TOMS RIVER, N.J. — JLL has arranged $26.8 million in financing for Camelot at Toms River, a 128-unit apartment complex in coastal New Jersey. Built in 2023, the property features one- and two-bedroom units with an average size of 1,109 square feet. Residences are furnished with stainless steel appliances, quartz countertops, walk-in closets and full-size washers and dryers. About 20 percent (26) of the units are reserved as affordable housing. Amenities include a pool, fitness center, clubhouse, outdoor grilling and dining areas and a dog park. Michael Klein, Matthew Pizzolato and Salvatore Buzzerio of JLL arranged the five-year, fixed-rate loan through Nuveen Real Estate on behalf of the borrower, Kaplan Cos.

loans

GRAND PRAIRIE, TEXAS — Gantry has arranged $23.4 million in senior financing and preferred equity for the acquisition of DFW Corporate Park, a 211,385-square-foot industrial flex property in the central metroplex city of Grand Prairie. The 22-building development is located at 2100 N Highway 360. Braden Turnbull and Keegan Bridges of Gantry arranged the financing through an undisclosed life insurance company. The borrower was also not disclosed.

SAN ANTONIO — Colliers Mortgage has provided $16.8 million in HUD-insured, construction-to-permanent financing for Culebra Road Apartments, a 199-unit affordable housing project in San Antonio. The property will offer one-, two- and three-bedroom units, all of which will be subject to income restrictions, and amenities such as a pool, fitness center, playground, business center, clubhouse, activities room and outdoor grilling and dining stations. Jeff Rogers of Colliers Mortgage originated the financing, which was structured with a 40-year term. The borrower was an entity doing business as Culebra Road Apartments LP.

MONROEVILLE, PA. — KeyBank has provided $90.7 million in financing for the acquisition and rehabilitation of Cambridge Square Apartments, a 204-unit affordable housing property in Monroeville, an eastern suburb of Pittsburgh. The financing consists of a $35 million construction loan, an $18 million Fannie Mae permanent loan, $15.7 million in Low-Income Housing Tax Credit (LIHTC) equity and $22 million in tax-exempt bonds that were sold by KeyBanc Capital Markets. Cambridge Square Apartments consists of eight three-story buildings in one-, two- and three-bedroom floor plans, with 97 percent (198) of the units subject to a 20-year Section 8 Housing Assistance contract. Residents have access to services such as healthcare education, financial and computer literacy, childcare, youth activities, nutritional services, disability services, tenant homeownership training and parenting programs. Anna Belanger and Jonathan Wittkopf of KeyBank structured the tax credit equity and debt financing for the transaction. Robbie Lynn of KeyBank structured the tax-exempt bonds, which were marketed for sale by Sam Adams of KeyBanc Capital Markets. The sponsor is Community Preservation Partners.

AUSTIN, TEXAS — JLL has arranged an undisclosed amount of construction financing for Lirica East Austin, a 338-unit multifamily project that will be located about three miles east of the downtown area. Lirica East Austin will feature studio, one-, two- and three-bedroom units with an average size of 799 square feet and amenities such as a pool, clubroom, fitness center, a leasing office, coworking space and a sky lounge. Doug Opalka, C.W. Sheehan, Scott Dickey and Samantha Jay of JLL arranged the loan on behalf of the borrower, a partnership between CSW Development and Blueprint Local. The direct lender was not disclosed. Completion is slated for early 2026.

LOGAN TOWNSHIP, N.J. — JLL has arranged a $23 million acquisition loan for a 209,437-square-foot industrial property in the Southern New Jersey community of Logan Township. The warehouse and distribution center was built in 2018 on a site that spans 88 acres, 17 of which can support future development. Building features include clear heights of 36 to 40 feet, 12 dock-high loading doors, two drive-in doors, 10,500 square feet of office space and parking for 336 cars and 22 trailers. Michael Klein, Max Custer and Michael Lachs of JLL arranged the fixed-rate loan through an undisclosed life insurance company on behalf of the borrower, foodstuffs provider Chelten House Products.

NEW YORK CITY — Wells Fargo has provided $293 million in Fannie Mae financing for Lyra, a 590-unit apartment building in Manhattan’s Hudson Yards neighborhood. The property was completed in 2022 and features Class A amenities, a full-time doorman and ground-floor retail space. Additionally, 30 percent of the units are designated as affordable housing. The five-year loan retires a $225 million construction loan that Wells Fargo provided in 2019. Matthew Wiener and Preyaa Strzalkowski of Wells Fargo originated the financing on behalf of the borrower, an affiliate of Rockrose Development.

NEW YORK CITY — A partnership between two locally based firms, EJS Group and New Hope Capital, has received $108.1 million in construction financing for a 240-unit multifamily project in Brooklyn’s Bedford-Stuyvesant neighborhood. The development at 12 Halsey St. will consist of three buildings, with 30 percent of the units to be reserved as affordable housing. Amenities will include a pool, fitness center, tenant lounge and rooftop garden, as well as ground-floor retail space. Completion is slated for fall 2025. The financing package consists of an $83.1 million senior mortgage loan from Bank OZK and $25 million in mezzanine financing from CanAm Enterprises. Aaron Appel of Walker & Dunlop arranged the debt on behalf of the developers.

WEST WINDSOR, N.J. — JLL has arranged an undisclosed amount of permanent financing for Woodmont Way at West Windsor, a 443-unit apartment community located about 12 miles northeast of Trenton. Completed in 2022, the garden-style property features 13 buildings that house one-, two- and three-bedroom units. Amenities include a clubhouse, pool with a sundeck, resident lounge, golf simulator, fitness center, game den, dog park, pet spa and outdoor courtyards with pickleball courts. Thomas Didio, Thomas Didio Jr., Salvatore Buzzerio and Benjamin Morgenthal of JLL arranged the five-year, fixed-rate loan through Northwestern Mutual. The borrower was New Jersey-based Woodmont Properties.

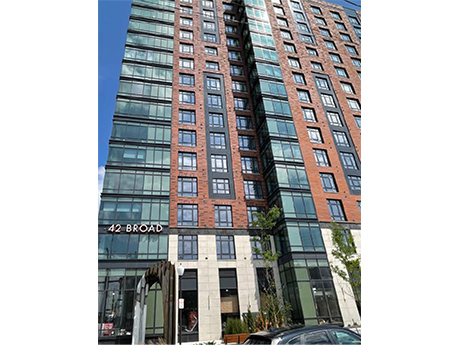

MOUNT VERNON, N.Y. — Canadian institutional investment firm Otera Capital has provided a $93 million loan for the refinancing of a 249-unit multifamily property in Mount Vernon, about 20 miles north of Manhattan. The 16-story building at 42 W. Broad St. houses studio, one-, two- and three-bedroom units. Amenities include a pool, fitness center, game room, entertainment kitchen, outdoor dining areas, coworking spaces, library and a courtyard garden. Kellogg Gaines and Geoff Goldstein of JLL arranged the financing. The borrower is a joint venture between two New York City-based firms, Alexander Development Group and The Bluestone Organization, and institutional investors advised by JP Morgan Asset Management.