By Taylor Williams

For the last several years, as COVID-19, inflation and interest rate hikes have chronologically rocked the commercial real estate industry, the term “dry powder” has increasingly factored into investment discussions. While the term generally refers to cash or capital that is parked on the sidelines, 2024 could well be the year for its deployment.

There are several basic reasons for endorsing this notion. First, at its December meeting, the Federal Reserve signaled that it would cut rates three times this year, which should theoretically make debt financing more accessible and less expensive — though the extent of that depends on the magnitude of the reductions.

Second, as evidenced by the stock market tear following that announcement, investors are itching to deploy capital and will rally around just about any reason to do so, proven or not.

Third, there is roughly $537 billion in commercial real estate loans that will mature next year, according to New York City-based Trepp. This staggering volume of impending maturities in a high-interest-rate environment all but assures that some assets will be forced into sales, whether by owners pre-default or lenders post-default. And finally, the 10-year Treasury yield — the benchmark rate against which many long-term, risk-carrying investments are evaluated — fell steadily from late October to the end of 2023 before rebounding slightly to begin 2024. When yields on these bonds compress, commercial acquisitions automatically look better by comparison, all other investment parameters being held equal.

“We haven’t really seen the bulk of the distress yet, but the amount of distressed assets will certainly increase in 2024,” says Derrick Barker, co-founder and CEO of Nectar, an Atlanta-based startup that serves investors and entrepreneurs through cash-flow-based financing. “Most bridge loans have terms of around three years, and deals that were done in 2021 at the top of the market will begin coming due in 2024. So those who have cash and the ability to buy using low leverage will have the biggest advantage in this market.”

“Many properties have been underperforming, and [their owners] cannot refinance their mortgages at today’s rates and property values but are still able to cover debt service,” Barker continues. “As loans get closer to maturity, many sponsors will conclude that they cannot hit the metrics they need and will sell at losses in order to move on to better opportunities.”

Barker also believes that some owners could sell properties that are stabilized and flowing cash simply because they need to free up capital to fund renovations or other improvements to assets that are in distress.

Of course, some loan defaults and forced sales happen in every asset class every year. But the consensus among Texas brokers, developers and investors seems to be that this go-round will be different, judging by the fact that interest rates are the highest they’ve been in more than 20 years, with the Fed currently targeting a range of 5 to 5.25 percent for the federal funds rate.

Rate hikes and cuts in recent years have generally been executed in 25- or 50-basis-point increments. So even if the nation’s central bank makes good on its trifecta of rate cuts, rates are still likely to remain well above their pre-pandemic levels. That scenario favors buyers with strong cash flows — dry powder — to fill the gaps that debt and equity financing would normally cover.

In participating in Texas Real Estate Business’ annual reader forecast survey, Texas brokers and developers/owners supported their positions on why 2024 could be an opportunistic year for buyers with the right kinds of financials. The survey, now in its 13th year of running, included separate questionnaires for the two groups, with some overlapping queries between them, as well as a separate survey for lenders and financial intermediaries. (A more detailed writeup of the results of the lender survey can be found here).

At the heart of this analysis was the simple premise of whether or not the market has truly bottomed out in terms of pricing and valuations. As interest rates have skyrocketed, buyers have pulled back. Less demand has caused prices to decrease, while sellers have in many cases clung to pre-rate-hike

prices.

Uncertainty on both sides has been the name of the game for the past 18 to 24 months. But investors who can correctly identify the trough in their markets/asset classes and scrape together enough cash to cover debt and equity gaps will be well-positioned to capitalize in the coming months, survey respondents indicated.

Below are some of the open-ended insights that brokers shared on the subject. (Some responses have been lighted edited for clarity and length.)

“The market is going to get worse. Defaults have to hit in order for the free market to churn, and there will be winners and losers, unless of course the government bails out the losers again. Those investors that have dry powder and can underwrite properties to hold and flow cash for the long term will see some incredible purchase opportunities in the next 12 to 18 months.” — Tyler Isbell, senior vice president at SRS Real Estate Partners.

“We see good opportunities for cash buyers in the office and multifamily markets that were overbuilt and [over]leveraged over the past decade of explosive growth in Central Texas. Too much multifamily vacancy, rising rates and notes coming due leave opportunities for investors with access to cash capital to possibly score some good properties needing help.” — Irulian Dabbs, vice president of industrial services at Partners Real Estate.

“The greatest challenge is the change in interest rates and not knowing where rates will go in the near term, which should continue in 2024. Sellers are not wanting to sell at prices that consider today’s rates for fear that in the near future rates will drop and they’d be leaving money on the table. Buyers won’t or can’t buy at year-old cap rates and today’s interest rates. That buyer-seller price gap is what has slowed market velocity significantly.” — Aaron Morris, Houston market manager, vice president of investment sales at Oldham Goodman Group.

“Millions of dollars are sitting on the sidelines waiting. Billions in loans are coming due. We are fighting multiple wars. I have been through several of these cycles, and this one is scary. But nonetheless, one person’s problem can become someone else’s opportunity.” — Brian Novy, owner at Austin-based commercial services firm The Novy Co.

Developers/owners expressed similar sentiments:

“With the lack of debt availability, the high cost of debt and near-term loan maturities on exiting loans, there will be a large number of forced sales at greatly reduced prices. Many of these will be on non-stabilized, newly constructed buildings where the owners will simply run out of time with their lenders or be forced to lease buildings at rents that barely cover debt service. Those with cash are king.” — Matt Brodnik, chief investment officer at EQT Exeter.

“The greatest opportunity in 2024 will involve acquiring properties with debt maturities that current owners can’t refinance without significant additional equity infusion.” — Jeff Harkinson, president of Dallas-based Harkinson Investment Corp.

Office Woes Persist

No major commercial asset class has more properties that are already distressed than the office sector.

According to CBRE’s most current data, the national office vacancy rate at the end of the third quarter of 2023 was 18.4 percent, a 20-basis-point increase quarter over quarter. Of the 55 markets tracked in the report, just 17 experienced positive net absorption in the third quarter, while total net absorption for that period clocked in at negative 4 million square feet.

However, CBRE’s data shows that negative net absorption became less severe as 2023 wore on, going from negative 16 million square feet in the first quarter to negative 8 million square feet in the second quarter.

While some owners of trophy buildings in urban districts have been able to successfully recoup or maintain occupancy via capital improvement programs or various employee perks, most industry professionals have resigned themselves to the notion that the asset class will simply never be the same following the fallout from COVID-19.

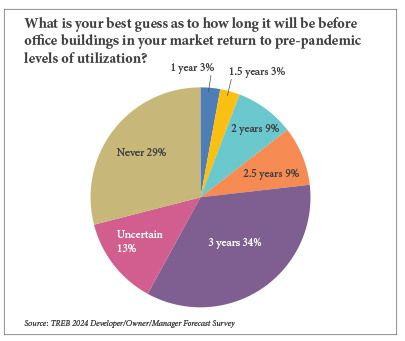

For the third straight year, brokers and developers who participated in the survey were both asked about how long it might take for office buildings to return to pre-pandemic utilization levels. Nearly a third of the brokers who answered the multiple-choice question selected “three years or more,” while 28 percent of respondents chose “never.” None saw the sector recovering within the next six months, and about 5 percent of respondents indicated that such a scenario could materialize within a year. In last year’s survey, the “never” option received just 19 percent of the vote.

Predictions about the fates of office buildings were similar among the developers and owners who completed the survey. Of those, 34 percent believe it will be at least three years before office buildings return to pre-pandemic levels of utilization, while 29 percent forecasted that it would never happen.

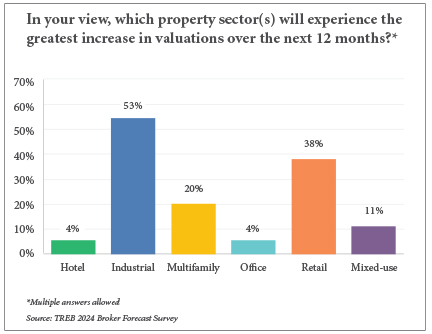

Brokers were also asked to rate the degree to which various asset classes would see higher proportions of distressed assets in 2024 relative to 2023 (see chart on front page). Two-thirds of respondents indicated that they expected the volume of distressed office properties would “increase significantly” this year versus last year.

Brokers had mixed views in terms of the extent to which distress within the office sector would translate to hard sales of those properties. About 35 percent of brokers who completed the survey stated that they expected office properties to experience a high velocity of sales in 2024, while 61 percent expressed confidence that office would have low sales volume in 2024.

Those findings, which were obtained via two separate questions in which participants rated performances of commercial asset classes on a relative basis, are subject to different interpretations. But they both reflect the reality that many office owners are struggling to bring in the rents needed to cover their debt obligations and operating expenses.

Developers and owners also weighed in on the future of the office market via other questions that were revealing in and of themselves. One key query centered on whether landlords’ negotiating power with tenants would be stronger or weaker in 2024 versus 2023. Respondents evaluated this prospect across the four largest commercial property types: office, industrial, multifamily and retail.

All told, 75 percent of developers and owners stated that their negotiating power with office tenants would be weaker this year — a tacit acknowledgment that there simply isn’t enough demand for office space to meet supply in most major markets.

And among the developer participants who planned to break ground on new projects this year, less than 10 percent have office projects in their pipelines.

Other Findings

Across all groups of respondents in last year’s survey, the overwhelming consensus was that interest rates would pose the greatest threat to sustained growth and healthy property performances in 2023. Despite the Fed’s signaling in its latest meeting that some relief was on deck, survey participants remain quite wary of interest rates in 2024.

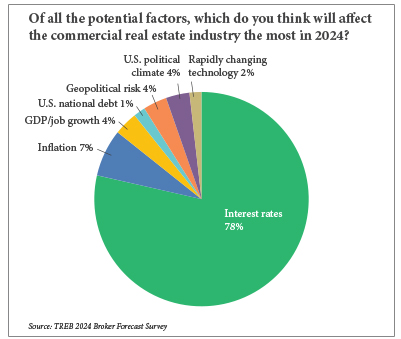

Broker and developer/owner respondents were given a choice of nine factors that could wield the greatest level of influence on the industry in 2024. Eight of the choices were concrete variables — inflation, geopolitical concerns, the national debt, the presidential election, among others — and a ninth option for “other” was also included.

Interest rates, however, carried the day on that question by a significant proportion. Among brokers who answered this question, 78 percent cited interest rates as the No. 1 determining factor to watch this year. Of the developers and owners who did the same, 83 percent selected interest rates.

The context of this finding is critical. The last two years have seen the Fed implement rate hikes in rapid succession, and the rate of inflation has come down as a result, settling at 3.1 percent at the end of the 2023 calendar year. But even with three hypothetical rate hikes totaling 75 to 125 basis points in 2024, benchmark rates will still be well above pre-pandemic levels.

The industry enjoyed a decade of obscenely cheap money, and transitioning from that period into the likes of what we have today was always going to be rocky and detrimental in terms of deal volume and new development. In other words, survey participants don’t expect a major rebound within those metrics in 2024.

Yet interestingly enough, in what is perhaps a subtle nod to the inevitability of more distressed properties hitting the market in 2024, owners expressed some bullishness on their overall buy versus sell positions. When asked if they expected to be net buyers or sellers in 2024, 41 percent of owner respondents indicated that they expected to be net buyers.

For reference, in last year’s survey, which was conducted about midway through the double-digit string of rate hikes, 62 percent of respondents said they expected to be net buyers.

Admittedly, 42 percent of that group said they were either unsure or didn’t really plan to buy or sell, suggesting that overall deal volume in 2024 could remain muted as a result of high interest rates. But this particular finding once again reinforces the notion that even in times of high distress, opportunities exist for buyers who fit the right profiles.

Brokers expressed similar sentiments on this subject. Of those queried on whether they expected their firms’ volumes of business to higher or lower in 2024 relative to 2023 — as measured by both leasing and investment sales combined — about half said that they expected to do more business this year. About 21 percent said they expected to do less business this year, while the remaining 29 percent stated that they anticipated similar deal volumes from one year to the next.

With rates expected to stay high compared to pre-pandemic levels, it therefore follows that the 10-year Treasury yield should remain in relatively high territory as well in 2024. Although bond yields usually move inversely to interest rates, that trend has been flipped in recent months as inflation has necessitated higher purchase prices — and therefore higher yields — on Treasuries.

Survey participants seem to see that trend continuing this year. Brokers and developers/owners were both asked to give their best guesses on where the 10-year Treasury yield would settle at the end of 2024. Aside from a few who opted not to speculate, all brokers indicated that the benchmark rate would close the year between 3.5 and 5.5 percent. Developers and owners felt similarly, with the vast majority also indicating that the 10-year Treasury yield would be somewhere within this range in a year’s time.

The 10-year Treasury yield closed 2023 at 3.86 percent. The last time the yield was below 2 percent was in

mid-March 2022, right around the time interest rate hikes started.