KNIGHTDALE AND DURHAM, N.C. — The Providence Group has arranged two leases in the metro Raleigh-Durham area with national retailers HomeGoods and Michaels. HomeGoods will occupy nearly 23,000 square feet at Knightdale Marketplace, a 325,000-square-foot, open-air shopping center in Knightdale. Michaels will occupy 16,200 square feet at Durham Festival, a 134,290-square-foot retail center in Durham. Melissa McDonald of The Providence Group represented the tenants in both lease transactions. Reagan Crabtree and Cristi Webb, also with The Providence Group, represented the landlords in both deals — Epic Real Estate Partners at Durham Festival and M&J Wilkow at Knightdale Marketplace.

Retail

SAN ANTONIO — Texas-based restaurant operator Emmer & Rye Hospitality Group has debuted Pullman Market, a 40,000-square-foot food hall within San Antonio’s Pearl District. The culinary destination features four full-service restaurants, fast-casual concepts, an artisan butcher and fishmonger program, various wine and beer selections, Texas-based produce and specialty foods, a seasonal bakery and a fresh pasta program. The four restaurants include Italian concept Fife & Farro, Mexican eatery Mezquite, fine-dining establishment Isidore and dessert bar Nicosi.

CHICAGO — The NFL’s Chicago Bears have released their plans for the development of a new fixed-roof stadium along Chicago’s lakefront. Local media reports state that the project cost is $3.2 billion. Plans call for a publicly owned multipurpose stadium located just south of the organization’s current Soldier Field. The proposal boasts year-round use for recreational and community events and an increase in open and green space, including 14 acres of athletic fields and park space for use by public and youth sports programs. The plan features a three-acre promenade and plaza area, which could include year-round food-and-beverage outlets, retail shops, and a cultural attraction focused on sports and Soldier Field history. A publicly owned hotel could also be included in this portion. The stadium would be capable of hosting large-scale sporting events year-round, including Super Bowls and NCAA Final Fours, as well as entertainment acts. Additional project features include a pedestrian mall and pavilion, a wider variety of food-and-beverage options, more public restrooms, and the preservation of Soldier Field’s historic colonnades, which will remain accessible to fans and continue to honor military personnel. The Bears have pledged to contribute more than $2 billion to the project, representing over 70 …

THORNTON, COLO. — Faris Lee Investments has arranged the sale of Thornton Town Center. The retail property is located at the southeast corner of Interstate 25 Freeway and E. 104th Street in Thornton, a suburb north of Denver. A Southern California-based private investor sold the property to a Southern California-based value-add investor for $14.4 million. Thornton Town Center offers 265,181 square feet of retail space. Don MacLellan of Faris Lee Investments represented the seller and procured the buyer in the deal.

Western Retail Advisors Brokers $5.5M Sale of Avenue at Olive Park Retail Center in Glendale, Arizona

by Amy Works

GLENDALE, ARIZ. — Phoenix-based Western Retail Advisors has arranged the sale of Avenue at Olive Park, a retail property at 5814 W. Olive Ave. in the Phoenix suburb of Glendale. A California family office sold the asset to 2015 K&A Kisidiaris Trust for $5.5 million. McDonald’s, dd’s Discounts, Panda Express, Jack in the Box and Circle K are tenants at the fully occupied retail center. Darrell Deshaw of Western Retail Advisors represented the seller, while Gabe Manzanares of Compass Commercial represented the buyer in the transaction.

NEW YORK CITY — Apparel retailer Vuori will open a 4,500-square-foot store at 120 Fifth Avenue, a 70,000-square-foot building in Manhattan’s Union Square neighborhood. Richard Skulnik and Lindsay Zegans of RIPCO Real Estate represented the tenant in the lease negotiations. Alan Schmerzler, Sean Moran and Patrick O’Rourke of Cushman & Wakefield represented the landlord, Bromley Cos. The opening is scheduled for the fall.

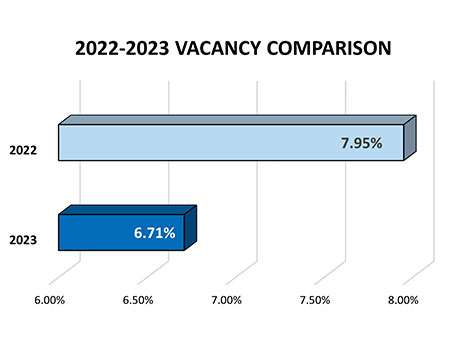

By Mandi Backhaus, The Lerner Co. As we finish out the first quarter of 2024, we reflect on the Omaha retail real estate market with consideration to the internal and external factors of trends, challenges, opportunities and the state of the economy. It can be said that the Omaha metropolitan area remains steadfast throughout difficult times. With its robust and diverse nature, anchored by industries such as healthcare, technology and finance, Omaha, although sometimes called a “flyover city,” remains a hidden gem for those looking for a steady yet vital lifestyle at an attractive cost. This favorability trickles down to how real estate is valued and utilized in the area. According to a Merrill Lynch article, approximately $84 trillion in assets is set to change hands over the next 20 years, from baby boomers onto their children and so on. While the various generations may invest differently, one constant remains: real estate. From a national standpoint, the unstable scenario results from a blend of factors, with inflation, interest rates and the collapse of banks in early 2023 being particularly prominent. This perfect storm had left the industry in a precarious position. The Mortgage Bankers Association revealed a 56 percent drop …

CYPRESS, TEXAS — Big Air Trampoline Park has signed a 35,311-square-foot retail lease at Cypress Landing Shopping Center on the northwestern outskirts of Houston. The space formerly housed a Gold’s Gym. Jason Gaines of locally based brokerage firm Sturbridge Commercial Real Estate represented the undisclosed landlord in the lease negotiations. R.J. Mohindra of FEC Real Estate represented Big Air, which now operates 15 facilities across the country and plans to open another 30. The opening is slated for May.

INDIANAPOLIS — The Picklr, an indoor pickleball franchise, is slated to open its first Indiana location this summer. The Picklr Indianapolis Keystone Crossing club, located at 3810 E. 82nd St., will be the first of more than five locations to open in the greater Indianapolis area. The 30,000-square-foot facility will feature 10 indoor courts, a full pro shop, private event space, unlimited league play, tournaments, youth academies and open play. Dave Gilreath and Ron Brock, local Indianapolis businessmen, are managing partners of Pickle Indy LLC and franchise owners of The Picklr Indianapolis Keystone Crossing.

KANSAS CITY, MO. — The Kansas City Current, a professional women’s soccer team, has unveiled plans for an $800 million mixed-use project on the Missouri riverfront in downtown Kansas City. The development follows completion of CPKC Stadium, a women’s soccer stadium that seats 11,500 people, in March. According to the project team, the $120 million venue is the first soccer stadium to be designed and built exclusively for women. Partners for the mixed-use project include Palmer Square Capital Management, Marquee Development and the Port Authority of Kansas City. The stadium will anchor the mixed-use district, along with Berkley Riverfront Park and the Missouri riverfront. The development will feature hundreds of multifamily units, food and beverage offerings, and new public recreational spaces such as a new town square and a riverfront promenade. The public areas will be programmed with family-friendly events like movie nights, food festivals, fitness classes and live music. Additionally, 10 percent of all residential units across all phases of the project will be set aside for tenants earning up to 50 percent of the area median income. “Kansas City was founded at the confluence of the Missouri and Kansas Rivers,” says Angie Long, co-founder and co-owner of the KC Current. “With the …