By Mandi Backhaus, The Lerner Co.

As we finish out the first quarter of 2024, we reflect on the Omaha retail real estate market with consideration to the internal and external factors of trends, challenges, opportunities and the state of the economy. It can be said that the Omaha metropolitan area remains steadfast throughout difficult times. With its robust and diverse nature, anchored by industries such as healthcare, technology and finance, Omaha, although sometimes called a “flyover city,” remains a hidden gem for those looking for a steady yet vital lifestyle at an attractive cost.

This favorability trickles down to how real estate is valued and utilized in the area. According to a Merrill Lynch article, approximately $84 trillion in assets is set to change hands over the next 20 years, from baby boomers onto their children and so on. While the various generations may invest differently, one constant remains: real estate.

From a national standpoint, the unstable scenario results from a blend of factors, with inflation, interest rates and the collapse of banks in early 2023 being particularly prominent. This perfect storm had left the industry in a precarious position. The Mortgage Bankers Association revealed a 56 percent drop in real estate lending in the first quarter of 2023 compared with the same period in 2022, reaching its lowest point in nearly a decade due to economic volatility.

Adding to the concern, a Business Insider report indicates that borrowers will face challenges in repaying debts due to restricted cash flow. JPMorgan’s estimates suggest that out of the approximately $659 billion in commercial mortgages set to mature in 2024, up to 20 percent are at risk of default. In addition, a generational shift will occur in both the workplace and consumer behaviors over the next few years, with Generation Z (those born between 1997-2012) expected to make up close to 30 percent of the U.S. workforce by 2025, therefore causing their spending power to reach trillions of dollars. With all of this in mind, the outlook appears cautiously optimistic.

In the Omaha MSA, we are seeing very low vacancy rates in the retail sector specifically, which speaks to the high demand and activity. But a portion of this can also be attributed to construction having slowed down from the time of the pandemic and trickling into the present day. Elevated materials costs along with labor shortages are still a concern in some scenarios. Currently, we are seeing leasing and sales activity picking up in pace.

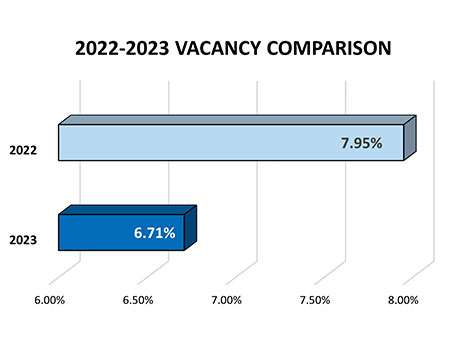

Each year, The Lerner Co. releases our Retail Market Summary, which consists of surveying two types of retail properties: multi-tenant shopping centers in excess of 15,000 square feet, and large freestanding stores operated by major chain store retailers in the Omaha metropolitan area. In 2023, we surveyed 373 centers, for a total of 31.5 million square feet. The retail vacancy rate hovered around 6.7 percent, marking the fourth consecutive year of decline.

Even with interest rates reaching a 22-year high, inflated construction costs and labor challenges, the landscape of retail real estate in Omaha is certainly not doom and gloom. In fact, foot traffic continues to increase in the metro area as many brick-and-mortar stores maintain successful operations. Many national, regional and local retailers continue to evaluate growth plans as well as private equity groups keeping a pulse on investment opportunities.

Furthermore, Omaha has also welcomed many new retail concepts to the market. Entertainment or eater-tainment, as some call it, has made its way into the market. Spare Time, an indoor arcade with bowling and laser tag has opened its first Nebraska location in the former Gordmans near 175th Street and West Center Road. Additionally, SmashPark Pickleball is under construction on its first Nebraska location near Southport Parkway and Giles Road, set to open in spring 2024.

Additionally, we have seen value-oriented retailers ramp up their expansion plans across the board. Five Below, Dollar Tree, Dollar General and Ollie’s Bargain Outlet have all been pursuing new sites in the market. From both the new construction and redevelopment perspectives, numerous projects are trekking along nicely. From The Crossroads mixed-use redevelopment at 72nd and Dodge streets to the new construction developments such as HyVee’s 12th metro location opening near 192nd Street and Highway 370 in Gretna, and Costco’s third metro location under construction on 180th Street and West Maple Road, it is refreshing to see activity flourishing in the Omaha area.

Overall, Omaha’s commercial real estate market, particularly in the retail sector, reflects a balance between tradition and innovation. As the city continues to evolve, savvy investors and developers are well-positioned to capitalize on the opportunities presented by adapting to changing consumer preferences, leveraging strategic locations and embracing innovative retail concepts. We anticipate 2024 to be a steadfast year for commercial real estate in the Midwest. The future of Omaha’s retail landscape holds promise, driven by a resilient economy and a commitment to staying ahead of the curve in the dynamic world of commercial real estate.

Mandi Backhaus is an associate broker with The Lerner Co. This article originally appeared in the April 2024 issue of Heartland Real Estate Business magazine.