SOUTHFIELD, MICH. — Colliers Detroit has negotiated the sale of a 51,954-square-foot industrial flex building in Southfield for an undisclosed price. The property is located at 26545 American Drive. John Fricke, Peter Kepic and Jonathon Loos of Colliers represented the seller, Veoneer, which previously used the building as office space. Oakland Family Centers, a family mental health services organization with existing locations in Michigan, was the buyer. Oakland plans to take occupancy this quarter.

sale2

ATHENS, ALA. AND SPRING HILL, TENN. — Birmingham-based Atlas Senior Living and Salta Capital have acquired two new senior living communities, The Goldton at Athens in Athens and The Goldton at Spring Hill in Spring Hill, bringing their total number of properties in their owned portfolio to 32. The seller and sales price were not disclosed. Atlas will be the owner-operator of the communities, which will be rebranded. Located at 22171 Traditions Way, The Goldton at Athens totals 75,824 square feet, comprising 12 independent living residences and 72 assisted living residences. Located at 3056 Miles Johnson Parkway, The Goldton at Spring Hill totals 66,395 square feet comprising 63 assisted living residences and 16 memory care residences.

KINGSTOWNE, VA. — Avison Young’s Capital Markets Group has brokered the sale of two office buildings located in Kingstowne, a live-work-play community situated about 16.3 miles south of Washington, D.C. Melrose Solomon Enterprises purchased the two office buildings, 5695 Kings Centre Drive and 5901 Kingstowne Village Parkway, for $12.9 million. Chip Ryan and Matt Weber of Avison Young represented the seller, The Halle Cos., in the transaction. Jon Goldstein, Wes Boatwright and Mike Yavinsky of Avison Young arranged the undisclosed amount of acquisition financing on behalf of Tenafly, N.J.-based Melrose Solomon. 5695 Kings Centre Drive is a three-story, 44,262-square-foot office building constructed in 2002, and 5901 Kingstowne Village Parkway features 8,000-square-foot floorplans and has 22,117 square feet of net rentable space. The properties were a combined 93 percent leased to a variety of medical office, government contractors and traditional office tenants at the time of sale. Developed by The Halle Cos. in the mid-1980s, Kingstowne spans 1,200 acres and is Northern Virginia’s second largest master-planned community. Kingstowne has more than one million square feet of retailers and office buildings.

ROCHELLE, ILL. — Colliers has brokered the sale of a 400,000-square-foot distribution center located at 101 N. Centerpoint Drive in Rochelle, about 25 miles south of Rockford. The sales price was undisclosed. Situated on 21 acres, the building features a clear height of 30 feet, 40 truck docks and 79 trailer spots. The facility is fully leased to global toy manufacturer TOMY, which has been the sole occupant since the building’s completion in 2004. Jeff Devine and Steve Disse of Colliers brokered the transaction. Hillwood Development purchased the asset from a fund advised by the U.S. real estate business of UBS Asset Management.

Lee & Associates Negotiates $68M Sale of Three-Property Multifamily Portfolio in San Gabriel Valley

by Amy Works

ROSEMEAD AND EL MONTE, CALIF. — Lee & Associates LA North/Ventura has arranged the sale of a three-property apartment portfolio in the San Gabriel Valley. Positive Investments acquired the portfolio from Hunsaker Family for $68 million. The portfolio includes Fashion Park Apartments, Glen Haven Apartments and Fashion Lane Apartments, spanning 4405 Rosemead Blvd., 5123-5205 Rosemead Blvd. and 4436-4438 Ivar St. in Rosemead, as well as a community at 3815 Baldwin Ave. in adjacent El Monte. Totaling 215,691 square feet, the portfolio features a mix of one-, two- and three-bedroom units and single-family residences, as well as swimming pools, clubhouses, secure entry, covered parking and carports. Warren Berzack of Lee & Associates LA North/Ventura handled the transaction.

Harrison Street Purchases Interest in Eight Student Housing Properties at Arizona State University

by Amy Works

TEMPE AND GLENDALE, ARIZ. — Harrison Street has formed a joint venture with American Campus Communities (ACC) for the ownership of ACC’s existing eight-property Arizona State University on-campus student housing portfolio. Under the terms of the transaction, Harrison Street, as part of its social infrastructure platform, has acquired a 45 percent interest in the joint venture, with ACC owning the remaining interest. ACC will continue to manage the day-to-day operations in collaboration with ASU under the terms of the existing P3 (public-private partnership) contracts. The portfolio includes 8,187 beds across eight assets, which include seven buildings at ASU Tempe and one building at ASU’s West Campus in Glendale. The facilities feature core campus amenities including retail, cafés, fitness centers, dining halls, academic halls and outdoor recreation spaces. The communities provide a broad range of products including first-year residence halls, honors college housing, Greek housing and upper division apartment-style housing.

IRVING, TEXAS — Pegasus Real Estate has acquired a two-property industrial portfolio totaling 271,100 square feet in Irving. The portfolio comprises a fully leased, 92,051-square-foot building and a 12-building complex that was 93 percent leased at the time of sale. The properties were built in phases between 1981 and 1999 and feature 12- to 18-foot clear heights. Stephen Bailey, Dustin Volz, Wesley Gilmer and Pauli Kerr of JLL represented the seller, Fort Worth-based Fort Capital, in the transaction. Dustin Dulin and Wyatt Simmons, also with JLL, arranged floating-rate acquisition financing on behalf of Pegasus Real Estate.

PENNSAUKEN, N.J. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has negotiated the $18 million sale of The Point at Pennsauken, a 109,217-square-foot shopping center in Southern New Jersey. Anchored by convenience store Wawa, the property was 100 percent leased at the time of sale. Brad Nathanson of IPA represented the seller, WRDC, in the transaction and procured the buyer, Florida-based Select Properties Inc.

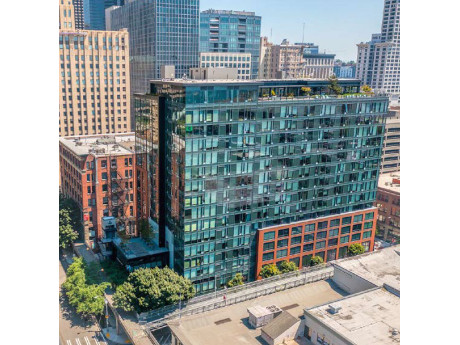

PCCP Provides $75M Acquisition, Repositioning Loan for The Post Apartments in Downtown Seattle

by Amy Works

SEATTLE — PCCP has provided a $75 million senior loan to Griffis Residential for the acquisition and repositioning of The Post, a 16-story multifamily community located at 888 Western Ave. in downtown Seattle. Situated in the Seattle Central Business District, Waterfront and Pioneer Square submarkets, The Post features 208 apartments with quartz countertops, vinyl-plank flooring, steel appliances, floor-to-ceiling windows and views of downtown Seattle, Elliott Bay and the Olympic Mountains. Community amenities include a rooftop deck with grilling areas and a reflection pool, multiple rooftop lounges, a media room, dog run, yoga studio, library and fitness center.

AUSTIN, TEXAS — Regent Properties, an investment and management firm headquartered in Dallas and Los Angeles, has acquired 816 Congress, a 435,000-square-foot office building in downtown Austin. The 20-story building offers amenities such as a fitness center, conference facilities and a sky lounge with a terrace. Regent plans to implement a capital improvement program that includes repositioning the lobby and courtyards, as well as the activation of roughly 12,000 square feet of retail space. The seller and sales price were not disclosed.