BURLINGTON COUNTY, N.J. — JLL has arranged a $47 million construction loan for an undisclosed, 300-unit multifamily project that will be located in Southern New Jersey’s Burlington County. The community will offer one-, two- and three-bedroom units with an average size of 971 square feet. Amenities will include a pool, fitness center, business center, courtyard lounge, dog park, grilling stations and walking trails. Matthew Pizzolato, Michael Klein and Salvatore Buzzerio of JLL arranged the three-year, floating-rate loan through Wells Fargo on behalf of the undisclosed borrower. Completion is slated for the second quarter of 2024.

loans

CROTON-ON-HUDSON, N.Y. — Northmarq has provided a $22 million Fannie Mae loan for the refinancing of Springvale Apartments, a 524-unit active adult community in Croton-on-Hudson, about 30 miles north of Manhattan. The 31-building property was built on a 35-acre site overlooking the Hudson River between 1956 and 1959 and is reserved for renters age 55 and above. Robert Ranieri of Northmarq originated the loan, which carried a 10-year term and a 30-year amortization schedule. The borrower was not disclosed.

PHILADELPHIA — JLL has arranged a $56.3 million acquisition loan for the 306-room Sofitel Philadelphia Hotel, located in the city’s Rittenhouse Square area. The luxury hotel offers a variety of room plans, including suites, as well as multiple onsite dining options. Mark Fisher and Ryan Ade of JLL arranged the loan through Square Mile Capital Management on behalf of the borrower, a joint venture between funds managed by Oaktree Capital Management and Clearview Hotel Capital.

HOUSTON — Northmarq has arranged an undisclosed amount of acquisition financing for a portfolio of three multifamily assets totaling 1,134 units that are located throughout the metro Houston area. Sedona Square is a 250-unit property that was built in phases in the early 1980s and offers one-, two and three-bedroom apartments. Verano was constructed in 1980 and totals 312 units in one- and two-bedroom formats. Rock Creek at Hollow Tree, also constructed in 1980, comprises 572 residences in one-, two- and three-bedroom floor plans. James Currell, Joel Heikenfel and Emily Balazi of Northmarq arranged the debt through an undisclosed bridge/mezzanine lender on behalf of the borrower, Dallas-based WindMass Capital.

NORTH HAVEN, CONN. — New Jersey-based financial intermediary Cronheim Mortgage has arranged a $23.5 million permanent loan for North Haven Pavilion, a 148,277-square-foot shopping center located north of New Haven. Tenants at North Haven Pavilion include Michaels, Wendy’s and Hartford Healthcare. Dev Morris, David Poncia, Allison Villamagna and Andrew Stewart of Cronheim Mortgage arranged the financing on behalf of the borrower, a subsidiary of National Realty & Development Corp., which originally developed the center in 2004. The loan carried a 10-year term and a 30-year amortization schedule.

AUSTIN, TEXAS — Locally based investment and development firm Stratus Properties (NASDAQ: STRS) has received a $56.8 million construction loan for The Saint George, a 316-unit multifamily project that will be located near the University of Texas at Austin. Comerica Bank provided the four-year loan, and an undisclosed equity partner is funding the majority of the remaining development costs. Ten percent of the units at The Saint George will be reserved as affordable housing. Amenities will include a pool, fitness center, rooftop deck and communal workspaces. Stratus expects to begin construction in the coming days and for the project to be substantially complete by mid-2024

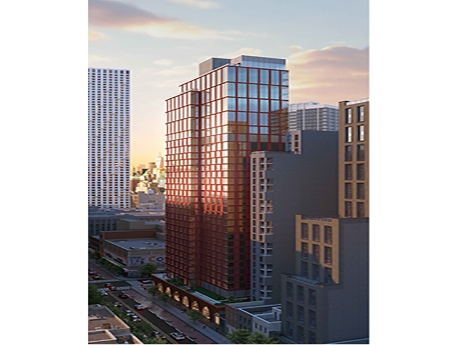

NEW YORK CITY — Cushman & Wakefield has arranged a $134 million construction loan for 15 Hanover Place, a mixed-income residential project that will be located in downtown Brooklyn. The 34-story building will house 314 units, 95 of which will be reserved as affordable housing, as well as 9,000 square feet of commercial space. Gideon Gil, Zachary Kraft and Sebastian Sanchez of Cushman & Wakefield arranged the loan through Santander Bank and City National Bank on behalf of the borrower, locally based developer Lonicera Partners. A tentative completion date has not yet been established.

LINDEN AND LOGAN TOWNSHIP, N.J. — Wells Fargo has provided $227 million in construction financing for two New Jersey industrial projects. In the first deal, the San Francisco-based bank provided a $142 million loan for Phase III of Linden Logistics Center, a development in the northern part of the Garden State. Phase III will consist of two buildings totaling 849,235 square feet that are scheduled for a second-quarter 2023 completion. In the second transaction, Wells Fargo provided $85 million for the third phase of Logan North Industrial Park, a project that spans 3.2 million square feet and is located in Southern New Jersey. The two buildings comprising Phase III of Logan North Industrial Park will measure 274,200 and 475,000 square feet and are also slated for delivery in the second quarter of next year. Existing tenants at Logan North include SEKO Logistics and LaserShip Logistics. John Alascio, T.J. Sullivan and Chuck Kohaut of Cushman & Wakefield arranged the financing on behalf of the borrower and developer, a partnership between Advance Realty Investors and Greek Development.

NEW YORK CITY — New York City-based development and investment firm Innovo Property Group (IPG) has received a $435 million loan for the refinancing of a 900,000-square-foot industrial project in the Long Island City area of Queens. IPG acquired the site, which previously housed the warehouse of online grocer FreshDirect, in January 2019 with Atalaya Capital Management and Nan Fung Group for $75 million. Since then, the development has demolished the existing structures on the site and is targeting a 2024 completion for the new facility, which will feature elevated truck courts and a vertical parking structure. Starwood Property Trust and J.P Morgan provided the loan, and the former originally provided the $155 million in construction financing in early 2021. Eastdil Secured arranged the financing.

HACKENSACK, N.J. — G.S. Wilcox has arranged a $60 million permanent loan for Print House, a 271-unit multifamily project that will be located in the Northern New Jersey community of Hackensack. Print House, which will be the first phase of a larger, 20-acre development along the Hackensack River, will offer studio, one- and two-bedroom units. Amenities will include a pool with a sundeck, fitness center with a yoga studio, clubroom with TVs and gaming areas, a bar area, private conference room and a dog walk. Gretchen Wilcox, David Fryer and Al Raymond of G.S. Wilcox arranged the 10-year loan on behalf of the borrower, a partnership between Russo Development, Hampshire Management and Fourth Edition Inc., which recently launched its leasing campaign. The direct lender was not disclosed.