WASHINGTON, D.C. — JLL’s Hotels & Hospitality Group has negotiated the sale of Mandarin Oriental, Washington D.C., a luxury hotel in the city’s southwest district that spans nine stories and 373 rooms. The sales price was not disclosed. The buyer, London-based private equity real estate manager Henderson Park, has rebranded the hotel as Salamander Washington D.C. under the management of Middleburg, Va.-based Salamander Hotels & Resorts. Gilda Perez-Alvarado, Jeffrey Davis and Stephany Chen of JLL represented the seller, Mandarin Oriental Hotel Group International Ltd., in the transaction. Mark Fisher of JLL arranged an undisclosed amount of acquisition financing on behalf of Henderson Park. Built in 2004 and recently renovated, the hotel overlooks the Tidal Basin and the Washington Channel. Nearby attractions include the National Mall, Washington Monument, Martin Luther King Jr. Memorial, Thomas Jefferson Memorial and the Smithsonian National Museum of Natural History.

sale2

PLYMOUTH, MINN. — Monument Capital Management, an A-Rod Corp. company, has acquired Talus in Plymouth, just west of Minneapolis. The purchase price was undisclosed. The 192-unit apartment community was built in 1974. Floor plans range from 800 to 1,100 square feet. Amenities include a dog area, walking paths, fitness center, outdoor pool, indoor heated pool, laundry centers, underground heated parking and a newly renovated clubhouse. Monument plans to upgrade units and amenities. Ted Abramson of CBRE represented the seller, Curtis Capital Group. This property is the first acquisition for Monument’s newly launched fund, Monument Opportunity Fund V. Monument now owns or manages eight communities in the Minneapolis market totaling more than 1,000 units.

BAINBRIDGE ISLAND, WASH. — Newmark has negotiated the sale of BLIS Apartments, a multifamily property located on Bainbridge Island, just across Elliot Bay from Seattle. Sound West Group sold the asset to Cairn West for $65.5 million. Marty Leith of Newmark represented the seller in the deal. Located at 747 Hanami Lane LE, BLIS Apartments features 114 residences comprising 107 apartments and seven loft townhomes. Units offer large laundry rooms, luxury vinyl plank flooring, quartz countertops, USB wall chargers, stainless steel appliances, undermount sinks and walk-in closets. Built in 2019 on 1.4 acres, the community features a courtyard terrace, controlled entry access, fitness center, grilling stations, rooftop deck, electric vehicle charging stations, community spaces and a conference room.

CORPUS CHRISTI, TEXAS — Northmarq has arranged the sale of Island Villas, a 336-unit multifamily property in Corpus Christi. The property was built in 2008 and features a pool, billiards room, fitness center, package room and a pet play area. Moses Siller of Northmarq represented the buyer and seller, both of which requested anonymity, in the transaction. Bryan Mummaw, Brandon Harrington, Bryan Liu and Tyler Woodard, also with Northmarq, originated an undisclosed amount of Freddie Mac acquisition financing for the deal. The financing was structured with a 10-year term and seven years of interest-only payments followed by a 30-year amortization schedule.

MUNCIE, IND. — JLL Capital Markets has arranged the sale of Muncie Marketplace in Muncie for $14.6 million. Built in 2014, the 77,871-square-foot retail center is fully leased to seven national tenants, including Dick’s Sporting Goods, Michaels, Five Below, McAlister’s Deli, Kay Jewelers and GameStop. Amy Sands, Clinton Mitchell, Michael Nieder and Tim Murray of JLL represented the seller, AlbaneseCormier Holdings LLC. War Chest Real Estate LLC was the buyer.

FORT LAUDERDALE, FLA. — Marcus & Millichap has brokered the sale of a four-property, 669-unit affordable housing portfolio located throughout Florida. The properties sold for a combined total of $91.8 million. Evan Kristol of Marcus & Millichap’s Fort Lauderdale office represented the private sellers, Benjamin Mallah and Benjamin Mallah II, as well as the buyer, a national owner and operator of affordable housing communities. The properties include The Overlook at Monroe in Sanford; Villas at Cove Crossing Apartments in Lake Worth; St. Luke’s Apartments in Lakeland; and Sonrise Villas Apartments in Fellsmere. Constructed between 1994 and 2007, the LIHTC properties range in size between 94 and 240 units. All were originally developed with affordable tax credits and have long-term income and rent restrictions, which Kristol says the new ownership will retain for “years to come.”

MEMPHIS, TENN. — Westmount Realty Capital has purchased Shelby Oaks Corporate Park, a portfolio of office/showroom and distribution facilities in Memphis totaling 480,911 square feet. Shelby Oaks is Westmount’s first purchase in Memphis and second acquisition in Tennessee. The seller and sales price were not disclosed. The corporate park is located one mile away from the I-240/I-40 interchange and near downtown Memphis and Memphis International Airport. Situated within a 640-acre wooded area that includes three lakes and a jogging trail, Shelby Oaks was built in several phases between 1979 and 2005 and was 95 percent leased at the time of sale to 78 tenants. The portfolio includes a total of 16 buildings: four distribution buildings with drive-in and dock doors and 12 office/showrooms. Buildings range from 12,000 to 90,000 square feet and are home to a variety of industries like telecommunications, medical, service and manufacturing companies.

ROSWELL, GA. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the $10.3 million sale of Mansell Oaks, a 43,190-square-foot shopping center in the north Atlanta suburb of Roswell. Zach Taylor of IPA represented the seller, an entity doing business as PLC Mansell LLC, in the transaction. Peachtree Industrial Partners LLLP is the buyer. Mansell Oaks’ tenant roster includes LongHorn Steakhouse, Bird Watcher Supply and Animal Emergency Center of North Fulton. “Well-located, unanchored retail strips with reasonable rents have become nearly as sought after as grocery anchored centers, and the cap rates are reflecting this demand,” says Taylor.

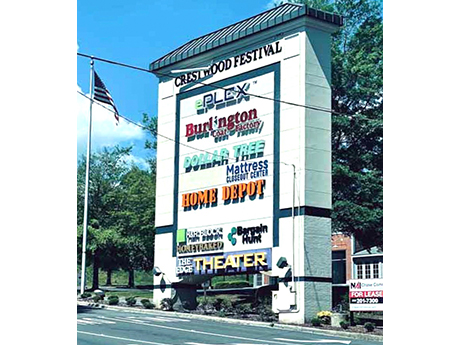

BIRMINGHAM, ALA. — Eastern Union has secured $7 million in acquisition financing for Crestwood Festival Centre in Birmingham. Marc Tropp of Eastern Union arranged the financing on behalf of the buyer, CityWide Properties, which intends to invest $1.5 million in capital improvements at the 299,707-square-foot shopping center. The five-year loan includes a fixed interest rate of 4.6 percent with one year of interest-only payments. The investor purchased the property, which is shadow-anchored by The Home Depot, for $9.4 million. Built in 1989 on 41 acres, Crestwood Festival Centre comprises 44 retail suites and nearly 1,000 parking spaces. Notable tenants include Phoenix Theatres The Edge 12 Birmingham, Burlington, Mattress Warehouse and Dollar Tree.

CEDAR PARK, TEXAS — Florida-based investment firm TerraCap Management has acquired Latitude at Presidio, a 337-unit apartment community located in the northern Austin suburb of Cedar Park. The property features one-, two- and three-bedroom units with an average size of 959 square feet. Amenities include a pool, game room, outdoor grilling and dining stations, fitness center, coffee bar and a dog park. Matt Pohl and Kevin Dufour of Walker & Dunlop represented the undisclosed seller in the transaction.