EUGENE, ORE. — PTLA Real Estate has acquired a four-property student housing portfolio near the University of Oregon campus in Eugene. The communities — named The Anthony, The Pearl, Westgate and The Sonja — offer a total of 186 units and 383 beds. The properties were 95 percent leased ahead of the current academic year. The portfolio recently underwent roughly $2 million in renovations, including updates to shared amenity spaces. Jaclyn Fitts, William Vonderfecht and Casey Schaefer with CBRE’s national student housing team and Josh McDonald with CBRE’s Northwest multifamily investment sales team arranged the transaction on behalf of the undisclosed seller.

sale1

NASHVILLE, TENN. — JLL has arranged $172 million in acquisition financing for Four Seasons Hotel Nashville, a 40-story hospitality tower located at 100 Demonbreun St. in downtown Nashville’s South Broadway district. The 235-room hotel includes Mimo Restaurant, Mimo Bar, a full-service spa, event space and a resort-style pool and pool deck. The Four Seasons property also includes 143 condominiums that were not part of the sale. Eric Tupler, Jeff Bucaro, Brian Dawson and Kevin Davis of JLL arranged the financing through Credit Suisse on behalf of the borrower, a joint venture between GD Holdings, Stonebridge Development Co. and Copford Capital Management LLC. The sellers, Congress Group and AECOM Capital, opened the hotel earlier this week.

TAMPA, FLA. — CIP Real Estate has purchased two industrial parks in east Tampa for a combined $74.3 million. The properties, Center Point Business Park and Hampton Oaks Business Park, are situated three miles apart via U.S. Route 301. The developments span 405,772 square feet of small and mid-bay industrial space and feature 37 dock-high doors, 58 grade-level doors and 22 ramp loading entrances. CIP expects to invest $6.3 million in upgrades to the facilities over the next three years. Rick Brugge of Cushman & Wakefield represented the seller, Albany Road Estate Partners, in the transaction. Jason Hochman and Ron Granite of Cushman & Wakefield arranged acquisition financing through BankUnited on behalf of CIP.

BROOKFIELD, WIS. — Mid-America Real Estate Corp. has brokered the sale of Shoppers World of Brookfield, a 178,784-square-foot shopping center in the Milwaukee suburb of Brookfield. The sales price was undisclosed. Tenants at the fully leased property include Ross Dress for Less, Burlington, Xperience Fitness and Best Buy Outlet. Metro Market, operated by Kroger Co., shadow anchors the property. Ben Wineman, Emily Gadomski and Dan Rosenfeld of Mid-America represented the seller, an affiliate of New Orleans-based private investment firm, PMAT. Brandon Goodman, Spencer Strong, Sage Shepard and Nate Monson of Colliers represented the buyer, a private investor completing a 1031 exchange. PMAT purchased the center in 2019 when it was 78 percent occupied.

NORWOOD AND FRAMINGHAM, MASS. — JLL has negotiated the sale of two Marriott-branded hotels totaling 221 rooms in metro Boston. The Residence Inn Boston Norwood/Canton and Residence Inn Boston Framingham total 96 and 125 rooms, respectively. Both hotels offer guest suites with fully equipped kitchens and complimentary breakfast, as well as physical amenities such as fitness centers, business centers and indoor pools. Alan Suzuki and Matthew Enright of JLL represented the seller, APEX Capital Investments Corp., in the transaction. The buyer, JNR Management Inc., plans to make capital improvements at both properties.

COLUMBIA, MD. — Excelsa Properties has acquired Columbia Pointe, a 325-unit multifamily community located at 5764 Stevens Forest Road in Columbia, approximately 20 miles southwest of Baltimore. Newmark represented the seller, Morgan Properties, in the $78 million transaction. Built in 1972, the 18-acre property features one residential tower and 14 garden-style buildings with apartments in one-, two- and three-bedroom layouts. Excelsa plans to invest $3.2 million in the renovation of about half of Columbia Pointe’s units that will include kitchen and bathroom upgrades. Occupancy at the time of sale was 95 percent.

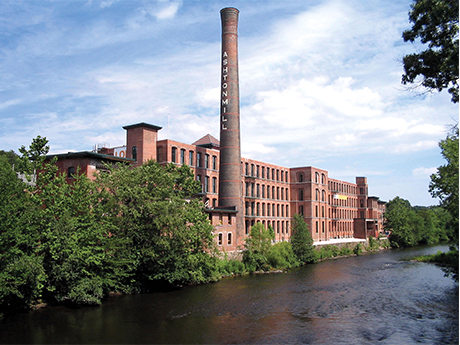

NEW HAVEN AND STRATFORD, CONN. — Illinois-based investment firm B3 Holdings LLC has acquired three multifamily properties in Connecticut and Rhode Island totaling 481 units units for $117 million. Winchester Lofts is a 158-unit complex in New Haven, and the second property is a 128-unit asset in Stratford, both of which are located in the southern coastal part of Connecticut. The third asset is River Lofts at Ashton Mills, a 195-unit community in Cumberland, R.I. Victor Nolletti, Eric Pentore and Wes Klockner of Institutional Property Advisors (IPA), a division of Marcus & Millichap, represented the seller, Brookfield Asset Management, in the transaction. The trio also procured B3 Holdings as the buyer.

ELK GROVE VILLAGE, ILL. — Westmount Realty Capital has sold a portfolio of 21 light industrial buildings totaling 757,557 square feet in the Chicago suburb of Elk Grove Village. The sales price and buyer were undisclosed. Westmount owned the portfolio for three years. The portfolio is 97 percent leased to 107 tenants. The buildings were constructed between the late 1960s and late 1970s. Westmount now owns and manages 58 industrial buildings totaling 5.4 million square feet across the Chicago market.

LA MESA, CALIF. — Waterton has purchased Veranda La Mesa, an apartment property located at 5353 Baltimore Drive in La Mesa, for an undisclosed price. The transaction marks Waterton’s first acquisition in the San Diego metro area. The name of the seller was not released. Situated on 18 acres, Veranda La Mesa features 406 apartments in a mix of studio, one- and two-bedroom layouts. Onsite amenities include multiple clubhouses, four swimming pools, six spas, a fitness center, game room, co-working lounge, dog washroom, tennis court, six laundry facilities and two dog parks. Waterton plans to implement a light value-add strategy across the common spaces while modernizing the remaining residences with new countertops, appliances, lighting, plumbing fixtures and flooring. The seller recently renovated the common areas and more than one-third of the residences.

MARIETTA, GA. — Capital Square has sold Ivy Commons Apartments, a 344-unit multifamily community located in Marietta, a northeast suburb of Atlanta. A group of Delaware statutory trust (DST) investors owned the 28.4-acre property, which was acquired by Capital Square in 2018. The property features 39 residential buildings with apartments in one-, two- and three-bedroom layouts. Community amenities include a swimming pool, fitness center, business center, tennis courts, laundry facility, playground and conference room. Investors saw a 200 percent total return on their 1031-exchange investment, according to Capital Square. The buyer was not disclosed.