By Brett Merz, senior vice president, KBS Texas continues to be a top state for job and population growth as its low cost of living and business-friendly policies attract companies and residents from other parts of the country. As such, many commercial real estate owners and operators are recognizing the state’s potential for increased leasing activity in the second half of 2022 and throughout 2023. The portfolio of KBS, which has long been investing in these markets, currently contains 16 office assets in these cities, and we continue to evaluate opportunities to acquire more that align with our investment strategy. Based on 30 years of experience in acquiring and operating premier office assets throughout Texas and beyond, here are a few trends we anticipate continuing for the remainder of 2022 and into next year. Rising In-Migration Major Texas markets including Austin, Dallas-Fort Worth (DFW), Houston and San Antonio are likely to remain magnets for in-migration. Residents are moving to these markets in search of a more affordable quality of life, which is aided by the absence of a state income tax. In addition, companies are seeking office space in a region with business-friendly tax policies. Austin, in particular, continues to …

Texas

By Chase Clancy, vice president, Colliers The Austin industrial market is booming. According to Colliers’ research, Austin’s industrial market continues to grow at an amazing clip, spurred by rapid population growth, major manufacturing relocations and new e-commerce and inventory trends. Despite the longstanding shadows that larger markets like Houston and Dallas have cast on Austin’s growth, the market is reaching a fever pitch of rising rents, tightening vacancy, significant new deliveries and equally noteworthy preleasing activity. Based on Austin’s population size, Colliers’ research suggests that the market has the runway — both in terms of supply and demand — to nearly double in size over the next five years. With demand for space showing no sign of cooling at the local level, we project a prolonged period of record development and record absorption. To put that into context, Austin’s industrial market currently spans roughly 57 million square feet. We are tracking more than 40 million square feet of product in our development pipeline — more than 10.2 million square feet of which is currently under construction — with more on the horizon. Trailing 12-month absorption stands at approximately 3.4 million square feet as of the second quarter of 2022, but …

By Rob Welker, president and partner, Hoefer Welker; and Steven Janeway, principal and commercial practice leader, Hoefer Welker As one of the biggest states, Texas regularly sees some of the largest demand in real estate development in the country. In recent years, North Texas specifically has experienced a rapid short-term increase in population, leading to a significant development boom and driving up urban and workforce construction volume, rental rates and sale values. Mixed-use developments have led the charge in commercial growth throughout the Dallas-Fort Worth (DFW) metroplex. Higher overall interest in a live-work-play lifestyle has contributed to the development of a larger number of spaces that provide corporate, retail and residential capabilities. Gone are the days when corporate campuses and multifamily complexes were predominantly in the suburbs; tenants and employers have increasingly searched for living experiences in urban environments where they can combine the three biggest facets of their lives within a single destination. This provides the convenience that tenants crave and the access to concentrated populations that retailers and office users need to be successful. The Coastal Exodus As personal and business income tax rates, regulatory hurdles and costs of living abound in coastal markets, corporations have begun relocating …

By Jim Breitenfeld, CCIM, president, Sidecar Commercial Real Estate While Collin County continues to see massive residential projects in markets like Anna, Celina and Melissa, as well as major redevelopments of existing shopping and dining destinations, a closer look at the region’s economic drivers reveals a significant shift in the types of industries that are driving demand for new commercial projects. Housing remains a critical need for all of North Texas, one of the fastest-growing regions in the country. With that comes demand for revamped retail, restaurant and entertainment options that include a healthy mix of necessity and luxury users, as well as some basic demand for office space. The latter is already well-supported via the swaths of corporate relocations and regional workforce consolidations that have occurred in the area over the past five to 10 years. But those needs are fairly germane to any area that is experiencing rapid and substantial job and population growth. In addition to this activity, we now see new types of commercial tenants targeting Collin County. These include life sciences/biotech, supply chain/logistics and specialized healthcare uses. According to data supplied by the U.S. Bureau of Labor Statistics and analyzed and published in the Sidecar …

By Chris McCluskey, vice president of development, VanTrust Real Estate; and Robert Folzenlogen, senior vice president of strategic development, Hillwood In the past decade, the popularity of “live-work-play” developments has skyrocketed, making the concept a somewhat overused cliché in the commercial real estate world. However, the reasoning behind the acclaim remains true — people love convenience and a sense of community. And “live-work-play” is the reason that cities like Frisco that are located outside dense urban cores have thrived. According to the U.S. Census Bureau, Frisco’s population has grown by 71 percent over the last decade, consistently ranking as one of the fastest-growing cities in the nation. But this growth did not happen overnight; rather, a combination of ideal location and elected leaders’ vision has driven much of Frisco’s success. By prioritizing all real estate classes — office, residential, retail — Frisco has been able to find the right balance between bustling urban amenities and the serene background of suburbia, making it one of the most competitive landscapes today and for the foreseeable future. A Balanced Approach Suburbs are no longer known for just their family appeal, although this feature still remains a high priority for many households. Young professionals …

By Chris McCluskey, vice president of development, VanTrust Real Estate; and Robert Folzenlogen, senior vice president of strategic development, Hillwood In the past decade, the popularity of “live-work-play” developments has skyrocketed, making the concept a somewhat overused cliché in the commercial real estate world. However, the reasoning behind the acclaim remains true — people love convenience and a sense of community. And “live-work-play” is the reason that cities like Frisco that are located outside dense urban cores have thrived. According to the U.S. Census Bureau, Frisco’s population has grown by 71 percent over the last decade, consistently ranking as one of the fastest-growing cities in the nation. But this growth did not happen overnight; rather, a combination of ideal location and elected leaders’ vision has driven much of Frisco’s success. By prioritizing all real estate classes — office, residential, retail — Frisco has been able to find the right balance between bustling urban amenities and the serene background of suburbia, making it one of the most competitive landscapes today and for the foreseeable future. A Balanced Approach Suburbs are no longer known for just their family appeal, although this feature still remains a high priority for many households. Young professionals …

By Kyle Knight, senior vice president, Weitzman Houston Houston’s construction of new retail space, after reaching a record low in 2021, is on track to exceed that level, based on projects in the pipeline for this year. But the increase is not large, and total new deliveries will remain on the conservative side. The limited new space is driving demand to existing projects and helping lift marketwide occupancy levels. The limited deliveries of new retail space, combined with healthy retail demand and limited closings, is helping Houston’s retail market build on the occupancy gains it experienced during 2021. As a result, the retail market currently has a healthy occupancy rate of 96.1 percent. The market remains among the strongest in recent memory, although economic issues — rising interest rates, increased construction costs, inflation — may lead to a slowdown. On the positive side, retailer, developer and investor interest remains at extremely high levels, since retail real estate is a long-term game that factors in short-term concerns. The retail market also bolstered by robust demand for small-shop space, new construction that is either built-to-suit or significantly preleased, healthy job and population growth and an economy that benefits from rising energy prices. …

By Kyle Knight, senior vice president, Weitzman Houston Houston’s construction of new retail space, after reaching a record low in 2021, is on track to exceed that level, based on projects in the pipeline for this year. But the increase is not large, and total new deliveries will remain on the conservative side. The limited new space is driving demand to existing projects and helping lift occupancy levels marketwide. The limited deliveries of new retail space, combined with healthy retail demand and limited closings, is helping Houston’s retail market build on the occupancy gains it experienced during 2021. As a result, the retail market currently has a healthy occupancy rate of 96.1 percent. The market remains among the strongest in recent memory, although economic issues — rising interest rates, increased construction costs and inflation — may lead to a slowdown. On the positive side, tenant, developer and investor interest remains extremely high since retail real estate is a long-term game that factors in short-term concerns. The retail market also benefits from several positive influences, including robust demand for small-shop space, new construction that is either built-to-suit or significantly preleased, healthy job and population growth and an economy that is bolstered …

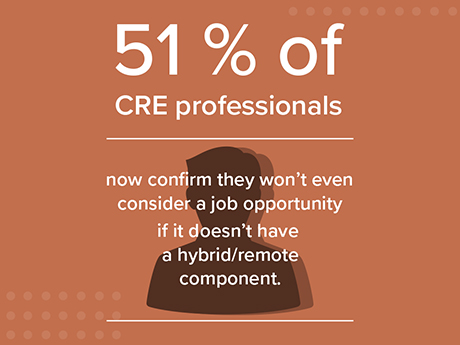

By Kent Elliott, principal, and Chase Fryhover, director, RETS Associates By now, we’re all familiar with the Great Resignation — workers’ mass exodus from their jobs during the pandemic. The phenomenon hit just about every office-using industry, including commercial real estate. In fact, our firm recently conducted a survey of 200 individuals in the industry on job sentiment, which revealed that more than 75 percent of respondents intend to or would consider leaving their current company this year. The trend has affected Texas in a very profound way. According to the Bureau of Labor Statistics, more Texans quit their jobs in September and October 2021 than did workers in any other state. So, what can commercial real estate companies — particularly in the Texas markets — do to maintain a productive and happy workforce and remain competitive in the field? Here are a few recommendations for companies looking to attract and retain talent in the current work environment based on our 20 years of experience as a national recruiting firm for the industry. Be Willing to Bend These days, flexibility is an essential quality at companies where people want to work. This largely began with the pandemic. The business community’s recognition …

By Taylor Williams First things first: By most objective metrics and standards, multifamily assets in major Texas markets still represent strong investment propositions relative to certain other commercial sectors, as well as to the stock market, the other long-term vehicle to which real estate investments are most commonly compared. But as we cross the midpoint of 2022, the U.S. economy finds itself awash in a unique combination of challenging and extreme circumstances. Mainstream news coverage increasingly includes the word “record” in reports on inflation, one-off interest rate hikes and movement in the 10-Year Treasury yield. The yield on two-year Treasury notes recently eclipsed that of the 10-year, creating the “inverted curve” that has historically been an indicator of an upcoming downturn. Rumblings of an imminent recession grow louder by the day. Fear is contagious, and some markets are already showing signs of hunkering down in anticipation of a downturn. The expectation of recession, let alone the materialization of it, impacts even the strongest of markets, including multifamily assets in Texas. Investors and brokers who specialize in the property type recognize that certain factors — net in-migration of hundreds of thousands of people per year, exceptional corporate relocation activity, and supply …