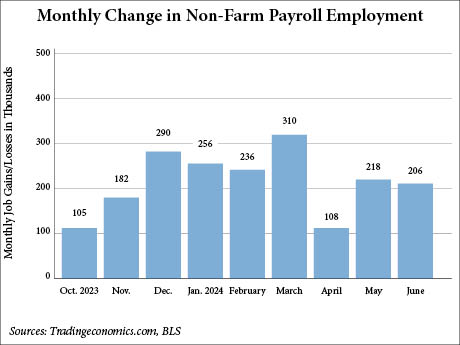

WASHINGTON, D.C. — Total nonfarm employment in the United States increased by 206,000 jobs in June, according to the U.S. Bureau of Labor Statistics (BLS). This figure slightly surpasses the expectations of Dow Jones economists, which predicted an increase of 200,000, according to CNBC. The number does, however, fall below that of May, which the BLS revised down to 218,000 jobs. The BLS also significantly revised the employment gains for April, from 165,000 jobs to 108,000. Combined, the BLS revised the prior two months down by a combined 111,000 jobs. Government employment increased by 70,000 jobs in June, higher than the average monthly gain of 49,000 over the prior 12 months. Other sectors with noteworthy gains included healthcare (49,000 jobs), social assistance (34,000) and construction (27,000). Other major industries saw little change. Employment in professional and business services fell by 17,000 jobs month-over-month, led by losses in temporary services, a subcategory that has tumbled by 515,000 jobs since March 2022. The unemployment rate in June increased slightly, reaching 4.1 percent. This marks the highest level since October 2021. According to CNBC, forecasts had called for the rate to hold steady at 4 percent.

Southeast

BALTIMORE — CBRE has negotiated the $140.5 million sale of Baltimore Crossroads, a six-building industrial portfolio totaling nearly 900,000 square feet in Baltimore’s East industrial submarket. EQT Exeter purchased the portfolio, which was 97 percent leased at the time of sale. Bo Cashman and Jonathan Beard of CBRE represented the undisclosed seller in the transaction. The assets within the Baltimore Crossroads portfolio are situated on nearly 200 acres along the I-95 corridor near the Port of Baltimore. Located at 1405, 1409 and 1411 Tangier Drive and 11501, 11503 and 11505 Pocomoke Court, the buildings range in size between 42,275 and 435,490 square feet.

Vista Residential Breaks Ground on 277-Unit Mixed-Use Apartment Community in Holly Springs, North Carolina

by John Nelson

HOLLY SPRINGS, N.C. — Vista Residential Partners has broken ground on Main Street Vista, a 277-unit mixed-use apartment community in Holly Springs, a southwest suburb of Raleigh. The 11.7-acre development site is located at the corner of North Main Street and Holly Springs Road. Main Street Vista will feature a mix of one-, two- and three-bedroom apartments averaging almost 1,050 square feet, as well as 19,000 square feet of retail space and 11,000 square feet of live-work space. Select apartments will have a ground-floor office space available for lease to prospective tenants who desire to work from home. Designed by Niles Bolton, Main Street Vista will feature a clubhouse, resort-style swimming pool, fitness center, central green area, pet park and 24/7 package concierge services. Dome Equities and two Ohio-based life insurance companies provided financing for the project. The construction timeline was not disclosed.

Octave Holdings Acquires 269,253 SF Belgate Shopping Center in Charlotte’s University District

by John Nelson

CHARLOTTE, N.C. — Octave Holdings and Investments LLC has purchased Belgate Shopping Center, a 269,253-square-foot power retail center in Charlotte’s University district. The Alpharetta, Ga.-based buyer’s investment fund, Octave Realty Fund IX LLC, acquired the center for an undisclosed price. The seller was also not disclosed. Located at the intersection of North Tryon Street and University City Boulevard, Belgate Shopping Center is situated within one mile of University of North Carolina – Charlotte, as well as near North Carolina’s only IKEA store. The property was fully leased at the time of sale to tenants including Hobby Lobby, T.J. Maxx, Burlington, Marshalls, PetSmart, Old Navy, Shoe Carnival and Ulta Beauty. Shadow anchors of the center include Topgolf and Walmart Supercenter. Octave’s in-house property management company, Pinnacle Leasing and Management, will operate Belgate Shopping Center.

Berkadia Arranges $39.9M Acquisition Loan for Brantley Pines Apartments in Fort Myers, Florida

by John Nelson

FORT MYERS, FLA. — Berkadia has arranged a $39.9 million acquisition loan for Brantley Pines Apartments, a 296-unit multifamily community located at 1801 Brantley Road in Fort Myers. Mitch Sinberg, Michael Basinski, Brad Williamson and Scott Wadler of Berkadia’s South Florida office arranged the five-year, fixed-rate Freddie Mac loan on behalf of the borrower, Boca Raton, Fla.-based Interface Properties. The seller was not disclosed. Built in two phases between 1988 and 1997, Brantley Pines is situated near Southwest Florida International Airport. The property features one-, two- and three-bedroom floor plans, as well as a 24-hour fitness center, pool, grills, business center, pickleball court and a pet park. Interface Properties plans to complete a light value-add program at the community during its ownership.

Marcus & Millichap Brokers $8.3M Sale of Adjacent Retail Properties in Milledgeville, Georgia

by John Nelson

MILLEDGEVILLE, GA. — Marcus & Millichap has brokered the $8.3 million sale of two retail properties located in Milledgeville. An undisclosed buyer acquired Town Central Shopping Center, a 140,097-square-foot retail center, and an adjacent single-tenant property totaling 54,765 square feet. Food Depot occupies the single-tenant property. Tenants at Town Central Shopping Center, which was fully leased at the time of sale, include Tractor Supply Co. Zach Taylor and Eric Abbott of Marcus & Millichap represented the seller of the shopping center, and Robby Pfeiffer of Marcus & Millichap represented the seller of the single-tenant, Food Depot property. Taylor, Abbott and Pfeiffer worked together to procure the buyer. “This sale is a prime example of the robust demand for grocery-anchored retail centers with below-market rents,” says Taylor.

Dwight Mortgage Trust Provides $142M Acquisition Financing for Southeast Skilled Nursing Portfolio

by John Nelson

MIAMI — Dwight Mortgage Trust, the affiliate REIT of Miami-based Dwight Capital, has provided a $142 million bridge acquisition loan for a portfolio of 10 skilled nursing facilities in urban areas surrounding Atlanta, Memphis, Mobile, Ala., and Shreveport, La. The properties include Bell Minor Home in Gainesville, Ga.; Cambridge Post Acute Care Center in Snellville, Ga.; Nurse Care of Buckhead in Atlanta; Riverside Health Care Center in Covington, Ga.; Rockdale Healthcare Center in Conyers, Ga.; Westminster Commons in Atlanta; Millington Healthcare Center in Millington, Tenn.; Parkway Health and Rehabilitation Center in Memphis; Kensington Health and Rehabilitation in Mobile; and Highland Place Rehabilitation and Nursing in Shreveport. Collectively, these facilities total 1,371 beds. Adam Offman and Sheldon Frankel originated the loan. Details on the buyer and seller were not disclosed.

NRP Group, Marshall Heights Break Ground on 115-Unit Affordable Housing Project in DC

by John Nelson

WASHINGTON, D.C. — A partnership between The NRP Group and Marshall Heights Community Development Organization Inc. (MHCDO) has broken ground on Emblem, a 115-unit affordable housing community located at 301 Florida Ave. NE in Washington, D.C. Situated in the District’s NoMa and Union Market neighborhoods, the property will be reserved for households earning up to 30 and 50 percent of the area median income (AMI). Residents of Emblem will be within walking distance of a Metro station, two bus lines, the Metropolitan Branch Trail and Union Market District. The 13-story, flatiron building will feature a dedicated toddler playroom, bike storage room and a multi-purpose community room. NRP Group and MHCDO plan to break ground this year and deliver Emblem in 2026. Financial partners for the project include DC Housing Finance Agency (DCHFA), Department of Housing and Community Development (DHCD), DC Housing Authority (DCHA), DC Green Bank and Bank of America.

DAVIE, FLA. — BBX Logistics Properties has formed a joint venture with FRP Development Corp. to develop The Park at Davie, a two-building industrial park in South Florida spanning 182,000 square feet. Located just south of State Road 84, the 11.3-acre project is situated near Fort Lauderdale-Hollywood International Airport and Port Everglades, as well as the Florida Turnpike and I-595. The co-developers plan to break ground on The Park at Davie in the fourth quarter and complete construction in 2025. The duo is also partnering on the development of The Park at Lakeland in Lakeland, Fla.

IPA Capital Markets Arranges $30.5M Construction Financing for Apartment Development in Greensboro, North Carolina

by John Nelson

GREENSBORO, N.C. — IPA Capital Markets, a division of Marcus & Millichap, has arranged $30.5 million in construction financing for Brooks North Apartments, a 340-unit multifamily development located at 4005 N. Church St. in Greensboro. Frank Montalto of IPA Capital Markets’ Chicago office arranged the financing with a regional lender on behalf of the borrower, a local development company. The ground-up development will feature three- and four-story garden-style buildings with an amenity package that includes a fitness center, pool, cabana clubhouse and a bark park. Brooks North will be delivered in phases, with Phase I (244 units) set to open next summer.