By Melissa Jahnke, associate director of operations, Walker & Dunlop

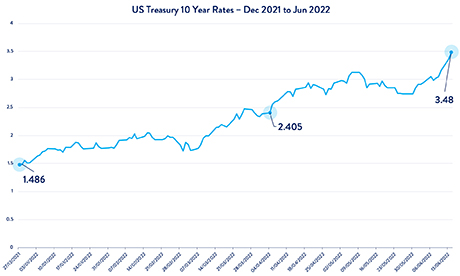

The Federal Reserve raised interest rates by 75 basis points in June and then another 75 basis points in July, sending shockwaves across the commercial real estate industry. Fortunately, there are opportunities and solutions to bypass these potential roadblocks. Specifically, investors in a segment of multifamily housing known as small balance lending (SBL), encompassing five- to 150-unit properties, have several options to realize their aspirations for financing multifamily portfolios. View a higher resolution version of the timeline above here.

During a recent webcast “Financing Amid Rising Rates: Best Approaches for $1M-$15M Multifamily Loans,” Walker & Dunlop’s market experts spoke about navigating today’s financing landscape. The expert panel included Allison Williams, senior vice president and chief production officer; Allison Herrera, senior director of SBL; and Tim Cotter, director of capital markets.

These experienced professionals have found ways to make deals happen in a wide variety of financing environments and have shared their perspectives and guidance. If you are an owner of five- to 150-unit properties that require loans between $1 million to $15 million, the following will help you navigate today’s financial environment and build your momentum.

Step 1: Consider the Full Range of Capital Sources

During the webcast, Walker & Dunlop polled audience members about the capital sources they’ve been using. Bank and credit union financing was the most prevalent, with 70 percent of respondents reporting that they had worked with a bank or credit union recently.

This form of capital fits many purposes, such as conventional and construction financing not large enough to interest debt funds. But loans from these highly regulated institutions can come with some disadvantages, such as recourse for some or all of the loan, stricter underwriting requirements and potentially tightened capital availability in the months ahead.

For these reasons, participants in the $1 million-$15 million sector of the multifamily market should expand their options beyond banks and credit unions. The full range of financing sources include Fannie Mae and Freddie Mac, the Department of Housing and Urban Development (HUD), life insurance companies and commercial mortgage-backed securities (CMBS).

Here’s a brief overview:

Agency financing: The United States government created Fannie Mae and Freddie Mac with a mission to provide financing for affordable housing, in good times and bad. This makes their programs less vulnerable to market volatility.

Agency financing is non-recourse, an advantage over many bank options, and execution can be swifter if you’re familiar with the program intricacies and requirements.

Other advantages for SBL multifamily borrowers include:

- Up to 80% loan to value (LTV)

- A relatively low debt service coverage ratio (DSCR)

- Interest rate holds and early interest rate locks

- A fairly flexible pre-payment structure, with opportunities for cashing out compared with other government financing programs

HUD financing: For SBL borrowers with the time for a longer execution process and the resources for extensive reporting and documentation after closing, HUD financing could be a good fit. HUD programs are known for their attractive interest rates and leverage, which can be higher than the leverage available from Fannie Mae and Freddie Mac. Borrowers can get longer terms, up to 30 years, full amortization and a lower debt service coverage ratio.

HUD finances market-rate properties as well as affordable and rent-restricted housing and has programs available for construction as well.

Life insurance companies: While these capital providers are typically known for low-leverage, institutional-quality deals involving well-leased properties in major metropolitan areas, don’t let this perception limit your thinking. Options exist for loans of all sizes, including those in the $1 million-$15 million range, and some life companies are open to financing older assets that need improvements. Furthermore, life insurance companies offer many of the advantages of agency financing, such as non-recourse terms and comparatively swifter and more streamlined execution.

CMBS: While these are often considered “financing of last resort” and spreads are currently widening out, CMBS can be a good option for:

- Transactions that aren’t a good fit for agencies or life companies

- A sponsor with a credit blemish

- A deal with a unique attribute

Finally, remember that not all financing has to be long term or permanent. Bridge loans of 2-5 years can be a good option for:

- Properties that require additional stabilization

- Rehabilitation of a property post-acquisition

- Acquiring a property that isn’t stabilized due to a recent event, like damage to some of the units

- Moving to a refinance, permanent loan transaction or a sale

While these loans often have floating interest rates, they can include an interest rate cap for protection. Such loans can be underwritten to pro forma operating income — the projected cash flow once the property is stabilized and occupied versus where it is today — for more loan dollars for purposes like rehab work.

Step 2: Control What You Can

While you can’t control inflation, the Fed or geopolitical events, there are many elements within a SBL borrower’s power as interest rate volatility continues.

This starts with your existing portfolio. Do you have a loan you weren’t quite ready to refinance a few years ago, or one with a pre-payment penalty on the horizon? Now may be the time to revisit these scenarios and explore refinancing options.

To get the best leverage and highest LTV possible, examine your net operating income:

- Are your operating expenses as tight as you can make them?

- Are there any unnecessary fees you can eliminate?

- Are you conducting maintenance as effectively as possible?

Finally, get your documentation in order. As your goal is to get locked into an interest rate as a quickly as possible, having the necessary paperwork on hand speeds up the process.

Throughout the process, consider cap rates. Right now, these are still at historic lows and not moving in lockstep with the Treasury rate. But today’s robust rent growth is likely to change this situation. As one of the most significant increases to the bottom line for operating income, continued rent growth will help shape where cap rates go. This means you could close a loan at a much lower cap rate now than one you end up with at the end of the year.

In Conclusion

Whatever next steps you take, work with an expert. As the market evolves, they’ll have an up-to-date view on who’s lending, how much, and under what kind of terms and conditions in the $1 million to $15 million space. Learn more about your options by downloading the Walker & Dunlop financing guide.

It’s never too early to get started. Even if your property is just in the planning stages, an expert partner can track the market, evaluate potential lenders, and even help you lock in a rate early that is based on your cash flow or projected stabilization.

With a full view of capital options, proactive action and the guidance of experts, you can ensure that you don’t have to put your multifamily plans on hold. An expert will be able to make sure 2022 is a year of progress, not pauses, regardless of what interest rates do in the months ahead.

Walker & Dunlop is a content partner of REBusinessOnline. For more articles from and news about Walker & Dunlop, click here.

Watch the entire Financing Amid Rising Rates: Best Approaches for $1M-$15M Multifamily Loans webcast here and learn more about Walker & Dunlop’s small balance lending capabilities here.