CARY, N.C. — Merritt Properties has bought 142 acres in Cary for $9 million with plans to build Merritt RDU Business Park, a 738,750-square-foot industrial park. The transaction includes three parcels. Construction is expected to begin early 2023. The seller of the land was not disclosed. Merritt RDU Business Park will span up to 13 single-story buildings ranging from 8,400 to 108,225 square feet. The industrial park will offer clear heights from 18 to 32 feet, leasable bays starting at 1,500 square feet, traditional rear-loaded docks and drive-in capabilities and free surface parking. The first phase of the project will include three buildings on the western side of the site, near the corner of Nelson and Pleasant Grove Church roads. The park will be located three miles from RDU International Airport, and will be close to Interstates 540 and 40, as well as US Highway 70. The project will be Merritt’s’ sixth speculative industrial project in the state, as well as the company’s largest North Carolina project since 2020. Merritt has nearly 2 million square feet of leasable space that is developed, proposed or under construction across five other projects in the Triangle area.

sale2

CORAL GABLES, FLA. — CBRE has arranged the sale of 2990 Ponce, a 57,790-square-foot office building in Coral Gables, about six miles from Miami. Black Diamond Equities LLC, an affiliate of Mexico-based BEA Equities, purchased the property for an undisclosed price. Christian Lee, Amy Julian and Tom Rappa of CBRE Capital Markets represented the undisclosed sellers. 2990 Ponce is a six-story building with 6,617 square feet of ground-floor retail space. Built in 2012, the property features contemporary finishes, a floor-to-ceiling curved glass curtain wall and a rooftop lounge offering views of Coral Gables and downtown Miami. The property’s tenants include Zubi Advertising, FirstBank Puerto Rico, Hunt Mortgage Group, Mas Group, Altermark and Collection Hair Studio. Located at 2990 Ponce De Leon Blvd., the property is situated 13 miles from Miami Beach, 2.5 miles from the University of Miami and 5.5 miles from Miami International Airport.

BLUE SPRINGS AND INDEPENDENCE, MO. — Curry Real Estate Services has acquired four apartment complexes in Missouri for an undisclosed price. The acquisition includes the 69-unit Blue Springs Apartments and the 28-unit Millwood Apartments in Blue Springs, as well as Chrysler Garden and Chrysler Garden II Apartments in Independence that total 120 units. Hawley Realty was the seller. Some of the properties had been managed by Curry since 2006.

FORT LAUDERDALE, FLA. — Berkadia has arranged the sale of Riverland Apartments, a 276-unit, garden-style apartment community located in Fort Lauderdale. Roberto Pesant, Jaret Turkell, Omar Morales and Jose Mota of Berkadia represented the Houston-based seller, Morgan, in the transaction. The buyer and sales price were not disclosed. Developed by Morgan in 2021, Riverland Apartments features six, four-story buildings with a unit mix of 24 studios, 164 one-bedroom, 80 two-bedroom and eight three-bedroom apartments. Community amenities include a business center, internet lounge, clubroom for gatherings, entertaining kitchen, fitness center, mailroom with parcel lockers, covered seating area with gas grill stations, covered veranda for relaxation, pool pavilions, sunbathing deck, dog park and a heated pool that overlooks a lake. Located at 420 SW 27th Ave., the property is situated close to Interstate 95 and the Tri-Rail Station. Additionally, the property is situated two miles from downtown Fort Lauderdale and 7.8 miles from Fort Lauderdale-Hollywood International Airport.

DALLAS — New York City-based Sentinel Real Estate Corp. has purchased Third Rail Lofts, a 164-unit multifamily property in downtown Dallas that also houses three retail spaces. The three-building complex features studio, one- and two-bedroom units with stainless steel appliances, walk-in closets, custom cabinetry and granite countertops. Amenities include a pool, bowling alley, billiards room, movie theater, wine tasting room, outdoor bar with a grilling area and a private dog walk. Sentinel plans to implement a value-add program and rebrand the community as Main 3 Downtown.

HAMMOND, IND. — Marcus & Millichap has brokered the $8 million sale of a 55,010-square-foot retail center in Hammond, about 25 miles south of Chicago. Dollar Tree and Ross Dress for Less anchor the property, which was constructed in 2016 and is located at 1105 5th Ave. Additional tenants at the fully leased center include Rainbow and Sadoni Beauty Supply. Nicholas Kanich and Mitchell Kiven of Marcus & Millichap represented the seller, Luke Brands. Friedman Real Estate represented the buyer, Canyon Park Capital.

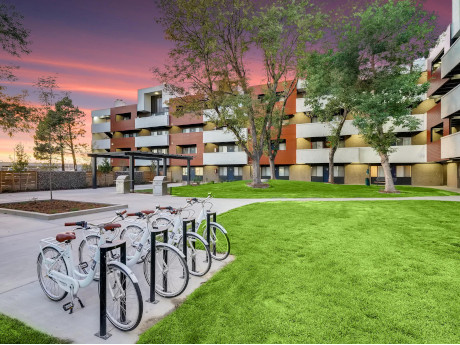

AURORA, COLO. — Northmarq has arranged the sale of Highline Lofts Apartments, a multifamily property located at 456 S. Ironton St. in Aurora. Lowe Property Group sold the property to Summit Communities for $29.1 million, or $260,000 per unit. Built in 1972, Highline Lofts Apartments features 112 units in a mix of one-, two- and three-bedroom floor plans, ranging from 740 square feet to 1,395 square feet. Alex Possick, Rich Ritter and Seth Gallman of Northmarq’s Colorado Multifamily Investment Sales team represented the seller in the deal.

FORT MYERS, FLA. — JBM Institutional Multifamily Advisors has brokered the $265 million sale of three multifamily properties in Fort Myers totaling 775 units. The three properties include Las Palmas, Drift at The Forum and Estero Oaks. Built in 2021 by The NRP Group, Las Palmas is a 300-unit, Class A apartment property with townhome-style units and attached two-car garages. Unit features include espresso flat-panel cabinets, vinyl flooring and kitchen islands with maple white quartz countertops. Community amenities include home office space, a fitness center, two resort-style saltwater pools and a volleyball court. PassiveInvesting.com purchased the property. Developed in 2021 by the Garrett Cos., the Drift at The Forum is a 195-unit apartment community that offers one-, two- and three-bedroom floorplans with in-unit washers and dryers and an elevator. Community amenities include a resort-style pool with shaded cabanas, a 1,500-square-foot fitness center, theater room, arcade and putting green. Situated at 3419 Forum Blvd., the property is located adjacent to The Forum shopping center, a Target-anchored power center. Miami-based Momentum Real Estate Partners purchased the property. Estero Oaks, a 280-unit apartment community, was completed in 2017. Unit features include granite countertops, walk-in closets, island kitchens and an in-unit washers and dryers. …

LAFAYETTE, LA. — New York-based Kushner Realty Acquisition LLC has purchased two multifamily properties in Lafayette for a combined $93.5 million. New Orleans-based Key Real Estate sold the communities, Robley Place and Ansley Walk, for $52.5 million and $41 million, respectively. Albert Elmore and Brian Savage of Colliers represented both the buyer and the seller in the transaction. The adjacent properties both offer one-, two- and three-bedroom floorplans. Built in 2016, Robley Place features 248 units with stainless steel appliances, wood-style flooring and walk-in closets. Community amenities include a courtyard, grill, fitness center, pet washing station, spa, pool, playground and a business center. Built in 2008, Ansley Walk has 242 units with walk-in closets, balconies and patios and master bathrooms with double vanities. Community amenities include laundry facilities, pet play area, car wash area, pet washing station, package service and Wi-Fi at the pool and clubhouse.

CHARLOTTE, N.C. — Taconic Capital Advisors has sold Three Resource Square, a 125,728-square-foot, Class A office building in Charlotte. Praelium Commercial Real Estate purchased the property for $21 million. Patrick Gildea, Matt Smith, Grayson Hawkins, Joe Franco and Stephanie Spivey of CBRE represented the seller in the transaction. Harris Ralston and C.J. Kelly of CBRE arranged an undisclosed amount of debt financing through Prime Finance on behalf of the buyer. Built in 1999, Three Resource Square was 85 percent leased at the time of sale. The property will be anchored by Republic Services, a solid waste management company, through 2026. The property’s other tenant is Resolvion, a financial services firm. The office property offers a six per 1,000-square-foot parking ratio and a fitness center. Located at 10815 David Taylor Drive, the property is situated close to Charlotte Douglas International Airport, the University of North Carolina at Charlotte and Interstate 85. Additionally, the property is situated within one mile from Centene’s 1 million-square-foot East Coast headquarters campus.