects for multifamily — of those that expect to be net buyers in 2023, 57.7 percent responded that they plan to purchase multifamily properties.

Additionally, among developers that indicated that they would break ground on new projects this year, 47.4 percent said plan to develop multifamily properties. This was followed closely by the 36.8 percent of respondents who plan to break ground in the industrial sector.

Even accounting for the possibility that some of the respondents exclusively specialize in multifamily, the numbers align with the palpable confidence in the sector. As one participating broker put it, “the stars remain aligned for multifamily.”

Conversely but unsurprisingly, survey results reflect the continued struggle of office properties. The same category of respondents that indicated an interest in multifamily appears reluctant to invest in office properties. Only a tiny fraction (3.9 percent) indicated that they will buy such assets in 2023.

In addition, brokers selected office properties as the assets likely to experience the lowest volume of sales activity in 2023, followed by retail properties and hotels.

Much like how inflation and subsequently rising interest rates originated during the onset and height of the pandemic, the woes of office real estate are inextricably linked with the global health crisis. Simply put,

Much like how inflation and subsequently rising interest rates originated during the onset and height of the pandemic, the woes of office real estate are inextricably linked with the global health crisis. Simply put,

COVID-19 spurred new remote work habits among American professionals that are very likely here to stay in some form or other. The future feasibility of these working habits represented a recurring theme in the free response comments provided by brokers.

Todd Korren, principal at Avison Young’s New York City office, noted that it would be critical to have “workers return to their office in meaningful amounts and for three to four days per week.” His sentiment on the importance of bringing people back to their buildings — despite the fact that some members of the workforce clearly prefer workplace flexibility — was echoed by other broker respondents.

When asked when office buildings in the Northeast would likely return to pre-pandemic levels of utilization, a majority of 26.5 percent projected that they “never” would.

A three-way tie existed between the number of respondents who selected the options of two years, three years and “uncertain,” with each of those options receiving 20.6 percent of the vote. Aside from the obvious implications for the office property sector, shifts in working habits impact the performance of retail properties as well.

Regarding this property sector, brokers were fairly optimistic, with 29.6 percent expecting retail to be the asset class with the greatest increase in valuations over the next 12 months. Industrial though, took the majority of votes, with 40.7 percent, followed by multifamily with 33.3 percent and hotel with 29.6 percent.

Other Revelations

It is unsurprising, given the level of concern and focus on interest rates and the current borrowing climate, that 81.8 percent of the developers, owners and managers surveyed expect the borrowing climate to be less favorable this year than in 2022.

Nonetheless, when asked whether they planned on being net buyers or net sellers in the year to come, 65.7 percent responded that they would be the former.

One possible explanation for this aggressive position is that with the increased cost to borrow, cap rates may be pushed higher, as these two forces generally move in lockstep. In that case, prices on some assets could come down as demand cools on the buyer side, particularly for investors that require high degrees of leverage on new acquisitions.

However, cap rates are also a direct function of net operating income. Against this backdrop, the gap that exists between the “haves” and “have-nots” of commercial real estate becomes clearer.

For example, across most major markets, rents for multifamily and industrial properties are expected to remain healthy as supply continues to catch up to demand, while office properties are seeing a “flight to quality” pattern that could render some older buildings functionally obsolete.

Another reason companies might be inclined to buy commercial assets in 2023, in spite of tight economic conditions, is that these aforementioned conditions can provide opportunities to purchase distressed assets.

In the current environment, owners that cannot afford the additional pressure on their loans brought on by rate hikes, yet which need to refinance due to imminent maturity dates, may be forced to sell.

This is especially true for borrowers that have floating-rate debt. Aside from recapitalizing with fresh equity, selling is the only option for owners that are unwilling or unable to refinance, lest they go into default or foreclosure.

But much like the assets themselves, not all buyers are positioned equally; well-capitalized investors and all-cash deals will naturally hold privileged positions.

A final key to getting business done in the coming year will be flexibility in terms of how capital stacks are put together. As previously noted, some owners may be forced to sacrifice equity.

But if the asset is positioned for long-term success and short-term, fixed-rate debt can be secured, then the owner can significantly mitigate the adverse impacts of the Fed’s war on inflation.

As Sean Baird, a managing director at Colliers and a survey participant, put it: “those willing to be more flexible and return leverage to early 2022 levels will win out.”

— This story originally appeared in the January/February 2023 issue of Northeast Real Estate Business magazine.