LITTLE ELM, TEXAS — New York City-based Dwight Capital has provided a $31.4 million HUD-insured loan for the refinancing of The Village at Lakefront, a 242-unit multifamily property located in the North Texas community of Little Elm. The property was built on 6.4 acres in 2017 and consists of two four-story apartment buildings, a clubhouse with a community room, fitness center and a leasing office. Brandon Baksh of Dwight Capital originated the financing through HUD’s 223(f) program on behalf of the borrower, ChadNic Properties.

loans

NEW YORK CITY — New Jersey-based intermediary Cronheim Mortgage has arranged a $47 million loan for the refinancing of Hyatt House New York, a 150-room hotel in Manhattan’s Chelsea neighborhood. Beau Williams of Cronheim’s hospitality capital markets group led a team that arranged the five-year, fixed-rate loan on behalf of the borrower, locally based investment firm Lexin Capital. An undisclosed, New York-based bank provided the debt.

AUSTIN, TEXAS — KeyBank Community Development Lending & Investment has provided $82 million in acquisition and rehabilitation financing for Woodway Square Apartments, a 240-unit affordable housing complex in Austin. The 12-building, garden-style complex offers one-, two- and three-bedroom units that are reserved for households earning 60 percent or less of the area median income. Amenities include a pool, playground and a community room. The borrower is Minnesota-based owner-operator Dominium. The financing includes an $18 million bridge loan to facilitate the purchase, $40 million in construction-to-permanent financing and $24 million in Low-Income Housing Tax Credit (LIHTC) equity.

NEW YORK CITY — Deutsche Bank Wealth Management has provided a $77.4 million acquisition loan for The Collection at Mercedes House, a 162-unit multifamily complex in Manhattan. The property’s one-, two- and three-bedroom units occupy the 22nd through 32nd floors of the building at 540 W. 54th St., which is known as Mercedes House. Residents have access to The Mercedes Club, an 80,000-square-foot amenity center that houses a full-service health club, resident lounges and workspaces, a day spa, outdoor pool and a specialty grocery store. Gideon Gil, Lauren Kaufman and Dale Braverman of Cushman & Wakefield, along with Meridian Capital’s Rael Gervis and Elliott Kunstlinger, arranged the loan on behalf of the borrower, a partnership between Empire Capital Holdings and Namdar Realty Group.

TETERBORO, N.J. — JLL has arranged a $39 million acquisition loan for a 221,448-square-foot warehouse and distribution center in the Northern New Jersey community of Teterboro. Building features include a clear height of 22 feet, 15 dock-high doors, 11 drive-in doors, 95 parking spaces and 15 trailer parking spaces. Michael Klein, John Rose, Jon Mikula and Ryan Carroll of JLL arranged the fixed-rate loan through insurance giant Nationwide on behalf of the borrower, a joint venture between local developer The Hampshire Cos. and Atlanta-based Invesco Real Estate. The property was fully leased to Fashion Logistics at the time of sale.

NEW YORK CITY — New York-based investment and development firm Triangle Equities has completed the $136 million recapitalization of Terminal Logistics Center, a 184,747-square-foot industrial facility located in the Jamaica area of Queens. The recapitalization includes a $75 million loan from H.I.G. Realty Credit Partners and $61 million in new equity from Goldman Sachs Asset Management and Triangle Equities itself. Geoff Goldstein, Max Herzog, Andrew Scandalios, Rob Hinckley, Tyler Peck and Nicco Lupo of JLL represented the joint venture between Goldman Sachs and Triangle Equities in the transaction. Terminal Logistics Center offers immediate proximity to JFK International Airport and features 36-foot clear heights and multiple levels of truck courts with parking for up to 53 trailers. Construction began in 2020, and the facility is expected to be available for occupancy by the end of the second quarter.

NEW YORK CITY — Affinius Capital, which is a partnership between USAA Real Estate and Square Mile Capital Management, has provided a $110 million loan for the refinancing of the 488-room Arlo Midtown hotel in Manhattan. The boutique hotel is located on 38th Street between Eighth and Ninth avenues, adjacent to Times Square, and offers both traditional guestrooms and suites, as well as several onsite food-and-beverage options. The borrower was Quadrum Global, a development and investment firm with offices in New York City and Miami.

UNION, N.J. — Locally based financial intermediary G.S. Wilcox & Co. has arranged a $90 million permanent loan for Sol at Vermella Union, a 309-unit apartment community in Northern New Jersey. The property, which is part of the larger Vermella Union mixed-use development, offers studio, one-, two- and three-bedroom units. Amenities include a pool, fitness center, children’s play area, outdoor grilling and dining stations and a rooftop terrace. Gretchen Wilcox and David Fryer of G.S. Wilcox arranged the seven-year loan through an undisclosed direct lender on behalf of the borrower, Russo Development.

BAYONNE, N.J. — Locally based development and investment firm Delta Equity Management has refinanced Harborview Logistics & Distribution Center, a 195,723-square-foot industrial property located in the Northern New Jersey community of Bayonne. The property features a clear height of 40 feet, 46 loading doors, 32 trailer parking spaces and 149 car parking spaces. Jon Mikula and Michael Lachs of JLL arranged the fixed-rate loan through Lincoln Financial Group. At the time of the loan closing, Harborview Logistics & Distribution Center was fully leased to an affiliate of The Home Depot.

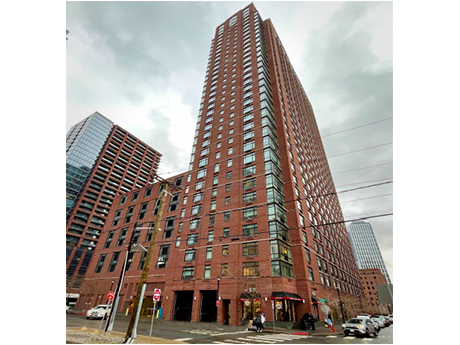

JERSEY CITY, N.J. — NewPoint Real Estate Capital has provided a $153.6 million Freddie Mac loan for the refinancing of The One, a 35-story apartment tower located in Jersey City’s waterfront district. Built in 2015, The One features 451 units in studio, one-, two- and three-bedroom formats, with 10 percent of the units reserved as affordable housing. Residences are furnished with stainless steel appliances, quartz countertops and individual washers and dryers. Amenities include a pool, fitness center, children’s playroom, theater room, golf simulator, game room and a dog park. Carol Shelby and Eric Schleif of Meridian Capital Group placed the loan, which carried a seven-year term and a 35-year amortization schedule, with NewPoint on behalf of the borrower and developer, BLDG Management. The One was 98 percent occupied at the time of the loan closing.