SAN ANTONIO — San Francisco-based investment firm Hamilton Zanze has sold Niche Apartments, a 150-unit multifamily complex located in the Oakwell Farms area of San Antonio. Built in 2000, the property offers one-, two- and three-bedroom units with an average size of 955 square feet, as well as a pool, fitness center, outdoor grilling areas and walking trails. Hamilton Zanze originally acquired the asset in 2016 and implemented a value-add program.

sale2

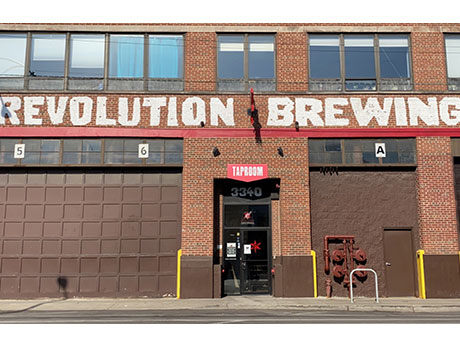

CHICAGO — Revolution Brewing, the largest independently owned brewery in Illinois, has purchased a 128,422-square-foot industrial property located on North Kedzie Avenue in Chicago. The purchase price was undisclosed. The building features clear heights ranging from 18 to 24 feet, 14 docks and one drive-in door. Mike Senner and Alex Kritt of Colliers represented the seller, a private investment group.

Laguna Point Properties Receives $328.8M in Acquisition Financing for Five-Property Multifamily Portfolio in Downtown Los Angeles

by Amy Works

LOS ANGELES — JLL Capital Markets has arranged $328.8 million in acquisition financing for a five-property apartment portfolio in downtown Los Angeles. The borrower is Laguna Point Properties. Totaling 1,037-units, the portfolio includes four historic pre-war buildings and a 1959-vintage building converted from an office asset. The properties are the 184-unit Lofts, 214-unit Main, 198-unit Manhattan, 178-unit Spring and 263-unit Tower, all of which underwent conversions to multifamily assets between 2007 and 2010. Charles Halladay, Jamie Kline and Charlie Vorscheck of JLL Capital Markets Debt Advisory team secured the three-year, floating-rate acquisition loan, which offers two 12-month extension options, through MF1 Capital. The seller was not disclosed.

LOS ANGELES — Kidder Mathews has arranged the sale of a 17,228-square-foot retail center located at 400-430 S. San Vicente Blvd. in Los Angeles. A Los Angeles-based private investor sold the asset to Oklahoma Rock Holdings and The Abraham Cos. for an undisclosed price. The buyers plan to build a mixed-use development with more than 100 multifamily units and ground-level retail and restaurant space on the 28,497-square-foot lot. Janet Neman of Kidder Mathews represented the buyer in the deal.

KISSIMMEE, FLA. — Franklin Street has brokered the sale of Southport Medical Center, a 37,454-square-foot, multi-tenant retail strip center in Kissimmee. Greg Matus, Adam Tiktin, Alex Lazo and Jonathan de Maa of Franklin Street represented the undisclosed seller in the transaction. Mark Shellabarger and Ari Ravi of CBRE represented the buyer, Stanley Properties, which acquired the property as part of a 1031 exchange. Southport Medical Center was fully occupied at the time of sale to Quest Diagnostics, IMA Medical Group, Cora Physical Health Services, Domino’s Pizza and a nail salon. All 10 tenants at Southport Medical Center have triple-net leases, many of which have over five years remaining on their terms. Built in phases between 2006 and 2012, the property has undergone significant capital improvements by some of the tenants over the years. Located at 3350 W. Southport Road on a 3.9-acre site, the property is situated 35.4 miles south of Orlando and 20.1 miles from Walt Disney World Resort.

NASHVILLE, TENN. — JLL has arranged the $10.2 million sale of a single-tenant, 51,528-square-foot industrial building in Nashville. Mitchell Townsend, Anthony Walters, Perry Wolcott, Matt Wirth and Robin Stolberg of JLL represented the seller, an affiliate of Next Realty LLC, in the transaction. Bridge Net Lease acquired the property for $10.2 million. The industrial building is triple net-leased to Fiserv, a provider of payments and financial technology solutions. Fiserv has been a tenant at the property since 2005 and uses the building to manufacture credit and payment cards. Next Realty recently executed a new long-term lease extension with Fiserv. The property offers a side-load configuration, clear heights ranging from 20 to 22 feet, three dock-high doors, one drive-in door, office space and a half-acre of land for expansion or outdoor storage. Located on 4.3 acres at 575 Brick Church Park Drive, the building is approximately five miles from downtown Nashville and 10.5 miles from Nashville International Airport.

BATTLE CREEK, MICH. — NAI Wisinski of West Michigan has arranged the sale of Minges Creek Plaza in Battle Creek for an undisclosed price. The 72,000-square-foot shopping center was fully leased at the time of sale to tenants such as Jo-Ann, Biggby Coffee, Xfinity, Supercuts, Tropical Smoothie Café, The UPS Store and LA Insurance. Jodi Milks of NAI Wisinski represented the seller, which purchased the center in 2013 following a foreclosure and made property improvements. NAI Wisinski will handle property management and leasing for the new owner.

BRATTLEBORO, VT. — FoxRock, a commercial investment firm based in Boston’s South Shore area, has acquired a 165,611-square-foot industrial facility located in the southern Vermont city of Brattleboro. The site at 90 Technology Drive spans 48.5 acres and is situated roughly a mile from Interstate 91. At the time of sale, the facility was fully leased to two tenants: New Chapter, a vitamin- and supplement-focused subsidiary of Proctor & Gamble; and UNFI, a wholesale grocery distributor. The seller and sales price were not disclosed.

INDIANAPOLIS — Colliers has arranged the sale of Franklin Road Business Center in Indianapolis for an undisclosed price. The two-story industrial flex building spans 320,219 square feet at 2855 N. Franklin Road. Originally built in 1961, the property features 16 docks, three drive-in doors, a 239-seat auditorium and office space. Franklin Road Business Center is 75 percent leased to five tenants, including Nakoma Products, Barrette and Siro Technology. Alex Davenport and Alex Cantu of Colliers represented the seller, Franklin Road Realty LLC. Denver-based Legacy Capital Partners Inc. purchased the asset.

MIAMI — Colliers has negotiated the sale of the Borden Dairy Co./Velda Farms dairy processing facility in Miami for $21.8 million. Steven Wasserman and Erin Byers of Colliers represented the buyer, CP Logistics Miami 95 LLC, in the transaction. Harold Ginsberg from Southern Asset Service Corp. represented the seller, New Dairy Florida LLC, in the transaction. The buyer, which is an entity of Panattoni Development, has plans to redevelop the site into a 126,000-square-foot Class A warehouse. The current tenant for the past 50 years, Borden Dairy, will vacate the site for redevelopment. Construction is slated for completion by late 2023. Located at 501 NE 181st St., the property is situated 19.7 miles from the University of Miami and 15.7 miles from Miami International Airport.