By Tyler Ziebel, Colliers Following one of the most active and aggressive periods in Chicago’s industrial capital markets history, 2022 ended as a year most market participants would rather forget. As the buying community returned to their desks and fastened their seatbelts for another year of fun in 2023, industrial sales brokers across the country are starting the year posed with a question from investors that hasn’t been asked in some time: “What are we going to be able to buy this year?” It’s easy to assume that investors will remain content to sit out of the turbulent market, but the answer to where we are, and aren’t, seeing liquidity requires a nuanced answer. In order to do that, we must take a quick look at 2022 and what set this uncertain market in motion. After several record-setting years for industrial leasing and sales in 2020 and 2021, accelerated by the COVID pandemic and a historically low interest rate environment, 2022 opened with the same frenzied pace and enthusiasm of 2021. But as the Federal Reserve pivoted its focus from keeping the economy stable to taming the resulting inflation, rapidly rising interest rates grounded institutional industrial transactions and development deals …

Illinois

By Jennifer Hopkins, MBA and Olivia Czyzynski, SVN Chicago Commercial The commercial real estate (CRE) industry has traditionally been relatively stable but can be impacted by the economy with normal ups and downs based on economic fluctuations. However, when COVID-19 hit, it was unprecedented and something the world had not seen in many years. The CRE industry started preparing for the changes that came along, including business shutdowns and many employees working from home. Although it was expected that the retail market would be the hardest hit sector, it turned out that the office market ended up being significantly impacted. The overall issues and pending work-from-home approach have had a major ripple effect on office markets across the nation. The Chicagoland market was impacted particularly hard, and this included the suburban Chicago markets. Chicagoland is broken out into several main commercial hubs: the city of Chicago, the East-West Corridor, the O’Hare market, the Northwest suburbs and the North suburbs. According to CoStar, office vacancy rates increased in all these markets. In 2020, the vacancy rates ranged from 7 to 20 percent, but currently stand at 18.8 percent, 17.3 percent, 16.9 percent, 23.2 percent and 11 percent, respectively. While no market …

By Tyler Hague, Colliers A colleague of mine recently had to move out of her West Loop apartment quickly and she faced a conundrum: how much am I willing to pay for a one-bedroom apartment in Chicago? The unfortunate answer: not even close to the $2,700 per month rent she was continually being asked to pay. She ended up renting a studio. The average price for a one-bedroom apartment in the central business district is $2,478 per month, a figure that has grown 9.5 percent in the last year alone and equates to a $235.41 year-over-year rental increase, according to Yardi Matrix. It also translates to a national housing insecurity crisis, not just a local and presumed urbanized problem, and one that has been exacerbated by many of the detrimental housing laws and zoning regulations that exist in Chicago today. Whether it is aldermanic privilege, the Affordable Requirements Ordinance (ARO) or general NIMBYism, it is clear rent is too darn high — and it isn’t the entrepreneurial real estate professional’s doing but rather a major (and obvious) supply dilemma. This summer, for the first time in U.S. history, median rent costs in major cities surpassed $2,000 per month, according to …

By Ryan Foran, Cresa As we approach the three-year anniversary of the start of the pandemic, it continues to affect the commercial real estate industry in many ways, with no asset class impacted as significantly as the office sector. While retail initially stumbled but rebounded, and industrial soared to unexpected heights amid distribution emergencies, millions of U.S. office employees continue a tenuous balance of working from home versus going into the office. The pandemic wasn’t all bad news for office tenants. Many businesses with simple infrastructure and experienced staff have been so effective with remote set-ups that they have shed office space permanently and eliminated rent from the books. Others have embraced emerging technologies like virtual meetings and chat solutions to reduce the need for face-to-face interaction. In one way or another, most businesses were able to leverage this unique situation to improve their business processes, technology and personnel, and have embraced remote work at some level. But many businesses with younger, less experienced staff have reported ongoing struggles with recruiting, mentorship, culture development and staff retention. Some of these may have been amplified by complex external factors such as an ongoing labor shortage, an unprecedented resignation of our older …

By Kelly Nickele, Mid-America As the summer season begins, retailers and restaurateurs in Chicago are scheduling tours for the city’s warmest months of the year, and overall leasing velocity is continuing to increase. Here’s a quick review of the top retail real estate trends in Chicago now. Digitally native brands continue to expand, embracing omnichannel sales strategies. I grew up at Fremont & Armitage in Chicago’s Lincoln Park neighborhood through my high school years. I remember when Aldo, Barbour and Bebe anchored Halsted, and United Colors of Benetton (now Interior Define), American Apparel (now Parachute), Intermix (now Outdoor Voices) and Hanig’s (now Marine Layer), were the mainstays of Armitage. I saw tenants like BCBG relocate from Halsted (now Apotheco Pharmacy) to Armitage (now Serena & Lily), and locals like Art Effect and Lori’s remain relevant while the trade area garnered national attention and the 60614 zip code continued to report strong catalog and ultimately e-commerce sales. I’ve experienced the rise and fall of many retailers, the emergence of digitally native brands, the major shift in how and where we shop and the influence of social media in the retail industry. As a consumer and a retail advisor, I believe in …

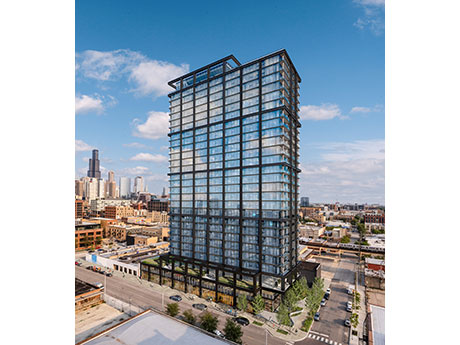

By Mike Drew, Structured Development As a longtime developer of multifamily, commercial and mixed-use properties in Chicago, I can tell you we’ve never seen anything like the last few years. From the highs of the pre-pandemic multifamily construction boom to the lows of the first year of COVID-19 lockdowns — when downtown emptied out — to today, it’s been a rollercoaster ride. But the multifamily sector has ultimately proved resilient and is roaring back stronger than ever. Here’s a look back at the past three years and a glimpse of three projects we broke ground on during the pandemic: Schiller Place, Big Deahl and Harrison Row. Early pandemic exodus For the years 2019-2021, developers were expected to build 9,000 apartment units in downtown Chicago, according to Integra Realty Resources. This figure was lower than the expected 10,700 units because of rising construction costs and uncertainty around property taxes, but still strong. Average rents for downtown Class A rental communities were $3.31 per square foot, per Integra, and occupancy was a robust 94.9 percent. When the pandemic hit nine months later, it greatly slowed that activity. Gov. J.B. Pritzker issued the first stay-at-home order on March 20, 2020, followed by other …

The industrial market will be forever changed by the COVID-19 pandemic. Before the pandemic, demand for industrial space was closely tied with gross domestic product (GDP), with demand rising and falling alongside the U.S. output of goods. The pandemic has accelerated an already shifting economy to an “on-demand” economy. This shift was created by technology companies fulfilling consumer demand via the immediate provisioning of goods and services, and has now led to industrial warehouse demand being more in line with consumer spending versus GDP. Consumer spending and personal income are at all-time highs, with e-commerce sales growing exponentially throughout 2020 and 2021. Companies have been leasing warehouse space at a meteoric rate, driven by the need to store goods to accommodate the demand and mitigate risk from supply chain complications that have been brought on by the pandemic. Over the past two years, millions of square feet of warehouse space in the Chicagoland area have been leased for e-commerce use to tenants such as Walmart, Wayfair, Hello Fresh, Imperfect Foods and, of course, Amazon. Additionally, as traditional brick-and-mortar retailers transition to greater online sales, they require more warehouse space for goods storage, which has led tenants such as Target, Walmart, …

When it comes to which office properties will succeed in the coming years, success may boil down in part to who is minding the store. Like most big cities, Chicago’s office market has been tested by the pandemic, and office property owners face a far more competitive environment. Year-end 2021 office vacancy rates were nearly 18 percent in the central business district (CBD) and over 25 percent in the suburbs, or 44 percent and 35 percent higher, respectively, than two years prior, according to NAI Hiffman research. Hybrid work is here to stay, and some employers are shrinking or shifting their office footprints. When the pandemic is finally in the rearview mirror, office demand is not going to be the same as it was a couple of years ago, although we are still figuring out just what it will be. Which office properties survive and thrive in post-pandemic Chicago and nationwide will depend on many factors, including the property’s age or condition, its location and, increasingly, how well the property is programmed and run. That includes satisfying tenants in terms of everything from air quality to event assistance; meeting lenders’ environmental, social and governance (ESG) requirements and other new demands; …

A common question Chicago office brokers are hearing from clients these days is, “When is the best time to start negotiating with my landlord?” In fact, it is also a question brokers are asking themselves, contemplating when they should advise their clients to get into the market. The truth is: 1) it’s very hard to say, and 2) it depends on the situation. Let’s explore what we do know. This is a historically tenant-favorable office market. Vacancy rates have increased from 13.8 percent to start 2021 up to 17.7 percent currently. Concessions are far over-weighted with construction allowances and free rent packages 20 to 30 percent higher than they were pre-pandemic, and landlords are being more flexible on term lengths allowing tenants three- or five-year leases despite offering full buildouts. On the other side of the coin, gross rental rates (base rent plus real estate taxes and building operating expenses) have not declined. In fact, in the last quarter they increased from $42.34 to $42.57 per square foot. The trends and market conditions surrounding concession packages and rental rates haven’t really changed in the last 12 months or so. The above touches on what the market is doing, but what …

If we consider that 2017 was the year that deconversion sales in Chicago began in earnest, we are now four years into the cycle. I’m frequently asked my opinion of how much longer this cycle will last, and what it will look like going forward. To me, that comes down mainly to supply and demand, with an eye on change in the relevant state and city statutes governing these sales. The supply of condominiums in Chicago is still plentiful, especially condominiums that were converted from apartment buildings. While there was a bit of a condo-buying frenzy in the early part of 2021 as the world opened back up, that frenzy has dissipated. Condominiums that would typically take a couple of months to sell sold in days, and often at asking price. With that said, there was little meaningful price appreciation. The factors that hinder appreciation of these condominiums did not change: high amounts of rental units in the association; lack of amenities; and aging buildings that are either behind on maintenance or expensive to keep up. Those factors are unlikely to ever change. The current demand for multifamily properties is quite strong. Most investors sat on the sidelines in 2020, …

Newer Posts