By Kent Elliott, principal, and Chase Fryhover, director, RETS Associates

While December’s national jobs report painted an optimistic picture of the employment landscape, some sources have noted that workers in commercial real estate are leaving the industry.

Yet although some national brokerage firms may be trimming the fat to cut costs in light of recent economic uncertainty, this trend does not seem to apply to Texas-based commercial real estate companies. In fact, according to Estateserve, with the Texas office market booming, vacancy rates dropping and rents rising, “Texas’ commercial real estate is experiencing a resurgence.”

Kent Elliott, RETS Associates

As a national executive search firm that has served the industry for more than two decades, RETS Associates has a seasoned perspective on job markets throughout the country. Here are the trends we are noticing throughout the industry in Texas and why we believe the market is poised for ongoing strength and stability.

Continued In-Migration

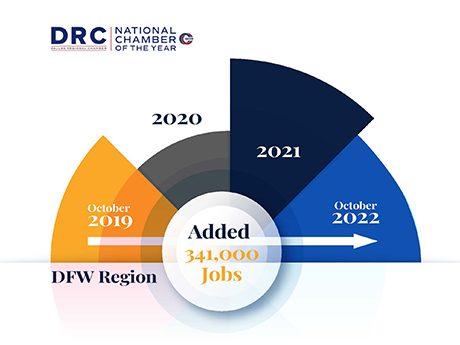

Texas is the ninth-largest economy in the world, as well as one of the leading markets in the country in job and economic growth. The Dallas-Fort Worth (DFW) area in particular, the fourth-largest MSA in the country, led the country in population growth in March 2022 and in post-pandemic job growth in December 2022.

One of the reasons for this expansion is Texas’ corporate-friendly tax policies, which have been attracting businesses from other parts of the country for quite some time. More recently, given rampant inflation, rising interest rates and the current “recession discussion,” companies throughout the United States are increasingly showing interest in moving to a more fiscally friendly environment.

Chase Fryhover, RETS Associates

Texas’ business-welcoming stance have helped position it as a major attraction for corporations like Tesla, Oracle, Caterpillar, Hewlett Packard and Chevron, to name just a few. Companies that are looking to grow and take advantage of a civilian labor force that numbers some 14.5 million are finding the market quite compelling.

While this stance is drawing high-profile company leaders including Douglas Merritt (CEO of Splunk), Tesla chief Elon Musk and comedian and podcaster Joe Rogan, who recently relocated to Texas from Los Angeles, its appeal extends to commercial real estate executives as well.

Over the last two years, our firm has facilitated the relocation of several commercial firm heads from New York and Southern California, where tax rates are notoriously high, to the Lone Star State. Other industry executives who have located to Texas include senior officials at one of the largest real estate services firms in the world and a dash of high-flying industrial development executives — all seeking tax relief from monstrous financial gains.

For this elite group, the moves can mainly be attributed to gains in carried interest or “the promote,” which significantly impact their income. But the state’s location in the center of the country is another draw. Employees need to be mobile, and their ability to hop on a plane and land anywhere in the country in just a few hours is a measurable timesaver and a huge boon for these firms.

Quality of Life

Texas’ lower taxes and affordable lifestyle are highly appealing to a large number of individuals, especially young people and residents of other parts of the country. According to U.S. Census data, 687,000 Californians have moved to the state since 2010, and about 13 percent of new Texans have come from California.

Our firm has seen a total of 60 percent of applicants for Texas-based commercial real estate jobs coming from out of state. Unlike in many other markets, these are not recruits — they are purposely and actively opting to live here. With people increasingly deciding to relocate to Texas if the job makes sense, recruiting efforts within the industry are essentially taking care of themselves.

What’s the draw? The major Texas markets offer a lower cost of living than New York, Los Angeles, Seattle and many other parts of the country, enticing large swaths of Americans to the state to enjoy a better quality of life.

What’s more, as technology has advanced and the COVID-19 pandemic set new standards of flexibility for where people work, hybrid and remote scenarios have become entrenched in the business world. This is allowing people to choose to work from home, often while living in less expensive markets like Dallas, Houston and San Antonio, where in many cases, their income goes twice as far.

Conclusion

We have seen robust employment growth among our Texas-based clients, particularly those in the Dallas and Houston multifamily and industrial sectors, which is positively impacting owners and investors in those markets. As people and businesses continue to migrate to the area, we anticipate ongoing hiring activity among Texas CRE firms for months to come.

Headquartered in Newport Beach, California, RETS Associates is an executive search firm, specializing in connecting today’s companies with valuable talent to deliver long-term profitability. RETS helps industry leaders find powerful executive positions, while also helping global, national, and regional real estate companies strategically recruit and hire both permanent and interim employees.