FRANKLIN, IND. — MDH Partners has purchased Franklin Tech Park, an 808,505-square-foot industrial facility in the Indianapolis suburb of Franklin. The purchase price was undisclosed. Constructed in 2009, the property sits on 42 acres at 500 Bartram Parkway. The facility is LEED Gold-certified and features a clear height of 32 feet, 78 exterior dock doors and over 100 trailer parking spaces. The transaction marks the first acquisition in Indiana for Atlanta-based MDH. Upon acquisition, MDH executed a lease with Atlanta-based, third-party logistics provider Broadrange Logistics. Houston Hawley of MDH served as the acquisition lead for the company. JR Wright and John Gosnell of Strategic Real Estate Partners brokered the sale.

sale1

PEACHTREE CORNERS, GA. — Cincinnati-based North American Properties and Nuveen Real Estate have acquired The Forum on Peachtree Parkway, a 500,000-square-foot shopping center in Peachtree Corners, about 22.9 miles from downtown Atlanta. The seller and sales price were not disclosed. Originally opened in 2002, The Forum on Peachtree Parkway is an open-air lifestyle center that is home to a mix of retail, restaurants and office space, including lululemon, Pottery Barn, Trader Joe’s and Ulta Beauty. Property amenities include walking trails, property-wide Wi-Fi, outdoor seating areas and a pedestrian bridge connecting to Peachtree Corners Town Center. North American Properties has plans to redevelop the property, including making the public realm bigger, improving the common areas and remerchandising the retail collection. No other redevelopment plans were disclosed.

HOUSTON — Berkadia has arranged the sale of The Dawson, a 354-unit apartment community located in the Energy Corridor area of West Houston. Built in 2014, The Dawson offers one- and two-bedroom units that range in size from 649 to 1,552 square feet. Residences are furnished with stainless steel appliances, granite countertops, individual washers and dryers and private balconies/patios. Amenities include a pool, fitness center, business center, outdoor kitchen and a dog park. Chris Curry, Todd Marix, Jeffrey Skipworth, Chris Young, Joey Rippel and Kyle Whitney of Berkadia represented the seller, Austin-based RPM Living, in the transaction. Clay Akiwenzie, also with Berkadia, originated an undisclosed amount of Freddie Mac financing on behalf of the buyer, California-based Bridge Partners. The loan carried a seven-year term and a floating interest rate.

WILMETTE, ILL. — Chicago-based Newport Capital Partners has sold Edens Plaza in the Chicago suburb of Wilmette for $110 million. Massachusetts-based WS Development was the buyer. The shopping center spans 350,000 square feet. Current tenants include The Fresh Market, Walgreens, Chicagoland Children’s Health Alliance, Starbucks and Big Blue Swim School. The property also comprises a two-story department store that was formerly occupied by Carson Pirie Scott and is currently vacant. Newport acquired Edens Plaza in 2018 and the vacant department store in 2019. WS plans to open the first-ever bricks-and-mortar store for online furniture retailer Wayfair in the department store. Joe Girardi of Mid-America Real Estate Group brokered the transaction.

LINDENHURST, N.Y. — JLL has negotiated the $146 million sale of The Wel, a 260-unit apartment community located in the Long Island community of Lindenhurst. Built in 2021, The Wel offers studio, one-, two- and three-bedroom units with an average size of 916 square feet. Residences are furnished with stainless steel appliances, stone countertops and individual washers and dryers. Amenities include a pool, fitness center, coworking space, game room, rooftop lounge, fire pits, a dog wash station and landscaped courtyards. Jose Cruz, Steve Simonelli, Andrew Scandalios, Michael Oliver, Kevin O’Hearn and Jason Lundy of JLL represented the seller, a joint venture between Tritec Real Estate Co. and an affiliate of Rockwood Capital, in the transaction. The buyer was Fairfield Properties.

PHOENIX — Taurus Investment Holdings has purchased an apartment property located in Phoenix’s northwest region for $42 million. The buyer will rebrand the Class B property, which was previously known as Rise Metro, as Raystone. Built in 1981, Raystone features 160 units. Through its energy-focused subsidiary, RENU Communities, Taurus plans to transition Raystone to a low-carbon, energy-efficient multifamily complex by replacing all HVAC units with highly efficient air-source heat pumps, replacing existing electric water heaters with heat pump water heaters, implementing an energy monitoring system in each unit, upgrading lighting and installing solar panels.

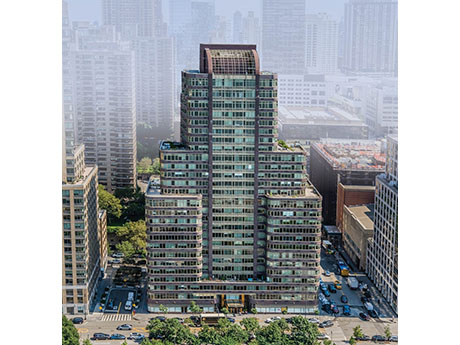

A&E Real Estate Acquires Apartment Tower in Manhattan from Equity Residential for $266M

by John Nelson

NEW YORK CITY — A&E Real Estate, a private multifamily investment and management firm based in New York City, has purchased 140 Riverside Boulevard, a luxury 354-unit apartment tower on the Upper West Side of Manhattan. Equity Residential (NYSE: EQR), a multifamily REIT based in Chicago, sold the 28-story community for $266 million. Darcy Stacom and Ryan Silber of CBRE represented Equity Residential in the sale. Built in 2002, the apartment tower features controlled access, a doorman, fitness center, interior courtyard, multiple tenant lounges, onsite management, package services, storage space and concierge services. The property is situated opposite Riverside Park South, a New York City park that fronts the Hudson River. Additionally, the community includes commercial space currently leased to New York Cat Hospital, a veterinarian’s clinic, and Dwight School, a private school catering to pre-K and kindergarten students. “140 Riverside Boulevard is a stand-out in the New York market, situated both waterfront and park-front with direct access to the Hudson River Park system,” says Stacom. “The property has been meticulously maintained and is truly excellent real estate — as this transaction validates.” Founded in 2011, A&E Real Estate began with the acquisition of a 49-unit apartment community in Brooklyn. …

DALLAS — A joint venture between Acram Group, an investment firm formerly known as JMC Holdings, and New York City-based alternative investment group Oak Hill Advisors has purchased Spectrum Center, a 614,000-square-foot office complex in North Dallas, for $114.3 million. The sales price equates to roughly $185 per square foot. Spectrum Center consists of two 12-story buildings. According to LoopNet Inc., the property offers amenities such as a fitness center, courtyard and an onsite restaurant, while users also have access to services such as banking, dry cleaning and daycare. Todd Savage of JLL represented the seller, Granite Properties, in the transaction. Jim Curtin and Ryan Pollack, also with JLL, represented the joint venture. Miami-based Rialto Capital provided an undisclosed amount of acquisition financing for the deal.

HOUSTON — JLL has arranged the sale of Champions Village, a 383,346-square-foot retail power center situated on 31.5 acres in northwest Houston. Retailers at the property include grocer Randalls, Barnes & Noble, T.J. Maxx, Tuesday Morning, Kirklands, Jenny Craig, Supercuts, Bath & Body Works, Body & Brain Yoga and Berkeley Eye Center. Restaurant users include La Madeleine, Don Ramons Mexican Restaurant, Cassandra’s Louisiana Kitchen and MOD Pizza. Chris Gerard, Ryan West, Sherri Rollins and Ethan Goldberg of JLL represented the seller, New Market Properties LLC, a subsidiary of Atlanta-based REIT Preferred Apartment Communities Inc., in the transaction. New Jersey-based First National Realty Partners acquired the asset for an undisclosed price.

DALLAS — Dallas-based CBRE has brokered the $91 million sale of an eight-building medical office portfolio across four states in the Southeast and Texas. A joint venture between Chicago-based Remedy Medical Properties and Boca Raton, Fla.-based Kanye Anderson Real Estate purchased the properties. Lee Asher, Chris Bodnar, Jordan Selbiger, Ryan Lindsley, Cole Reethof, Sabrina Solomiany and Zach Holderman of CBRE represented the seller, Los Angeles-based Spruce Healthcare, in the transaction. The 177,000-square-foot portfolio includes five properties in Florida and one each in Texas, North Carolina and Tennessee. The portfolio was fully leased at the time of sale with 11 years of weighted average lease terms remaining. Two-thirds of the overall tenancy features orthopedics, oncology and imaging practices. Other specialties include ophthalmology and dermatology, both of which include ambulatory surgery centers.