LINCOLN, ILL. — The Boulder Group has negotiated the $2.1 million sale of a single-tenant property net leased to Starbucks in the Central Illinois city of Lincoln. The building is located at 3103 Woodlawn Road near I-55. Randy Blankstein and John Feeney of Boulder represented the seller, a West Coast-based investment group. The Illinois-based buyer completed a 1031 exchange.

sale1

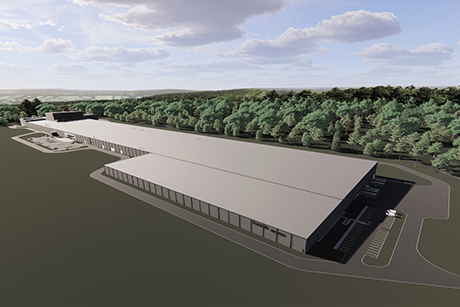

BAXTER, TENN. — Avison Young’s Capital Markets Group has arranged the sale-leaseback of a manufacturing facility in Baxter. The transaction totaled approximately $90 million. Timothy Hall, James Hanson and Tom Viscount of Avison Young arranged the sale-leaseback transaction. Chicago-based Oak Street Real Estate Capital will fund the construction and purchase the 965,000-square-foot facility, then lease it back to Portobello America, a tile manufacturer and distributor based in Brazil. Portobello America is building the plant and will use it to manufacture ceramic tiles and to house its U.S. headquarters. Portobello America will execute a long-term lease when construction is complete, which is expected in late 2022. The firm estimates the facility will create more than 200 local jobs and generate $150 million in annual revenue, as soon as the full capacity is reached, which is expected to occur by 2026. The 92-acre, build-to-suit project will include the main manufacturing, warehouse and office building, which will also contain the corporate headquarters and a showroom. The manufacturing plant will feature the latest green technologies to reduce the consumption of electricity, natural gas and water, according to the developer. The project site is situated on the south side of Interstate 40, about 70 miles …

TURLOCK, CALIF. — Faris Lee Investments has brokered the sale of Turlock Town Center, a community retail center located at 503-795 N. Golden State Blvd. in Turlock. A California-based developer sold the asset to an undisclosed buyer in a 1031 exchange for $37.4 million. Don MacLellan of Faris Lee Investments represented the seller and procured the buyer in the deal. Situated on 8.4 acres, Turlock Town Center features 144,364 square feet of retail space. At the time of sale, the property was fully leased to 29 in-line tenants and five retail pad tenants. Current tenants include Smart & Final, with a new 15-year lease, Rite Aid, dd’s discount, Big 5 Sporting Goods and Goodwill.

CHICAGO — Sterling Organization has acquired North Mayfair Commons, an 87,274-square-foot grocery-anchored shopping center in the North Mayfair neighborhood of Chicago, for $18.2 million. A 65,224-square-foot Jewel-Osco grocery store anchors the property. Other tenants include H&R Block and FedEx Kinko’s. Sterling Organization utilized its fund named Sterling United Properties II LP to purchase the property. The fund’s portfolio now spans approximately 1.2 million square feet of gross leasable area.

HOUSTON — Chicago-based investment firm 29th Street Capital has purchased The Highbank, a 284-unit multifamily property located near Texas Medical Center in Houston. Built in 2017, the community offers amenities such as a pool, outdoor grilling areas, a fitness center and a clubhouse with a wine lounge and library. The new ownership plans to upgrade the unit interiors. The seller and sales price were not disclosed. Haven Residential, an affiliate of 29th Street Capital, will assume management of the property.

ORLANDO, FLA. — Park Partners Residential and Independencia Asset Management have acquired The Commons, a 280-unit multifamily property in Orlando, for $77.8 million. The property was purchased from real estate funds managed by Ares Management. Jubeen Vaghefi, Denny St. Romain and Charles Crapse of Cushman & Wakefield brokered the sale. The joint venture between Boca Raton, Fla.-based Park Partners Residential and Miami-based Independencia Asset Management received a $58.5 million construction loan. American Real Estate Capital provided the loan, which will be used to fund a full renovation of the property’s 280 units, clubhouse and amenity spaces. The joint venture will renovate the pool, clubhouse and fitness areas along with the add a game room, co-working offices, dog parks and dog wash, a car washing station and outdoor activity deck with grill stations. Additions will also include an array of wellness-focused amenities including a gym, sports court and a basketball court along with a cardio gym with yoga and spinning areas. Located at 8050 Gables Commons Drive, The Commons is situated 16.4 miles from downtown Orlando. The property is also 2.3 miles from the Walt Disney World Resort.

GRAPEVINE, RICHARDSON AND CARROLLTON, TEXAS — A fund backed by Mexico City-based private equity firm Eagle Property Capital Investments has acquired a trio of apartment communities totaling 840 units in the Dallas-Fort Worth metroplex. Mustang Villas is a 246-unit property in Grapevine that was built in 1974 and offers one-, two- and three-bedroom units that range in size from 530 to 1,310 square feet. Prestonwood Apartment Homes in Richardson was constructed in 1979 and offers 194 residences in one- and two-bedroom floor plans ranging between 788 and 1,222 square feet. Bella Vista, which is located in Carrollton and was built in 1981, features 400 units in one- and two-bedroom formats spanning between 600 and 1,189 square feet. Amenities at Mustang Villa include a business center, fitness center, community room, playground and a sports court. Prestonwood Apartment Homes and Bella Vista have amenity packages that include pools, fitness centers and outdoor picnic and grilling areas, while Prestonwood features a playground and Bella Vista a sports court. The new ownership plans to invest in various capital improvements throughout the three properties.Brad Williamson, Mitch Sinberg, Matt Robbins and Abigail Beauchamp of Berkadia secured acquisition financing on behalf of the buyer.

TUCSON, ARIZ. — Los Angeles-based AndMark Management Co. has completed the disposition of Paseo Del Sol, a 152-unit multifamily property located at 6280 S. Campbell Ave. in Tucson. Los Angeles-based Element Property Co. acquired the asset for $33.6 million, or $221,382 per unit. Built in 1994, Paseo Del Sol features 38 two-story buildings offering 76 three-bedroom/two-bath and 76 four-bedroom/two-bath units that range in size from 1,050 square feet to 1,150 square feet. Onsite amenities include a pool, clubhouse and covered parking. Trevor Koskovich, Bill Hahn, Jesse Hudson and Ryan Boyle of Northmarq’s Phoenix Investment Sales team represented the seller in the deal. Northmarq Phoenix’s Debt & Equity team of Griffin Martin, Brandon Harrington, Bryan Mummaq and Tyler Woodard arranged a $27.2 million bridge loan for the acquisition.

FISHERS AND CARMEL, IND. — Stan Johnson Co. has brokered the sale of two retail properties occupied by Fresh Thyme Market in suburban Indianapolis for $18.7 million. The freestanding buildings span roughly 28,600 square feet each and are located in Fishers and Carmel. A Chicago-based private equity fund sold the portfolio to a private equity fund with headquarters in Mexico City. Mark Lovering of Stan Johnson represented both parties in the transaction.

ELK GROVE VILLAGE, ILL. — A joint venture between Clear Height Properties and Blackbird Investment Group has sold a 56,500-square-foot industrial building located at 1400 Greenleaf Ave. in the Chicago suburb of Elk Grove Village. The sales price was undisclosed. The partnership acquired the property in January 2021 and invested $720,000 in renovations. Originally constructed in 1973, the building features a clear height of 18 feet, three loading docks and 9,500 square feet of office space. Justin Lerner of Transwestern represented both the sellers as well as the buyer, Ideal Property Investments. Avatar Financial Group provided a $1.5 million bridge loan for the acquisition.