MIAMI — Trion Properties, a private equity investment firm with offices in West Hollywood and Miami, has purchased Art 88 Apartments in Miami for $87.3 million. The seller was not disclosed, but South Florida Business Journal reports that Grand Peak Properties was the previous owner. Built in 1971 within one mile of Miami International Airport, Art 88 comprises 294 one- and two-bedroom apartments averaging 787 square feet. The community is configured in eight two- to five-story elevator buildings and features two pools, a fitness center, laundry facilities and a dog park. Maurice Habif, Simon Banke and Ted Turner of JLL brokered the transaction, and Jesse Wright with JLL arranged acquisition financing. Art 88 was 97 percent occupied at the time of sale, and the new ownership plans to make capital improvements to the property in the near future.

sale1

CHARLOTTE, N.C. — A fund sponsored by CBRE Investment Management has purchased The Line, a newly built, 16-story office tower in Charlotte’s South End district. The 314,221-square-foot property is located at 2151 Hawkins St. and features shared workspaces, sky lobby, amenity terrace, open-air plaza, lawn, outdoor decks, bike rooms, lockers, showers, covered parking and 24,000 square feet of retail space. The CBRE Strategic Partners U.S. Value 9 fund acquired The Line in a joint venture with Atlanta-based Portman Holdings, which co-developed the property with Washington, D.C.-based National Real Estate Advisors LLC. Mike McDonald and Jonathan Napper of Cushman & Wakefield represented the seller in the transaction. The sales price was not disclosed.

DALLAS — Global Real Estate Advisors (GREA) has arranged the sale of four multifamily assets totaling 851 units that are located throughout the Dallas-Fort Worth metroplex. The properties include Villa Placita in Garland (122 units); Antigua Village in Fort Worth (152 units); WaterWalk Las Colinas in Irving (153 units); and The Club at Fossil Creek in Fort Worth (424 units). Mark Allen and Zac Thomas of GREA brokered the deals. The sellers were not disclosed.

Thompson Thrift Retail Group Sells Sonoran Creek Marketplace in Maricopa, Arizona for $34M

by Amy Works

MARICOPA, ARIZ. — Thompson Thrift Retail Group has completed the sale of Sonoran Creek Marketplace, a shopping center located on the southwest corner of John Wayne Parkway and Edison Road in Maricopa. An undisclosed buyer acquired the asset for $34 million, or $461 per square foot, in an off-market transaction. Situated on 10.2 acres, the 73,692-square-foot Sonoran Creek Marketplace was 100 percent occupied at the time of sale. Current tenants include Sprouts Farmers Markets, Jimmy John’s Sandwiches, Supercuts, Marshalls and The Joint Chiropractic. Danny Gardiner and Chad Tiedeman of Phoenix Commercial Advisors represented the seller in the transaction. Cameron Warren, Nick DeDona, Dan Gardiner and Greg Laing of Phoenix Commercial Advisors handled leasing at the property.

CHICAGO — Stan Johnson Co. has brokered the sale of an 83,652-square-foot retail building in Chicago for $13.7 million. Located along North Cicero Avenue, the property is leased to Ross Dress for Less and its affiliate brand, dd’s Discounts. Both retailers operate under a single master lease. Mike Sladich of Stan Johnson represented the seller, an Illinois-based institutional investor. A California-based REIT acquired the asset.

WEST PALM BEACH, FLA. — Publix Super Market Inc. has purchased River Bridge Centre, a community shopping center situated on 28.4 acres at 6714-6868 Forest Hill Road in West Palm Beach. An affiliate of Apollo Global Management sold the asset to the Lakeland, Fla.-based grocer for $56.5 million. Danny Finkle, Eric Williams and Kim Flores of JLL represented the seller in the transaction. Opened in 1986 and renovated in 2005, River Bridge Centre features 229,781 square feet of retail space. Publix, Ross Dress for Less, Crunch Fitness, Five Below, Ace Hardware, Chipotle Mexican Grill, MD Now Urgent Care, Humana and Pizza Hut are tenants at the retail center. The value-add center was 86.3 percent occupied at the time of sale.

SAN ANTONIO — JLL has negotiated the sale of Corner Ridge Crossing, a 576,047-square-foot industrial park on San Antonio’s east side. Built in 2020, the property comprises four industrial buildings: one cross-dock, one front-load and two rear-load buildings. Each building has 28- to 32-foot clear heights, 28- to 60-foot dock high doors and truck court depths ranging from 130 to 210 feet. Trent Agnew, Dustin Volz, Dom Espinosa, Josh Villarreal and Zach Riebe of JLL represented the seller, Houston-based Hines, in the transaction. Global investment firm KKR acquired the development for an undisclosed price.

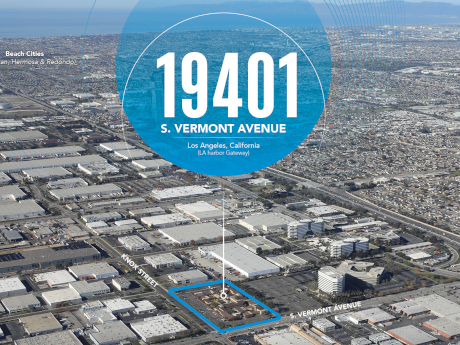

Harbor Gateway Sells Office-to-Industrial Conversion Property in Los Angeles for $39.8M

by Amy Works

LOS ANGELES — Harbor Gateway LLC has completed the disposition of a 5.4-acre industrial redevelopment property located at 19401 S. Vermont Ave. in Los Angeles’ South Bay market. Atlas Capital acquired the asset for $39.8 million. The property currently comprises 12 office buildings totaling 94,113 square feet. The location offers close proximity to two of the busiest seaports in North America and Los Angeles International Airport, as well as immediate access to the 105, 110, 710, 405 and 91 freeways. Kevin Shannon, Scott Schumacher, Ken White, Bret Hardy, Jim Linn, Andrew Briner, John McMillan and Danny Williams of Newmark represented the seller.

Madison Marquette Purchases 380-Unit Crosswinds Apartment Complex in Wilmington, North Carolina

by Amy Works

WILMINGTON, N.C. — Madison Marquette has acquired Crosswinds, a multifamily property in Wilmington, as part of its Evergreen Multifamily Value Add Fund for an undisclosed price. Terms of the transaction were not released. Built in 1989 on 23 acres, Crosswinds features 380 apartments in a mix of one-, two- and three-bedroom units, ranging from 645 square feet to 1,306 square feet, spread across 19 buildings. The units feature wood-style flooring, patio/balconies in each unit, wood-burning fireplaces and full-size washer/dryer connections in most unit types. Community amenities include a saltwater resort-style pool with a sundeck, grilling and picnic areas, lighted tennis and volleyball courts, a fitness center and business center. The buyer plans to complete strategic unit upgrades that will provide higher quality hardware and finishes, including appliances, flooring and countertops. Additionally, Madison Marquette will improve the community’s amenities, perform aesthetic work and upgrade landscaping.

Coastal Ridge, Goldman Sachs Acquire 448-Bed Student Housing Community Near Northern Arizona University

by Amy Works

FLAGSTAFF, ARIZ. — A joint venture between Coastal Ridge Real Estate and Goldman Sachs Asset Management has acquired the Commons at Sawmill, a 448-bed student housing community near Northern Arizona University in Flagstaff. The property offers studio, two- and four-bedroom, fully furnished units. Shared amenities include a newly built clubhouse, fitness center, game area, theater, study lounge and outdoor courtyard. Jaclyn Fitts, Casey Schaefer and William Vonderfecht with CBRE brokered the acquisition of the property from an undisclosed seller. Coastal Ridge will manage the community.