CHICAGO — Kiser Group has arranged the sale of an 18-unit multifamily property at 7224 N. Rockwell St. in Chicago’s Rogers Park neighborhood for $2.7 million. The property has been partially renovated and houses four dorm units for the Hebrew Theological College. The building comprises a mix of one-, two- and three-bedroom units. Danny Logarakis of Kiser brokered the sale. The buyer, a local investor, also recently purchased another building nearby with 40 units.

sale1

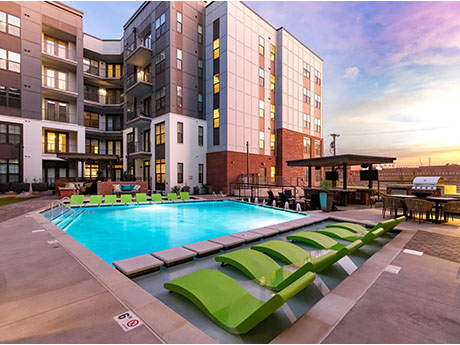

SCOTTSDALE, ARIZ. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of SeventyOne15 McDowell, an apartment property in Scottsdale. The asset traded for $150 million, or $547,445 per unit. The buyer and seller were not disclosed. Completed in 2022, SeventyOne15 McDowell features 274 apartments, a swimming pool and spa, private cabanas, a rooftop lounge with fire pits, two-story fitness center, direct-access parking garage, rooftop deck, electric charging stations and 24-hour parcel package concierge. Alliance Residential developed the property. Steve Gebing and Cliff David of IPA represented the seller and procured the buyer in the transaction.

SAN ANTONIO — Locally based investment firm The Lynd Group has acquired Parc 410, a 344-unit apartment community in San Antonio’s Leon Valley submarket. Built in 1985, the garden-style property offers one- and two-bedroom units with an average size of 716 square feet. Amenities include two pools, a clubhouse, fitness center, outdoor grilling and picnic areas, a dog park and a basketball court. As part of a $6 million capital improvement program, Lynd will install package lockers and a children’s playground, as well as upgrade unit interiors and other common areas.

WILLOW STREET, PA. — JLL has negotiated the sale of Kendig Square, a 186,749-square-foot shopping center in Willow Street, about 70 miles west of Philadelphia. Built in 1991, the property was 95 percent leased at the time of sale, with grocer Weis Markets serving as the anchor. Other tenants include Rite Aid, Planet Fitness, Dollar Tree and PNC. Northpath Investments sold Kendig Square to Triple Bar Properties Inc. for an undisclosed price. Christopher Munley, Jim Galbally, Colin Behr and James Graf of JLL brokered the deal.

WAUCONDA, ILL. — Mid-America Real Estate Corp. has arranged the sale of Liberty Square in the Chicago suburb of Wauconda for an undisclosed price. Anchored by Jewel-Osco, the 107,431-square-foot shopping center is 97 percent leased. Other tenants include Pet Supplies Plus, USPS, Athletico, Subway, Great Clips and T-Mobile. Ben Wineman of Mid-America represented the seller, Maryland-based Broad Reach Retail Partners LLC. Connecticut-based AmCap purchased the asset.

Westcore Acquires Four-Building Central Logistics Industrial Campus in Phoenix for $93.5M

by Amy Works

PHOENIX — Westcore has purchased Central Logistics, a four-building industrial campus located in the Central Phoenix market of Arizona. Phoenix-based ViaWest Group sold the asset for $93.5 million. Situated on 24.9 acres, Central Logistics offers a total of 1.1 million square feet of industrial space spread across four buildings with 32-foot clear heights. Currently leased to Bay Logistics, the 76,189-square-foot cold storage facility Building D North offers 13 dock-high doors and one grade-level door. Waymo occupies the 72,349-square-foot Building D South, which features 10 dock-high doors, one grade-level door and ESFR sprinklers. Ferguson occupies the 94,612-square-foot Building E, which offers a four-acre, fully secure concrete yard, two grade-level doors, 12 dock-high doors and ESFR sprinklers. Westcore plans to renovate the 165,518-square-foot Building B, which is currently vacant. John Werstler, Cooper Fratt, Tanner Ferrandi and Connie Nelson of CBRE will market the property for lease.

MINNEAPOLIS — CBRE has brokered the sale of a four-property, value-add multifamily portfolio in Minneapolis for an undisclosed price. Grannes Properties LLC sold the portfolio to two separate buyers. Webdigs LLC purchased a 14-unit building at 3710 Minnehaha Ave. Millennial Properties LLC acquired a 12-unit property at 315 University Ave. SE, a six-unit building at 3505 22nd Ave. and an 11-unit property at 420 73rd St. The assets were built in the 1960s and were fully occupied at the time of sale. Drew Rafshol of CBRE Minneapolis Multifamily represented the seller.

TUCSON, ARIZ. — San Diego-based Tower 16 Capital Partners has completed the disposition of two apartment properties in Tucson to an undisclosed buyer for $65.1 million. The seller assembled the portfolio over the last 24 months and repositioned the properties, Sierra Vista and La Mirada. Both assets received significant renovations, including the leasing offices, outdoor amenity areas and interior unit renovations on 40 percent of the units. Tower 16 purchased the properties for $36 million and spent $4.9 million on improvements. The new buyer plans to continue the renovation efforts. Located at 3535 N. 1st Ave., Sierra Vista features 258 apartments, two pools and a new clubhouse, leasing office and gym. La Mirada, located at 4415 E. Grand Road, offers 201 apartments, two pools, a new clubhouse with a fitness center and new outdoor amenity area. Art Wadlund, Clint Wadlund and Hamid Panahi of Institutional Property Advisors, a division of Marcus & Millichap, represented the seller in the deal.

KANSAS CITY, MO. — Avanti Residential has purchased Artistry Apartments in Kansas City’s Crossroads Arts District for $94 million. The 341-unit, Class A apartment complex marks Avanti’s seventh investment in the Kansas City market. Constructed in 2021, Artistry Apartments features 11,675 square feet of street-level retail space that is 70 percent leased to Sola Salon. Jeff Stingley and Max Helgeson of CBRE represented the seller, a joint venture between Milhaus Development and CrossHarbor Capital Partners. Brady O’Donnell, Jill Haug, Alexandra Scott and Kyle Tucker of CBRE arranged acquisition financing on behalf of Avanti. The property was 95 percent leased at the time of sale.

NASHVILLE, TENN. — Newmark has secured the sale of Alta Foundry, a newly built, 231-unit apartment community located at 640 21st Ave. N in Nashville’s Midtown district. Tarek El Gammal and Vincent Lefler of Newmark represented the seller and developer, Wood Partners, in the transaction. Blacksburg, Va.-based HHHunt purchased Alta Foundry, which was in lease-up and 75 percent occupied at the time of sale, for $86.6 million. Amenities include a rooftop sky lounge, resort-style saltwater pool and a covered outdoor entertainment and gaming lawn. Alta Foundry’s floor plans range from studio to two-bedroom units, and rental rates start at $1,751 per month, according to Apartments.com.