DALLAS — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of Mosaic Dallas, a 440-unit multifamily property in downtown Dallas. Constructed as office buildings in the 1950s, Mosaic Dallas was converted into apartments in 2006. The two high-rise buildings also house 8,766 square feet of ground-floor retail space. Amenities include a rooftop pool, indoor putting lounge, valet and concierge services, dry cleaning service and a fitness center. Joey Tumminello, Drew Kile, Taylor Hill, Michael Ware, Grant Raymond and Will Balthrope of IPA represented the seller, Olympus Property, and procured the buyer, a New York-based investment manager, in the deal.

sale1

HOPEWELL, N.J. — A partnership between two regional investment firms, The Birch Group and Lionstone Capital, has acquired a three-building office complex in the Central New Jersey community of Hopewell for $70 million. Princeton Place at Hopewell spans 307,510 square feet and was 96 percent leased at the time of sale to tenants such as Merrill Lynch, Horizon Blue Cross Blue Shield and Janssen R&D. Amenities include multiple cafeterias, a fitness center, indoor basketball court, conference center and a central plaza with water features and outdoor dining space. Cushman & Wakefield represented the undisclosed seller in the transaction.

BOLINGBROOK, ILL. — Mid-America Real Estate Corp. has brokered the sale of The Landings, a 112,622-square-foot shopping center in the Chicago suburb of Bolingbrook. The sales price was undisclosed. Anchor tenants at the property, which is 91 percent leased, include PetSmart, OfficeMax, Planet Fitness and Modern Furniture. Ben Wineman of Mid-America represented the seller, an affiliate of Atlanta-based RCG Ventures. Irvine, Calif.-based Sperry Equities was the buyer.

SEATTLE AND SAN FRANCISCO — Seattle-based tech giant Amazon (NASDAQ: AMZN) has agreed to acquire San Francisco-based primary medical care chain One Medical (NASDAQ: ONEM) for $3.9 billion. One Medical operates over 180 doctor’s offices throughout major metro areas in the United States. Approximately 767,000 people have memberships to One Medical, paying a $200 annual subscription fee for the service. The company also mixes in-person, digital and virtual care services, with the intent of being convenient to where people already work, shop and live. Amazon has been pushing its way into healthcare in recent years, and the One Medical acquisition represents its biggest push into the sector to date, particularly regarding the physical real estate. “We think healthcare is high on the list of experiences that need reinvention,” says Neil Lindsay, senior vice president of Amazon Health Services. “Booking an appointment, waiting weeks or even months to be seen, taking time off work, driving to a clinic, finding a parking spot, waiting in the waiting room then the exam room for what is too often a rushed few minutes with a doctor, then making another trip to a pharmacy — we see lots of opportunity to both improve the quality …

MIAMI — Affiliates of Harbor Group International (HGI), a privately owned real estate investment and management firm based in Norfolk, Va., has purchased Miro Brickell, a 372-unit multifamily property in the Brickell neighborhood of Miami. The undisclosed seller sold the asset for $184.5 million. Built in 2017, Miro Brickell features studio, one- and two-bedroom floor plans with balconies, stainless steel appliances, energy-efficient washers and dryers and modern finishes. Community amenities include outdoor electric grills, a resort-style pool with poolside cabanas, fitness center with a yoga studio, outdoor boxing gym, onsite management and maintenance, movie theater, bike storage and a dog wash station. The acquisition of Miro Brickell marks the seventh property currently under HGI’s ownership in Miami-Dade County, bringing the investor’s local portfolio to more than 1,500 units.

FUQUAY-VARINA, N.C. — Aldon, a multifamily developer and investor based in Bethesda, Md., has purchased Elevate Powell & Broad, a luxury apartment community located at 141 Stobhill Lane in the Raleigh suburb of Fuquay-Varina. The undisclosed seller traded the 384-unit community to Aldon for $129 million. Completed in 2021, Elevate Powell & Broad has been rebranded as Aldon at Powell & Broad. The property features one- and two-bedroom floorplans with stainless steel appliances, movable kitchen islands, granite countertops, private terraces and balconies, nine-foot ceilings and sunrooms in select units. Community amenities include a resort-style pool, fitness center, two dog parks, dog spa, coffee bar, game room, car care center, cornhole, playground and an outdoor pavilion with a fire pit. Aldon’s purchase of Aldon at Powell & Broad caps a trio of multifamily investments the company has made in the Research Triangle in the past 12 months totaling $315 million.

MISSOURI CITY, TEXAS — Thompson Thrift Residential, a subsidiary of Indianapolis-based investment firm Thompson Thrift, has sold The Ranch at Sienna, a 312-unit apartment community in the southwestern Houston suburb of Missouri City. Built in 2016, the property offers one-, two- and three-bedroom units averaging 1,105 square feet. Residences are furnished with private balconies and full-sized washer and dryers. Communal amenities include a pool with cabanas, a fitness center, clubhouse, coffee bar, outdoor kitchen, game room and a dog park. Houston-based Laye Capital Investments purchased the community for an undisclosed amount.

MILWAUKEE — The Boulder Group has brokered the sale of a 120,000-square-foot property occupied by grocer Pick ’n Save in Milwaukee. Retailers in the surrounding area include Starbucks, Domino’s Pizza, U.S. Bank, Dunkin’, McDonald’s, Napa Auto Parts and Culver’s. Jimmy Goodman and John Feeney of Boulder represented the seller, a Milwaukee-based real estate investor, and the buyer, a national private real estate company. There are more than eight years remaining on the Pick ’n Save lease.

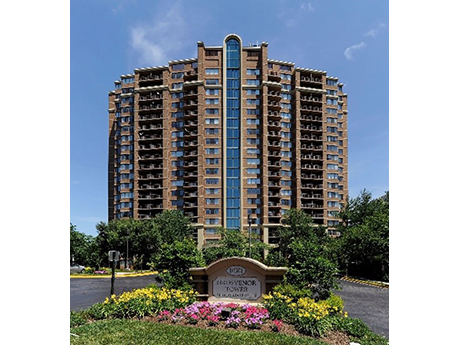

BETHESDA, MD. — Grosvenor and an unnamed investment partner have acquired a 21-story apartment tower in North Bethesda that coincidentally shares a name with the private investor. Grosvenor Tower is located at 10301 Grosvenor Place and features 237 apartments. The acquisition price was not disclosed, but the Washington Business Journal reports that the asset traded for $95 million and that Grosvenor plans to invest $10 million to upgrade the property. The property was originally built in 1987, renovated in 2008 and includes 80 one-bedroom, one-bath apartments and 157 two-bedroom, two-bath apartments. Grosvenor has engaged Bozzuto Management to oversee day-to-day property management. The buyer plans to enhance energy and water efficiency at Grosvenor Tower as part of its $10 million value-add program.

SANTEE, CALIF. — Faris Lee Investments has arranged the $27.1 million sale of Santee Town Center, a shopping center in Santee. Brixton Capital acquired the asset from a Los Angeles-based private family office. Sean Cox and Alex Moore, Don MacLellan and Gene Ventura of Faris Lee represented the buyer and seller in the deal. At the time of sale, the 106,903-square-foot retail center was fully leased. Current tenants include Ross Dress for Less, Dollar Tree and Michaels.