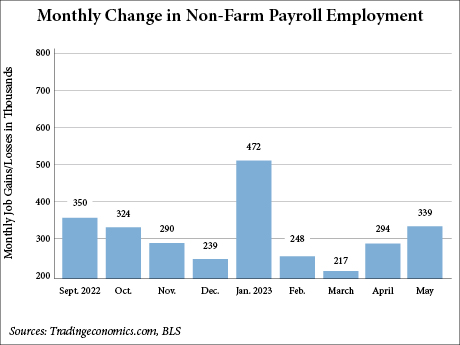

WASHINGTON, D.C. — Nonfarm employment in the United States increased by 339,000 in May, according to the Bureau of Labor Statistics (BLS), with broad-based gains led by the professional and business services sector. Economists surveyed by Dow Jones in advance of Friday’s report had expected job gains of 190,000 in May.

The professional and business services sector added 64,000 jobs in May, followed by government (+56,000), healthcare (+52,000), leisure and hospitality (+48,000), construction (+25,000), transportation and warehousing (+24,000), and social assistance (+22,000). The total number of private-sector jobs added for the month was 283,000.

The unemployment rate increased from 3.4 percent in April to 3.7 percent in May, and the number of unemployed persons rose by 440,000 to 6.1 million.

In May, average hourly earnings for all employees on private nonfarm payrolls rose by 11 cents, or 0.3 percent, to $33.44. Over the past 12 months, average hourly earnings have increased by 4.3 percent.

“Despite the increase in job growth, two data points in this report show signs of somewhat weaker labor demand,” said Mike Fratantoni, chief economist of the Mortgage Bankers Association (MBA), in a prepared statement. “Wage growth has slowed to 4.3 percent over the past 12 months, and the unemployment rate ticked up to 3.7 percent.”

The increase in unemployment was not caused by an increase in the labor force participation rate, which held steady at 62.6 percent, explained Fratantoni. “The household survey, which is the basis for the unemployment rate, is telling a very different story than the establishment survey this month, one showing weakness in employment, the other strength.”

Against that backdrop, several Federal Reserve officials have signaled that they are likely to hold interest rates steady at their upcoming June meeting but are unlikely to reduce rates anytime soon, according to Fratantoni. “This somewhat mixed jobs report is likely to support that approach.”

The central bank has raised the federal funds rate nine consecutive times since early 2022 to a range of 5 percent to 5.25 percent. Jack Kleinhenz, chief economist of the National Retail Federation, says that the Fed’s increases in interest rates in an effort to control inflation have been slowing the U.S. economy but not so much as to tip it into recession.

“Consumer spending has been bolstered by a strong job market and rising wages, which have helped counter rising prices and higher borrowing costs,” says Kleinhenz. “While it’s difficult to reconcile these views, what we’ve learned over the last several years is don’t count the American consumer out, at least not yet.”

The BLS also made upward revisions to total nonfarm payroll employment for the months of March and April. As a result, the employment gains for those two months combined were 93,000 higher than previously reported.