DELRAY BEACH, FLA. — The Milestone Group has purchased Axis Delray Beach, a 488-unit, garden-style apartment community located at 1495 Spring Harbor Drive in Delray Beach, a city in South Florida’s Palm Beach County. The seller and sales price were not disclosed. Milestone plans to implement a multimillion-dollar renovation to the property’s common area amenities, landscaping and exteriors. The previous owner recently made capital improvements to Axis Delray Beach’s unit interiors.

Southeast

CARY, N.C. — Accesso has executed 30,000 square feet of leases at Weston I, a two-building office property located at 1001 Winstead Drive in Cary, a suburb of Raleigh. The deals include 12,000 square feet in new leases and 18,000 square feet in renewals. New tenants include K&A Engineering, a global engineering consultancy, and Contiem Inc., an international content management company. Hall & Burns Wealth Management LLC and Western & Southern Life Insurance Co. are two of the tenants that have renewed at Weston I. Brian Carr and Brad Corsmeier of CBRE represented Accesso in the lease transactions. Accesso cites the property’s recently renovated lobby, fitness center and tenant lounge as helping drive the recent leasing activity.

TAMPA, FLA. — JLL has arranged the sale of 100 North Tampa, a 572,111-square-foot office tower in downtown Tampa’s central business district (CBD). At 42 stories, the high-rise is the tallest building in Tampa and was 83 percent leased at the time of sale. Hermen Rodriguez, Ike Ojala, Matthew McCormack, Robbie McEwan, Blake Koletic, Max Lescano and Hunter Smith of JLL represented the seller and procured the buyer in the transaction. Both parties requested anonymity, and the sales price was not disclosed. Amenities at 100 North Tampa include concierge service, a retail bank branch with ATMs, sundry shop, fitness center, conference rooms and a parking garage with electric vehicle charging stations and car detailing. The previous owner recently executed a $21 million renovation prior to the sale. Built in 1992, the tower has achieved LEED Gold, WiredScore Platinum and ENERGY STAR certifications, according to the property website.

Capital Square Plans Multifamily, Hospitality Development in Scott’s Addition Neighborhood of Richmond

by John Nelson

RICHMOND, VA. — Capital Square has launched a new opportunity zone fund, with plans to develop a multifamily and hospitality property at 1600 Roseneath Road in Richmond. Plans for the 2.2-acre development include 220 apartment units and 100 apartment-hotel rooms. Dubbed CSRA Opportunity Zone Fund IX LLC, the fund aims to raise $77 million in equity from accredited investors to fund the project. This marks the ninth opportunity zone fund for Capital Square and its sixth development in the Scott’s Addition neighborhood of Richmond. The unnamed property will be situated within walking distance of several restaurants, breweries and attractions, including the Virginia Museum of Fine Arts, Science Museum of Virginia and Virginia Museum of History and Culture.

Wingspan Development, ABC Capital Sell 192-Unit Jade at North Hyde Park Apartments in Tampa

by John Nelson

TAMPA, FLA. — Wingspan Development and ABC Capital Corp. have sold Jade at North Hyde Park, a 192-unit apartment community located at 608 N. Willow Road in Tampa’s North Hyde Park neighborhood. San Francisco-based Hamilton Zanze acquired the property, which is located approximately a half-mile from downtown near the University of Tampa, for an undisclosed price. The acquisition represents Hamilton Zanze’s entry into the Florida market. Matt Mitchell of Berkadia brokered the transaction. Built in 2022, Jade at North Hyde Park was 97 percent occupied at the time of sale. The property features studios, one-, two-, three- and four-bedroom units ranging in size from 463 to 1,421 square feet. Select units have built-in wine storage, dual-sink vanities in the primary bathroom and/or covered balconies. In addition to amenities like a pool, coworking spaces and a pet spa, Jade also features 3,200 square feet of ground-level retail space. Tango Brew, a pet-friendly coffee and wine bar, will soon open a 1,600-square-foot eatery at Jade, with plans to offer both indoor and outdoor seating for up to 66 people, including an outdoor bar and patio as well as a water and treat station for patron’s dogs.

KeyBank Provides $42.9M Agency Refinancing for Apartment Community in Dawsonville, Georgia

by John Nelson

DAWSONVILLE, GA. — KeyBank Real Estate Capital has provided a $42.9 million Fannie Mae loan for the refinancing of Pointe Grande Dawsonville, a 300-unit apartment community in metro Atlanta. Justin Ownby and Patrick Fitzgerald of KeyBank’s Commercial Mortgage Group originated the financing on behalf of the borrower, Central Florida-based Hillpointe. Built between 2022 and 2023, the garden-style property is situated on a 23.5-acre parcel and features 12 three-story apartment buildings, as well as a 24-hour fitness center, resort-style pool with private cabanas, 24-hour conference and business center, Starbucks coffee/tea bar and a bark park with agility equipment and a pet spa.

Gantry Arranges $22.3M Acquisition Financing for Target-Anchored Shopping Center in DC

by John Nelson

WASHINGTON, D.C. — Gantry has arranged a $22.3 million acquisition loan for Cityline at Tenley, a Target-anchored shopping center located at 4500 Wisconsin Ave. NW in Washington, D.C.’s Tenleytown neighborhood. The center is part of a mixed-use development that also features 204 condominiums. Other retail tenants at the 89,000-square-foot retail property include Ace Hardware and Bank of America. Cityline at Tenley is situated above a Metro station near American University and across Wisconsin Avenue from a Whole Foods Market grocery store, Wawa and Chick-fil-A. Braden Turnbull, George Mitsanas and Austin Ridge of Gantry arranged the fixed-rate financing through a life insurance company on behalf of the borrower, Lincoln Property Co. The loan features a seven-year term with five years of interest-only payments followed by a 30-year amortization schedule.

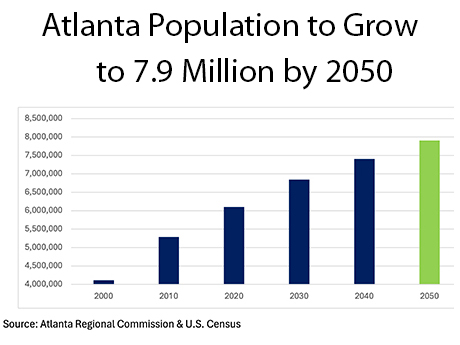

By Will Mathews and Mike Kidd of Colliers What is the reason behind Atlanta’s explosive growth over the last 20 to 30 years? Simply put, it’s been the exponential increase in population driven by an influx of new residents from the Northeast, Midwest and Mid-Atlantic. Atlanta is home to 17 Fortune 500 companies (the third-largest market in the nation), numerous high-paying jobs, a culturally diverse population and multiple prestigious universities, laying a strong foundation for incredible net migration. Multifamily investors are drawn to Atlanta, evidenced by the region’s high volume of multifamily transactions. According to MSCI Real Capital Analytics, Atlanta is currently ranked No. 4 in the country behind New York City, Dallas and Los Angeles in transactions. Despite challenges related to new supply and systematic traffic problems, the future of Atlanta’s multifamily market is very bright for a number of reasons. 7.9 Million by 2050 According to the Atlanta Regional Commission, the population of Atlanta will grow to 7.9 million, or an increase of 1.8 million people from 2020 to 2050. One of the direct beneficiaries of population growth is multifamily rent growth. Reflecting recent population trends, rent growth is forecasted to peak in the suburban counties east of …

Jacksonville City Council Approves $1.4B Renovation of EverBank Stadium, Home of NFL’s Jaguars

by John Nelson

JACKSONVILLE, FLA. — The Jacksonville City Council voted 14-1 Tuesday night to approve an agreement between the city and the NFL’s Jacksonville Jaguars for the $1.4 billion renovation of EverBank Stadium. ESPN reports that the agreement needs to be ratified by 24 of the 32 NFL owners, who will review the agreement when they convene in Atlanta in October for their annual meeting. If passed, the anticipated construction timeline of the renovation would begin at the conclusion of the Jaguars’ 2025 season and deliver before kickoff of the team’s 2028 season. The Jaguars, along with Jacksonville Mayor Donna Deegan and lead negotiator Mike Weinstein, presented the renovation agreement in mid-May. “This day has been a long time coming,” says Deegan. “I am truly grateful for the partnership with the Jaguars throughout the negotiation process, and to the City Council for passing this historic deal. Together, we are turning renderings into reality for the betterment of Jacksonville.” The Jaguars released conceptual designs for the renovated EverBank Stadium last summer. The team estimates that the economic impact of the project throughout the Jaguars’ 30-year lease will total $26 billion, with an estimated $2.4 billion in one-time economic impact during construction. The deal …

WASHINGTON, D.C. — Affordable Homes & Communities (AHC) and Hoffman & Associates have opened The Westerly, a 449-unit apartment community in southwest Washington, D.C. The mixed-income property features apartments in studio, one- and two-bedroom layouts, including 136 units that are evenly split with income restrictions set at 30 and 50 percent of the area median income (AMI). The property is situated less than one block from the Waterfront Station Green Line Metro station and three blocks from The Wharf, a multibillion-dollar mixed-use development co-developed by Hoffman & Associates. Designed by Torti Gallas + Partners, The Westerly features a façade with cascading balconies and landscapes by Michael Vergason. The property also includes 20,000 square feet of amenities, including a rooftop pool deck, outdoor courtyard with a fire pit, entertainment lounges, fitness center, coworking and meeting spaces and a lobby lounge. The Westerly also houses 29,000 square feet of retail space leased to Good Company Doughnut Café, GoodVets and AppleTree Public Charter School. AHC and Hoffman funded the project using a market-rate equity investment with both 4 percent and 9 percent Low-Income Housing Tax Credits (LIHTC). Partners in the development included development partners CityPartners and Paramount Development; capital partners Grosvenor Americas, Merchants …