AUSTIN, TEXAS — TSB Realty has negotiated the sale of 21 Rio, a 296-bed student housing community located near the University of Texas at Austin. Built in 2009, the 21-story property features one-, two- and three-bedroom units and 2,680 square feet of ground-floor retail space. Amenities include a 24-hour fitness center, rooftop pool with a sundeck, resident lounge and a convenience store. Nimes Real Estate purchased the property from a joint venture between CA Student Living and Principal Real Estate for an undisclosed price. TSB Capital Advisors also arranged acquisition financing on behalf of the buyer.

sale2

GAINESVILLE, GA. — Global Real Estate Advisors (GREA) has brokered the $9.1 million sale of Cielo at Lanier Apartments, a multifamily community located at 3656 Browns Bridge Road in Gainesville, roughly 50 miles northeast of Atlanta. Built in 1985, the property features 66 units in one- and two-bedroom layouts. Taylor Brown and John A. Topping Jr. of GREA represented the seller, Zavala Capital, in the transaction. Ryan Haase of Magnitude CRE Capital Advisory acquired the property and plans to continue interior renovations.

HAMMOND, IND. — Marcus & Millichap has brokered the $1.9 million sale of a two-property retail portfolio in Hammond, about 30 miles southeast of Chicago. The properties are located at 2739 169th Street and 902 Roby Drive. The property on Roby Drive is home to three tenants and a drive-thru and is situated near the Horseshoe Hammond Casino. The property on 169th Street is located near the Purdue University Hammond Campus. Mitchell Kiven and Nicholas Kanich of Marcus & Millichap represented the Indiana-based seller, which was the original developer of both properties. The duo also procured the buyer, a private investor based in the Southwest Chicago suburbs.

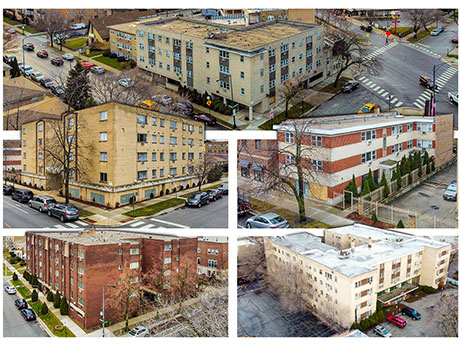

CHICAGO — Kiser Group has brokered the sale of a five-building multifamily portfolio in Chicago for $23 million. The 198 units are located within the West Rogers Park, Bowmanville and Budlong Woods neighborhoods and are largely vacant. Danny Logarakis of Kiser brokered the sale. The seller was a private individual that had owned the properties for more than 40 years. The buyers, Sam Trachtman and Stak Holdings LLC, plan to renovate the kitchens, bathrooms and common areas.

PHOENIX AND GLENDALE, ARIZ. — Tides Equities has purchased three multifamily properties in Phoenix and Glendale from Denver-based PaulsCorp for an undisclosed price. The portfolio includes 445 studio, one- and two-bedroom units. Constructed in 1985 and 1986, the communities were each at least 95 percent occupied at the time of sale. The portfolio includes: The Perry, a 148-unit property at 6231 N. 67th Ave. in Glendale Serena Park, a 141-unit community at 8546 N. 59th Ave. in Glendale Red Sage, a 156-unit asset at 5704 W. Thomas Road in Phoenix Brad Cooke, Cindy Cooke, Matt Roach and Chris Roach of Colliers Arizona handled the transaction.

Timberline Real Estate Ventures Sells 432-Bed Student Housing Community Near Louisiana Tech University

by John Nelson

RUSTON, LA. — Timberline Real Estate Ventures has sold CEV Ruston, a 432-bed community serving students attending Louisiana Tech University in Ruston. Constructed in 2008, the property offers two- and four-bedroom, fully furnished units. Shared amenities include a fitness center, group and private study rooms, a computer center and swimming pool. The community is situated adjacent to campus at 1812 W. Alabama Ave. Scott Clifton, Stewart Hayes, Teddy Leatherman, Kevin Kazlow and Jack Goldberger of JLL represented Timberline in the disposition of the property to Briar Meads Capital. The sales price was not disclosed.

SRS Brokers $14.4M Sale-Leaseback of Single-Tenant Retail Property in Miami Leased to Walgreens

by John Nelson

MIAMI — SRS Real Estate Partners’ National Net Lease Group (NNLG) has facilitated the $14.4 million sale of a single-tenant retail property located 3595 Coral Way in Miami. Comprising 16,285 square feet, the property is occupied by the seller, Walgreens, which has signed a new 15-year, corporate guaranteed, triple-net lease. Sean Lutz, Dan Elliot, Matthew Mousavi and Patrick Luther of SRS represented the buyer, a Nevada-based private investor, in the 1031, all-cash transaction.

PARKVILLE, MD. — Neuman Commercial Group has arranged the sale of a 21,200-square-foot shopping center located at 1901‐7 E. Joppa Rd. in Parkville, roughly 10 miles northeast of Baltimore. Gil Neuman of Neuman represented the seller, Besche Realty, in the $4.5 million transaction. Originally built in 1965, the property was fully occupied by three tenants at the time of sale. The buyer was not disclosed.

Marcus & Millichap Brokers $18M Sale of Oceanfront Hotel in Atlantic Beach, North Carolina

by John Nelson

ATLANTIC BEACH, N.C. — Marcus & Millichap has brokered the $18 million sale of Inn at Pine Knoll Shores, a 102-room oceanfront hotel located at 511 Salter Path Road in Atlantic Beach. Robert Hunter, Leo Reilly and McLean Hicklin of Marcus & Millichap represented the undisclosed seller in the transaction and procured the buyer, Blue Water Development, a development, investment and management company based in Ocean City, Md. Benjamin Yelm, Marcus & Millichap’s North Carolina broker of record, assisted in closing the transaction. Built in 1973, the seven-story Inn at Pine Knoll Shores hotel is located along the Bogue Banks, a 21-mile barrier island on the Atlantic Ocean’s coast. Food-and-beverage options at the recently renovated hotel include Clamdigger Restaurant and a tiki bar, the Cutty Sark Lounge.

LAKEWOOD, WASH. — Sage Homes Northwest has acquired a three-community multifamily portfolio from a private local owner for $20.4 million in an off-market transaction. The portfolio includes: Garden Park Apartments, a 49-unit property at 12802-12878 Lincoln Ave. SW Colonial Court Apartments, a 41-unit asset at 9120 Lawndale Ave., 9104 Newgrove Ave. SW and 9119 Kenwood Ave. SW Evergreen Court Apartments, a 40-unit community at 12805-12809 47th Ave. SW The buyer plans to perform value-add upgrades to the properties, which were built in the 1960s and 1970s, to bring the assets up to market-rate value. Brandon Lawler, Jerrid Anderson and Dylan Simon of Kidder Mathews’ Simon and Anderson team represented the buyer in the transaction.