By Taylor Williams

The results of Texas Real Estate Business’ annual reader forecast survey are in, and they paint a somewhat surprising picture of an optimistic business outlook for the new year.

Why surprising? Well, geopolitically speaking, 2026 has already picked up right where 2025 left off. The Trump administration’s capture of Venezuelan president Nicolas Maduro and his wife in early January touched off a fresh source of geopolitical angst. The administration then subsequently ratcheted up its preexisting talk about Greenland becoming part of the United States, including issuing a threat to impose more tariffs on European countries that opposed that plan.

Editor’s note: In mid-November, Texas Real Estate Business sent email invitations to participate in the annual online survey to three separate groups — brokers; developers, owners and managers; and lenders and financial intermediaries. The survey was held open through mid-December. Invitations to participate were also included in the Texas Real Estate Business e-newsletter, as well as through ReBusinessOnline.com.

The tariff threat has since been walked back, but it’s hardly an understatement to say that the first month of 2026 has been rocky in terms of geopolitics. And when that happens, it’s anyone’s guess as to just how rattled markets will get.

So far, however, the business community seems to be taking it all in stride — a reflection of its detached resignation to the fact that unorthodox, vacillating policy is simply the name of the game, as well as the realization that today’s losses can quickly become tomorrow’s gains.

The business community’s apparent desensitization to rockiness and murkiness of policy that defined much of 2025 at the national level — paired with ever-reliable job and population growth at the state level — seemingly means that commercial real estate professionals in Texas can still be guardedly optimistic for 2026.

This writer also reviewed responses that commercial brokers and developers in the Northeast gave to the same survey questions that were posed to Texas dealmakers and builders. The outlook among those groups in the Northeast was decidedly more mixed, suggesting that the “Texas factor” plays a part in the cautiously positive outlook.

As it should. According to World Population Review, while Texas did cede the top spot for year-over-year population growth in 2025 to Florida (1.96 percent), the Lone Star State came in a close second (1.77 percent). The state’s total headcount is now somewhere in the neighborhood of 32 million, according to most sources.

Job growth in Texas remained healthy as well in 2025. In December, the office of Texas Gov. Greg Abbott released a statement declaring that Texas had the largest 12-month job gains of all 50 states, based on September data from the Bureau of Labor Statistics (BLS). Due to the federal government shutdown, the schedule and veracity of the BLS’ fourth-quarter employment summaries have been impacted.

Among the highlights of the Abbott administration’s report were the following statistics:

• Texas gained 168,000 jobs from September 2024 to September 2025, outpacing the national annual job growth rate by 0.4 percent

• Texas closed the year with a statewide unemployment rate of 4.1 percent, below the national average of 4.4 percent

• Texas set a new state record for the size of its labor force at nearly 16 million

What People Said

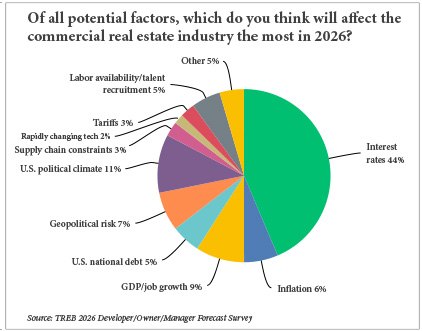

Written replies to a free-response question about the biggest opportunity and/or challenge facing the industry in 2026 bore out the notion that Texas was prevailing over Washington, D.C. When asked to identify the large-scale factor that was most likely to affect the industry in 2026, only 7 percent of developer respondents chose geopolitics (see chart at top).

“[The greatest challenge facing the commercial real estate industry in 2026] is clearly White House policies and uncertainty. [It’s] tough for companies to make decisions with all the chaos,” wrote survey regular Brian Novy, owner at Austin-based commercial services firm The Novy Co.

“The greatest opportunity [for the industry] is businesses moving out of New York City and coming to better business environments in the South,” wrote survey participant Robert Watson, president of Houston-based brokerage firm Robert C. Watson Associates Inc.

Novy added in his comment that at the same time, he was optimistic for 2026 with regard to dealmaking opportunities stemming from maturing commercial loans that will need creative financing solutions. He was hardly the only respondent to have an opinion on this matter, though others tended to assess the “looming wall” of loan maturities as more of a headwind than a tailwind.

“The greatest challenge is the large volume of maturing loans facing a significant valuation gap, tight lender standards and insufficient NOI [net operating income] to support new leverage,” wrote one anonymous developer. “This refinancing wall may lead to extensions, restructurings or forced sales, especially in weaker asset classes. Overall, 2026 will be defined by how well the industry navigates the mix of improving liquidity and persistent debt stress.”

“The greatest challenge will be navigating the reset in valuations and the refinancing wave coming due in 2026 and 2027,” added Amanda Chapa, commercial support specialist and CRE associate at Browning Commercial Real Estate. “Many owners face loans originated in a low-rate environment that no longer pencil out under today’s DSCR [debt service coverage ratio] requirements, particularly with regard to office and multifamily assets in oversupplied submarkets.”

“As capital markets stabilize, investors with liquidity will be able to acquire quality assets at adjusted pricing while distressed owners reposition or sell,” Chapa concluded.

Numerical Findings

Brokers and developers/owners completed separate surveys, but there were some overlapping questions between the two, including a basic query about overall projected volumes of business for 2026 versus 2025. Responses to this question and its follow-up query illustrated the positivity.

Among broker respondents, 65 percent said they expected their overall transaction volume this year to exceed that of last year. In addition, all of those who anticipated greater deal volume in 2026 further said that the year-over-year increase would likely be at last 5 percent, if not greater.

Among owners, about 66 percent expressed some degree of confidence that their development pipelines for 2026 would expand relative to 2025. To be fair, that’s a bit of a loaded takeaway; putting shovels in the ground in 2026 speaks more to confidence in supply-demand metrics in two to three years rather than today. But developments of the future still require financing today, and 89 percent of developers expressed belief that the 2026 borrowing climate for new projects would be more favorable than or at least on par with that of 2025.

More to the point of telegraphing optimism for the new year, 72 percent of owner respondents said they plan to be net buyers in 2026.

Hope for Office?

Return-to-office (RTO) mandates remain sore points of discussion for many companies.

Flight to quality continues to be the prevailing trend among tenants pushing for stronger office presences. Certain submarkets have already seen significant improvements in office occupancy. Hiring slowed among some of the major office-using sectors of the economy toward the end of the year.

All of these statements are truthful on the national level, and they all contribute to an evolving narrative on the office market that is more perplexing than purely pessimistic.

But Texas has always been more of a leader than a follower when it comes to RTO, as data from Kastle Systems, which tracks keyfob swipes and usage across U.S office buildings, has routinely shown. This trend is difficult to explain, but some real estate professionals have told this writer that Texans’ willingness to return to their offices stems in part from a statewide culture that prioritizes conducting business in person.

In early 2025, Gov. Abbott mandated an RTO for all state agencies, although that move has since been walked back. In addition, some major tech and finance companies that are either based in Texas or rapidly expanding there, such as Dell and Goldman Sachs, have pushed for full-scale RTO movements. And across both the broker and developer surveys, participants seemed to think that 2026 could finally be the year of a meaningful rebound in utilization of office space.

About 60 percent of brokers surveyed said that they expected office usage to increase either significantly or moderately in 2026. Another 23 percent of brokers expected it remain about the same, meaning only 17 percent projected a worsening of office fundamentals.

Similarly, among developers, only 5 percent of respondents indicated an expectation of lower office utilization rates in 2026, though a larger proportion (39 percent) contended that it would stay the same.

— This article first appeared in the January 2026 issue of Texas Real Estate Business magazine.