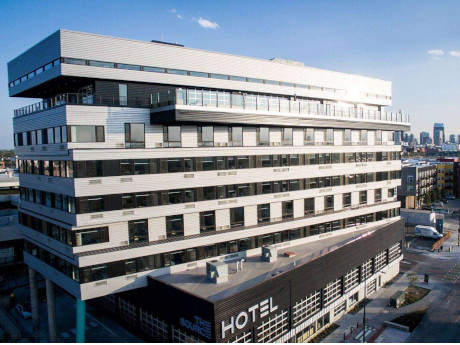

DENVER — Stockdale Capital Partners has acquired The Source, a hotel located in Denver’s River North Arts District, for $61.9 million. The transaction also included a 300-stall parking garage and 17,000-square-foot surface parking lot. The Source features 100 guest rooms, a full-service rooftop restaurant, 5,575 square feet of event space, a fitness center, rooftop pool and business center. Additionally, the hotel offers 44,000 square feet of onsite restaurant and retail space in its Market Hall I & II locations. Stockdale Capital plans to refresh guest rooms, re-imagine the rooftop restaurant, “activate the hotel lobby experience” and create additional revenue drivers for the hotel’s retail space. The name of the seller was not released.

sale2

BREMERTON, WASH. — Security Properties has completed the disposition of Insignia Apartments, a multifamily property at 1060 Insignia Loop in Bremerton. An undisclosed buyer acquired the community for $48.5 million. Built 2017, Insignia Apartments features 162 one- and two-bedroom apartments spread across 12 buildings on 6.2 acres. Community amenities include a fitness center, rec room, playground and dog park. Eli Hanacek, Jon Hallgrimson, Mark Washington and Kyle Yamamoto of CBRE’s Pacific Northwest-based multifamily team represented the seller in the transaction.

HARTFORD, CONN. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has negotiated the sale of Capitol View Apartment Homes, a 264-unit multifamily complex in downtown Hartford. Built in 1955 and renovated between 2002 and 2013, the 10-story building houses units with an average size of 542 square feet and offers amenities such as a lounge, fitness center and concierge service. Victor Nolletti, Wes Klockner and Eric Pentore of IPA represented the seller, an entity doing business as MATP LLC, in the transaction. The trio also procured the buyer, EOM Equity LLC.

JLL Brokers Sale of 244,768 SF Acadiana Square Shopping Center in Lafayette, Louisiana

by John Nelson

LAFAYETTE, LA. — JLL has brokered the sale of Acadiana Square, a 244,768-square-foot shopping center located at 5700 Johnston St. in Lafayette. Jim Hamilton, Ryan West and Brad Buchanan of JLL represented the sellers, DRA Advisors and RCG Ventures, in the transaction. Property Commerce Dividend Fund acquired the center for an undisclosed price. Acadiana Square was 95 percent leased at the time of sale to tenants such as Burlington, Home Furniture Co. of Lafayette, T.J. Maxx, PetSmart, Office Depot and Party City. The previous ownership executed new leases or renewals totaling over 87,000 square feet at Acadiana Square in the past 18 months, according to JLL.

MOBILE, ALA. — CLK, a Long Island-based commercial real estate investment firm, has acquired The Park Apartments, a 201-unit multifamily community located at 1 Country Lane in Mobile. Lakewood, N.J.-based Walden Asset Group sold the property for $15.8 million, or $78,600 per unit. Aaron Jungreis and David Wildes of Rosewood Realty Group represented both the buyer and seller in the off-market transaction. Built in 1975, Park Apartments features 20 two-story buildings, a pool, fitness center, playground and a picnic area. The property is situated on 11.5 acres within three miles of the Mobile Regional Airport and the University of Southern Alabama. The community was 95 percent occupied at the time of sale.

OMAHA, NEB. — Marcus & Millichap has arranged the sale of a 65,413-square-foot retail property net leased to Family Fare Supermarket in Omaha for $4.6 million. The building is located at 5110 S. 108th St. Family Fare operates more than 80 locations across seven states. Brennan Clegg, Chris Lind and Mark Ruble of Marcus & Millichap represented the seller, a limited liability company. Buyer information was not provided.

CBRE Arranges Sale of Three-Property Multifamily Portfolio in Azusa, California for $33.6M

by Amy Works

AZUSA, CALIF. — CBRE has brokered the sale of a three-property apartment portfolio in Azusa. Azusa Riviera Holdings LLC, Azusa Rainbow Holdings LLC and 1345 San Gabriel Holdings LLC sold the portfolio to Azusa 116 Assets LLC for $33.6 million. Eric Chen and Joyce Goldstein of CBRE represented the seller and buyer in the transaction. The three properties are: The Riviera Apartments, a 36-unit property at 1381 N. San Gabriel Canyon Road Palm View Apartments, a 36-unit community at 1311 N. Azusa Ave. The Azusan Apartments, a 44-unit asset at 1345 N. San Gabriel Ave. Each property has a mix of one- and two-bedroom units averaging more than 800 square feet per apartment. The properties include a community pools, laundry facilities, private patios/balconies, air conditioning and covered parking.

MAG Capital Partners Acquires Flex Industrial Facility in Nicholasville, Kentucky in Sale-Leaseback Deal

by John Nelson

NICHOLASVILLE, KY. — MAG Capital Partners has purchased a 112,400-square-foot flex industrial facility located on 40.9 acres at One Security Drive in Nicholasville, a suburb of Lexington. The Fort Worth, Texas-based firm acquired the property in a sale-leaseback deal with Los Angeles-based OpenGate Capital, parent company of the tenant, Sargent & Greenleaf. Founded in 1857, Sargent & Greenleaf is an electronic and mechanical lock manufacturer for the banking, residential, railroad and government sectors. Nick Foster of JLL’s Newport Beach, Calif., office represented MAG Capital in the transaction. The sales price was not disclosed. The property comprises 90,000 square feet of manufacturing space with 22-foot clear heights and 22,400 square feet of office space.

MINNESOTA — Marcus & Millichap has arranged the sale of a 24-property self-storage portfolio in Minnesota for an undisclosed price. Nathan Coe, Gabriel Coe and Brett Hatcher of Marcus & Millichap represented the seller, KO Storage, and procured the undisclosed buyer. The portfolio spans more than 700,000 net rentable square feet.

AUSTIN, TEXAS — Houston-based investment firm Disrupt Equity has purchased Array Apartments, a 369-unit multifamily property in Austin’s Riverside District. The property was built in 1973 and features one-, two- and three-bedroom floor plans. The amenity package comprises two pools, two dog parks, a sports court, clubhouse, outdoor grilling and dining areas and onsite laundry facilities. Disrupt Equity’s in-house team will manage the property, and the new ownership also plans to implement a value-add program. The seller and sales price were not disclosed.