NEW YORK CITY — New York City-based investment management firm Clarion Partners has provided a $415 million mezzanine loan for the refinancing of a national portfolio of 110 industrial buildings totaling 15.7 million square feet. The portfolio consists of properties in 15 markets, including Dallas-Fort Worth, Phoenix, Baltimore and Atlanta. At the time of the loan closing, the portfolio was approximately 93 percent leased to a roster of 300-plus tenants. The borrower was Blackstone.

loans

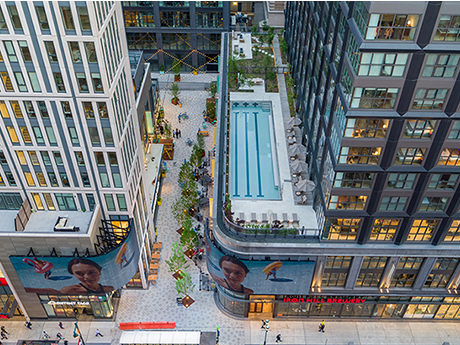

PHILADELPHIA — JLL has arranged a $260 million loan for the refinancing of East Market, a mixed-use project that spans an entire city block in Philadelphia’s Center City neighborhood. East Market consists of two apartment buildings totaling 562 units, 120,000 square feet of retail and restaurant space and a 100-year-old warehouse that has been redeveloped into creative office space. Chad Orcutt and Blaine Fleming of JLL arranged the loan through Pacific Life Insurance Co. on behalf of the borrower, a joint venture led by National Real Estate Advisors. The developer also plans to convert a traditional office building on the site into a boutique hotel and medical facility.

ZMX, Forbes Plunkett Secure Construction Financing for $67.7M Multifamily Project in Metro Nashville

MADISON, TENN. — Nashville-based ZMX Inc. and Forbes Plunkett Real Estate & Development has secured construction financing for The Northern, a 297-unit, garden-style multifamily development in Madison. Atlanta-based Patterson Real Estate Advisory Group arranged the development financing with Origin Investments and Fifth Third Bank for the $67.7 million project. Construction is slated for completion by early 2024. The Northern will offer studio, one-, two- and three-bedroom floorplans ranging from 592 square feet to 1,285 square feet. Community amenities will include a pool, fitness center, clubhouse with outdoor grilling areas, several green spaces and pocket parks, dog park and a dog spa. The project is located close to downtown Nashville.

PLANO, TEXAS — Seattle-based Avatar Financial Group has provided a $30 million loan for the refinancing of City View Corporate Center, a 293,821-square-foot office building in Plano. The property was originally built in the 1980s and most recently renovated between 2019 and 2021. At the time of the loan closing, City View Corporate Center was 58 percent leased to a roster of more than 50 tenants. The undisclosed borrower plans to use a portion of the proceeds to fund capital improvements.

FORT MILL, S.C. — Ready Capital has closed a $9 million acquisition loan for a 64-unit, unnamed multifamily property in Fort Mill, a South Carolina suburb of Charlotte. Upon acquisition, the unnamed sponsor will implement a capital improvement plan to renovate the common areas and unit interiors. The non-recourse, interest-only, floating-rate loan features a 36-month term, two extension options and is inclusive of a facility to provide future funding for capital expenditures.

GEORGETOWN, TEXAS — JLL has arranged $38.5 million in acquisition financing for Summit at Rivery Park, a 228-unit apartment community located in the northern Austin suburb of Georgetown. Built on 32 acres in 2015, the property is situated within a larger mixed-use development that features a Sheraton Hotel and conference center, as well as office and retail space. Summit at Rivery Park offers one-, two- and three-bedroom units that range in size from 576 to 1,410 square feet. JLL arranged floating-rate acquisition financing through Vancouver-based QuadReal Finance Inc. on behalf of the borrower, Austin-based Old Three Hundred Capital. In addition, the firm structured joint venture equity with Sound Mark Partners. Marko Kazanjian, Chris McColpin, Max Herzog and Andrew Cohen of JLL arranged the loan and joint venture partnership. The new ownership plans to implement a value-add program.

NEW YORK CITY — Locally based direct lender Ready Capital has closed a $16.5 million loan for the acquisition, renovation and stabilization of an 81-unit multifamily property in the Murray Hill submarket of New York City. The nonrecourse, interest-only loan carried a 36-month term, floating interest rate and two extension options. Upon acquisition, the undisclosed sponsor will execute a sale-leaseback of the ground and implement a capital improvement plan to renovate units and upgrade common areas.

CHARLOTTE, N.C. — Charlotte-based Grandbridge Real Estate Capital LLC has secured $113.7 million in financing for three multifamily properties, including The Reserve at Chaffee Crossing in Fort Smith, Ark., and Medlock Woods Apartments and Country Club Apartments in Norcross, Ga. Sunbelt Residential was the borrower for the Medlock Woods and Country Club deals, while the borrower for The Reserve at Chaffee Crossing was Canyon View Capital. The Reserve at Chaffee Crossing is a 438-unit multifamily property that offers one- and two-bedroom floorplans. Grandbridge secured a $43 million acquisition loan with a five-year term, including an initial interest-only period and extension options to accommodate the lease up and stabilization of the property. Medlock Woods is a 246-unit multifamily property that offers one-, two- and three-bedroom floorplans. The borrower received $35.5 million acquisition loan that was structured with a five-year term, including an initial interest-only period and extension options. Country Club is a 298-unit property that offers one-, two- and three-bedroom floorplans. The borrower received a $35.2 million acquisition loan that was structured with a five-year term, including an initial interest-only period and extension options.

CONYERS, GA. — Ready Capital has closed a $36.5 million acquisition loan for a 256-unit, unnamed multifamily property in Conyers, a suburb outside of Atlanta. Upon acquisition, the unnamed sponsor will implement a capital improvement plan that includes improving deferred maintenance, as well as renovating unit interiors, building exteriors and common area upgrades. The non-recourse, interest-only, floating-rate loan features a 36-month term, two extension options, flexible prepayment and is inclusive of a facility to provide future funding for capital expenditures.

JACKSONVILLE, FLA. — Ready Capital has closed on a $17 million acquisition loan for a 160-unit unnamed multifamily property in Jacksonville. Upon acquisition, the unnamed sponsor will implement a capital improvement plan. The non-recourse, interest-only, floating-rate loan features a 36-month term, two extension options and is inclusive of a facility to provide future funding for capital expenditures.