HOUSTON — New York City-based brokerage firm Rosewood Realty Group has arranged the sale of Quail Creek I and Quail Creek II, a 529-unit multifamily portfolio in northwest Houston. The communities were built in the late 1970s and respectively consist of 12 and 30 buildings for a total of 436,447 square feet of residential space. Units come in one- and two-bedroom floor plans, and amenities include a pool and outdoor entertainment spaces. Mike Kerwin and Scott Bernstein of Rosewood Realty Group represented the seller, locally based investment firm Nitya Capital, in the transaction. Aaron Jungreis, also with Rosewood, represented the buyer, Ventus Capital.

sale1

MOUNT SHASTA, CALIF. — One Shasta LLC has purchased a 266-acre property in Mount Shasta. Crystal Geyser Water Co. sold the asset for $7.1 million. The property comprises industrial, low-intensity agriculture and residentially zoned land in Siskiyou County, Calif. Additionally, the acquisition includes a 144,900-square-foot industrial building at 210 Ski Village Drive. The building offers dock-high access and proximity to Interstate 5. John Troughton and Adam Elomari of Kennedy Wilson Brokerage represented the buyer in the deal.

ROUND ROCK, TEXAS — Edge Realty Partners has arranged the sale of Round Rock Crossing, a 245,592-square-foot shopping center in the northern Austin suburb of Round Rock. Built in phases on 31.5 acres between 2004 and 2006, the eight-building property was 52 percent leased at the time of sale to 18 tenants. The roster includes Best Buy, Michael’s, Dollar Tree, Vitamin Shoppe, Five Guys and Salons by JC. Mart Martindale and Brandon Beeson of Edge Realty Partners represented the undisclosed seller in the transaction. The buyer, Los Angeles-based BH Properties, intends to execute a value-add program at Round Rock Crossing.

CHAMPIONSGATE, FLA. — Grandbridge Real Estate Capital has negotiated the sale of Merrill Gardens at ChampionsGate, a 223-unit seniors living campus in ChampionsGate, approximately 25 miles southwest of downtown Orlando. David Kliewer and Jay Jordan of Charlotte-based Grandbridge facilitated the $45 million sale to funds managed by Fortress Investment Group, which has tapped Watermark Retirement Communities to manage the property. The new owner also changed the property’s name to The Glades at ChampionsGate. Built in 2017, the community offers 114 independent living, 73 assisted living and 36 memory care units. Following challenges in meeting the operating covenants of the bond structure, in July 2021 a court order appointed William King of WK Financial as receiver.

RENTON, WASH. — Innovatus Capital Partners has purchased Triton Towers, a trio of seven-story office buildings in Renton. Terms of the transaction were not disclosed. Triton Towers features more than 400,000 square feet of Class A office space. At the time of sale, Tower Three was fully occupied, Tower One had 24,413 rentable square feet available, and Tower Two had 48,650 rentable square feet available. The property offers two conference centers, an exercise facility with showers and lockers, outdoor picnic areas, a full-time day porter service, bike storage and free surface parking. LPC West, the West Coast arm of Lincoln Property Co., will provide property management services for the asset.

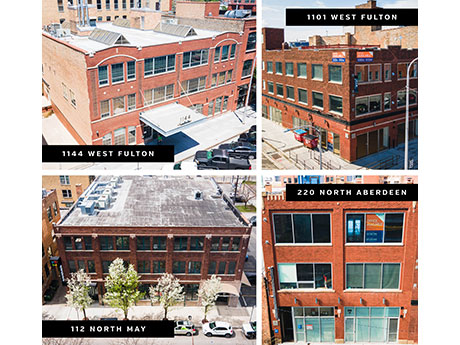

CHICAGO — SVN | Chicago Commercial has brokered the sale of a portfolio of office and retail buildings in Chicago’s Fulton Market district for $33.5 million. The portfolio comprises four buildings totaling more than 76,000 square feet as well as deeded parking spaces that can hold up to 58 cars. Scott Maesel, Drew Dillon, Chad Schroedl, Adam Thomas and Logan Parsons of SVN | Chicago Commercial’s Urban Team represented the seller. Buyer and seller information was not provided.

Mirae Asset Global Purchases Academy Sports Headquarters Campus in Metro Houston for $190M

by John Nelson

KATY, TEXAS — Mirae Asset Global Investments, a global investment firm based in Seoul, South Korea, has purchased the headquarters campus of sporting goods retail giant Academy Sports + Outdoors (Nasdaq: ASO) in the west Houston suburb of Katy. Phoenix-based Tratt Properties sold the 1.5 million-square-foot campus, which is triple-net leased to Academy Sports on a long-term lease, for $190 million. The 93-acre campus includes a little over 1.2 million square feet of warehouse space, 250,000 square feet of flexible office space and mezzanine space totaling approximately 800,000 square feet. Located at 1800 N. Mason Road, the site has immediate access to Interstate 10 and Texas Highway 99, which circles Houston. “From a logistics perspective, this property is exceptionally well-located, with access to highways in all directions,” says Ken Hedrick, executive managing director of Newmark. “The scarcity and increasing value of land in the west Houston area further enhance the property’s value.” Hedrick, along with Newmark colleagues Jerry Hopkins, Andrew Ragsdale, Alex Foshay and Kristian Nielsen, represented Tratt Properties in the sale. Dustin Stolly, Jordan Roeschlaub and Nick Scribani, also with Newmark, arranged acquisition financing on behalf of Mirae Asset Global. Tratt Properties is an active logistics real estate investor …

CHICAGO — Chicago-based JLL has arranged the sale of a 27-property healthcare portfolio totaling 1.2 million square feet for $600 million. The assets are located in Arizona, California, Colorado, Illinois, Indiana, Florida, Massachusetts, Minnesota, Oklahoma and Texas. The portfolio includes 15 medical office buildings, five micro-hospitals, four behavioral hospitals, two inpatient rehabilitation hospitals and one heart and surgical hospital. Nine of the properties are in Arizona. The portfolio is 97 percent occupied by tenants such as Advocate Aurora Health, Rush University Medical Center, Memorial Hermann, Ascension, Banner Health, Tenet Health, Lutheran Health Network, Baylor Scott & White Health and Edward-Elmhurst Healthcare. A JLL Healthcare Capital Markets team led by Mindy Berman, Evan Kovac, Andrew Milne and Brian Bacharach represented the seller, Harrison Street. NorthWest Healthcare Properties was the buyer.

Drawbridge Realty Buys Arrow Electronics Headquarters Property in Englewood, Colorado for $106M

by Amy Works

ENGLEWOOD, COLO. — Drawbridge Realty has purchased one of the Arrow Buildings at Dry Creek Station in Englewood for $106 million. The acquisition is Drawbridge’s first since completing a $1.7 billion recapitalization of its national portfolio in February with institutional investors KKR and General Atlantic. Arrow Electronics (NYSE: ARW) fully occupies the 223,177-square-foot, Class A headquarters building, located at 9151 E. Panorama, on a long-term basis. Constructed in 2017, the property enabled Arrow to consolidate its more than 1,600 local employees spread across nine buildings into one campus-style location. The seven-story building offers parking for more than 1,300 cars and is adjacent to Interstate 25 and near the Dry Creek light rail station. The acquired building is adjacent to Arrow’s other worldwide headquarters building. Terms of the transaction were not released.

READING, PA. — JLL has negotiated the sale of Exeter Commons, a 361,095-square-foot shopping center in the Eastern Pennsylvania city of Reading. Grocer Giant Food and Lowe’s Home Improvement anchor Exeter Crossing, which was built in 2009 and was 99.5 percent leased at the time of sale. Other tenants include Ross Dress for Less, PA Wine & Spirits, Five Below, Petco, Staples, Famous Footwear, America’s Best Contacts, Moe’s Southwest Grill, Red Robin, Supercuts and Mattress Firm. Christopher Munley, Jim Galbally and Colin Behr of JLL represented the undisclosed seller in the transaction. Wharton Realty Group purchased the center for an undisclosed price.