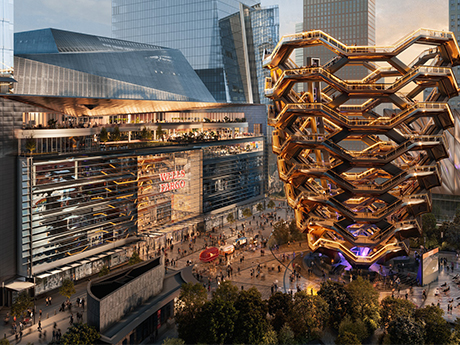

NEW YORK CITY — Wells Fargo & Co. (NYSE: WFC) has announced formal plans to expand its office footprint within Hudson Yards, a mixed-use district on Manhattan’s west side. The San Francisco-based banking giant, which already occupies space within the $25 billion Hudson Yards campus, has purchased additional space from Related Cos., the master developer behind Hudson Yards along with Oxford Properties Group.

Multiple media outlets have reported that Wells Fargo purchased the space at 20 Hudson Yards, which formally housed a Neiman Marcus store, for $550 million. The bank plans to convert the 400,000 square feet of space to offices in synergy with its current 500,000-square-foot footprint at 30 Hudson Yards, according to Bloomberg News. Forbes reported that the Neiman Marcus location closed in summer 2020.

Wells Fargo plans to begin moving employees from its existing office space at 150 E. 42nd St. to the new Hudson Yards office beginning in late 2026. The property is expected to house 2,300 Wells Fargo employees at full operation. The 11-story building will also include a dedicated entrance on 10th Avenue and naming rights to Wells Fargo for signage on the exterior of the property.

“This investment further solidifies our longstanding commitment to New York City and will help us create an enhanced, more collaborative environment for our New York City-based employees,” says Charlie Scharf, CEO of Wells Fargo. “Our new space at Hudson Yards will allow us to bring our Manhattan employees together in one place where they can work in a new, modern workplace as we work to build a stronger company.”

Wells Fargo’s new offices will include a variety of workspace settings and collaborative areas, as well as a food hall for employees with a rotating local restaurant program and an all-day coffee bar with views of the 16-story Vessel attraction and the Backyard at Hudson Yards, a public gathering area with programmed events.

“This significant expansion demonstrates both the success of Hudson Yards’ modern lifestyle offices and live-work-play environment, as well as the power of New York City to meet the evolving needs of the world’s most innovative companies,” says Jeff Blau, CEO of Related Cos. “New York City is once again a magnet for the best talent, and industry leaders like Wells Fargo recognize the long-term advantage of having dynamic office space at Hudson Yards.”

Wells Fargo has approximately $1.9 trillion in assets under management and serves one in three households in the United States, as well as more than 10 percent of small American businesses.

The firm’s stock price closed on Monday, Nov. 27 at $43.02 per share, down from $46.98 a year ago, an 8.4 percent decrease.

— John Nelson