By Hayden Spiess

To say that the seniors housing sector has encountered strong headwinds over the past few years would be an understatement. The property sector was uniquely impacted by the COVID-19 pandemic. It scarcely had a chance to recover and enjoy rebounding occupancy before being faced with the reality of heightened interest rates.

Amid all the challenges, industry professionals adopted a motivational yet pragmatic mantra and strategy: “Stay Alive Until ’25.”

Now that 2025 has arrived, the sentiment among seniors housing investors is one of growing optimism. Brokers and investors alike say that more favorable conditions are leading to an uptick in transaction activity, even as some debt difficulties linger.

Azhar Jameeli, managing director of investments at IRA Capital and head of the firm’s seniors housing segment, is particularly bullish on the current prospects for the sector. “I don’t think that the opportunity has ever been better than what it is today,” asserts Jameeli, who has multiple decades of experience in seniors housing and cites the supply-demand balance as one of the main sources of his confidence.

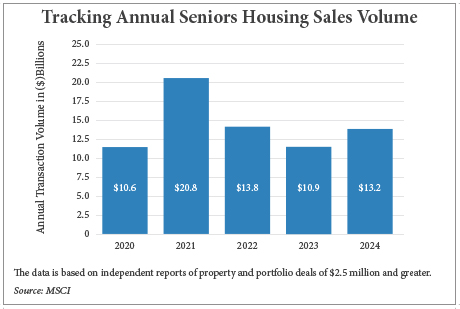

Data from MSCI supports this optimism. U.S. property and portfolio sales totaled $13.2 billion in 2024, up from $10.9 billion the prior year, a 21 percent increase, according to the research firm. (The data covers independent living, assisted living or nursing care properties.)

Capital Comeback

Some sources say that they are observing an improving availability of debt, and that this is a major factor in the uptick in transactions. Following much volatility in the capital markets early in 2024, the end of the year saw debt markets opening up.

“Capital markets progressively got better throughout 2024, and I think will slowly, progressively get better in 2025,” says Jason Punzel, senior managing director with Senior Living Investment Brokerage (SLIB). “There is definitely more debt and equity interested in this space today than 12 or 24 months ago.”

That being said, debt does “remain an obstacle” for certain properties and transactions, according to Rick Swartz, senior managing director and co-leader of the Senior Housing Capital Markets Group with JLL.

Jameeli also reports that the debt market and interest rate environment continue to prove complicated to navigate. He says that this is “probably the biggest hindrance” to the execution of most deals.

IRA Capital — which closed $350 million of investments last year in seniors housing —can pay all cash for properties if it cannot line up a lender in short order.

In fact, all the seniors housing acquisitions completed by IRA in 2024 were all-cash transactions, with delayed financing arranged for some of the assets after purchase.

Flexibility and available equity are important markers of successful would-be buyers in today’s environment. Jameeli also notes that while investors don’t need to be giant entities, it is important to have at least $1 billion of assets under management, and a strong balance sheet is paramount.

REITs were well-capitalized and prominent buyers of seniors housing in 2024, according to Punzel, who expects this trend to continue throughout 2025. “Very recently, we’ve also seen some private equity groups be pretty aggressive on stabilized properties,” he adds.

Regional owner-operators are generally the ones going after the non-stabilized properties, in Punzel’s experience. He explains that it is difficult for these buyers to compete with REITs for stabilized properties and that some non-stabilized properties are attractive acquisitions in their own right.

Additionally, multi-asset class funds are increasingly “recognizing seniors housing as a credible component of those funds,” according to Punzel.

Quality Above All

For those investors who can complete acquisitions, what makes for an attractive investment? Quality above all else is a recurring theme in the current landscape of seniors housing investment sales, say sources.

This holds true independent of the geographic market, says Swartz. “If a secondary market happens to have three or four buildings that are well occupied, well-constructed and fairly new, with a single operator, the portfolio will attract significant investor attention almost anywhere in the country.”

Certain subcategories of property are also generating more interest among investors. For instance, Swartz says that “properties that offer multiple levels of senior care are in favor” over those with a single level of care.

Properties that offer independent living exclusively are also preferred because they are “viewed as less operationally intensive,” says Swartz. Meanwhile, investors are less bullish on skilled nursing facilities, which are more operationally demanding.

Who’s Selling?

Though Punzel believes that it is currently a buyer’s market, he reports that the bid-ask spread is getting much narrower. “At a certain point it’s going to flip back to being a seller’s market,” he adds.

Greater levels of property stabilization are motivating sellers to divest of properties. According to a press release issued by the National Investment Center for Seniors Housing & Care (NIC) in January, the seniors housing occupancy rate for independent living and assisted living combined reached 87.2 percent in the fourth quarter of 2024, with occupancy in the 31 primary markets surpassing pre-pandemic levels.

Though it may seem counterintuitive to sell amid improving occupancies and the prospect for increased net operating income, Punzel says that many of these properties were originally slated to be sold much earlier.

“There are a lot of properties that were opened in 2021 or 2022 that really struggled filling up because of COVID, and now they’re just stabilizing and filling up,” says Punzel. “It was probably a plan to sell it a year or two ago or longer.”

On the flip side, owners of non-stabilized properties may see a sale as a welcome exit from a property with which they have struggled.

Stymied Development

Another factor driving investment sales deals is the current dip in development activity. This is in part due to high costs of construction stymying ground-up projects.

The Weitz Co. reported in October 2024 that labor costs are being driven up by “difficulties locating quality workers” and that construction costs were expected to rise between 3 and 6 percent over the subsequent 12 months.

According to Swartz, there are significant opportunities to acquire properties at prices below replacement cost. This marks a stark contrast to the pre-COVID market, in which attractive, successful, higher-end properties were trading at significantly above replacement cost.

However, Swartz notes, that the landscape will evolve over the next couple of years, as acquisition prices per unit increase and interest in new development grows as a consequence.

Jameeli concurs, noting that today there are unique chances to purchase assets at “amazing values.” For this reason, Jameeli says that IRA Capital does not allow itself to be dissuaded by any lingering economic headwinds.

This is emblematic of IRA’s approach to seniors housing and the confidence in the sector among other professionals. Says Jameeli, “we’re believers in in the long-term fundamentals and tailwinds of seniors housing.”