Often lauded as a recession-resistant asset class, the student housing sector was able to add another feather to its cap over the course of the past year, proving that it is also pandemic-resistant.

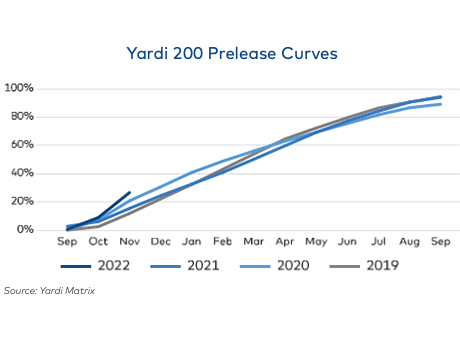

The fall 2021 pre-leasing period ended in September at an occupancy rate of 94 percent, up from 89 percent in 2020 and 0.4 percent from levels seen prior to the start of the COVID-19 pandemic in fall 2019, according to the Yardi Matrix National Student Housing Report January 2022.

These numbers were seen within the company’s ‘Yardi 200’ markets, which include the top 200 investment-grade universities across all major collegiate conferences.

Pre-leasing for the fall 2022 term is already underway with levels at 27 percent as of November — an 11 percent increase over the same time in 2020, and a 6 percent increase over levels seen in 2019.

Yardi reports that the top five universities with the greatest year-over-year growth in percentage of beds pre-leased are the University of Wisconsin-Madison with 66 percent growth; the University of Nevada-Las Vegas with 48 percent growth; Purdue University with 43 percent growth; the University of Pittsburgh with 31 percent growth; and the University of North Carolina at Chapel Hill with 30 percent growth.

A small number of universities within the Yardi 200 are showing signs of struggle in pre-leasing for fall 2022, with 10 universities showing pre-leasing levels lower than fall 2021. Three universities had more notable losses in pre-leasing levels compared to the prior year: Syracuse University (21 percent pre-leased, 10 percent below the prior year); Virginia Commonwealth University (14 percent pre-leased, 8 percent below the prior year); and the University of Southern California (5 percent pre-leased, 5 percent below the prior year)

Rents rise

The average per-bed rent at Yardi 200 universities was $791 as of December, up 2 percent over the previous year and 0.3 percent over the previous month. This is the highest average rent for off-campus student housing in years, according to Yardi, and is $2 over the previous month’s high. Yardi expects that pre-leasing and rent growth will increase modestly as spring approaches.

Seven universities in the Yardi 200 had negative annual rent growth as of December. These markets were diverse in location, campus setting and size. The University of Alabama had the lowest annual rent growth in December at -2.7 percent, followed by Miami University-Oxford at -2.6 percent and the University of Pennsylvania at -2.3 percent.

The most expensive student housing rents were — unsurprisingly — seen in markets with a high cost of living. Four California universities made the top 10 list of most expensive per-bed rents in December, including the University of Southern California at $2,476; the University of California-Santa Barbara at $1,751; the University of California-Davis at $1,226; and the University of California-Irvine at $1,179.

Development levels set to grow

Student housing deliveries slowed in 2021, with just over 19,000 beds delivered at Yardi 200 universities as of December, down from more than 30,000 annual beds delivered over the past few years. Yardi predicts that 2022 will bring more deliveries at just over 25,000 beds.

There are more than 135,000 beds in various stages of development surrounding Yardi 200 universities, with 49,000 of those currently under construction. Most of these projects are concentrated in the Southern and Southwestern U.S. — specifically in Florida and Texas.

The top five universities with the most beds under construction are the University of Washington with 4,245 beds; The University of Texas at Austin with 2,950 beds; the University of Michigan with 2,611 beds; the University of California-Davis with 2,361 beds; and Washington State University with 2,019 beds.

Transaction volume picks up

Student housing transaction volume began to slow prior to the pandemic after three consecutive years of over $3 billion sales at Yardi 200 universities. That volume picked up again in 2021, with strong leasing levels despite the pandemic catalyzing a greater number of investors to enter the space.

Sales volume surrounding Yardi 200 universities as of December totaled $2.8 billion, with an average price per bed of $67,000. Much like development activity, universities in the South and Southwest saw the greatest number of sales transactions during 2021.

The top five university markets with the highest year-to-date sales were Arizona State University with $222.5 million; The University of Texas at Austin with $151.9 million; Texas Tech University with $147.1 million; Clemson University with $142.9 million; and the University of Central Florida with $138.5 million.

—Katie Sloan