ATLANTA — Balfour Beatty has completed construction of 560 Edgewood, the adaptive reuse of a historic Coca-Cola bottling plant in Atlanta. Charlotte-based Asana Partners is the owner of the 60,000-square-foot building, which is situated along the Atlanta BeltLine’s Eastside Trail and adjacent to Krog Street Market, a popular food hall also owned by Asana Partners. Balfour Beatty was the construction manager of the redevelopment, which converted the 1915-built factory into a mixed-use project with a new rooftop amenity, 104-space parking deck, restored windows and a revamped brick façade. Locally based ASD|SKY was the architect for the redevelopment. Asana Partners has tapped Molly Morgan and Allie Spangler of JLL to handle retail leasing at 560 Edgewood. Bennett Gottlieb with Capital Real Estate Group is handling service and office space leasing.

Search results for

"Adaptive Reuse"

STERLING HEIGHTS, MICH. — Developer Repvblik has opened The Block at Sterling Heights, a 213-unit apartment development in Sterling Heights. The adaptive reuse project transformed the former Wyndham Gardens Sterling Heights hotel into studio and one-bedroom apartments. The multi-million-dollar project began in July 2022. Several months into construction, Repvblik decided to demolish a sprawling section of the building that used to contain the Loon River Café and Sterling Inn Banquet and Conference Center in order to free up more than three acres of street-facing land for future development. Units at The Block range from 315 to 825 square feet. Rents for most apartments range from $795 to $1,300 per month, with large loft apartments renting for $1,500 per month. A significant number of the units will be reserved for those making between 60 and 120 percent of the area median income. Amenities include a fitness center, recreational green space, laundry facility on every floor, mail room, resident lounge and 24-hour emergency maintenance. Future amenities will likely include an outdoor dog park and bike parking. PK Housing and Management is managing the community.

ST. PAUL, MINN. — Dominium has completed the final phase of Upper Post Flats, a 192-unit affordable housing development that repurposed buildings at the historic Fort Snelling site in St. Paul. Minneapolis-based BKV Group served as the architect. Preference is given to residents who are military members, veterans, first responders and their families. The 42-acre site included 26 buildings, including barracks, an administration building, gymnasium, morgue and hospital, all of which have been transformed into a residential community. Floor plans range from 285 to 2,676 square feet. The individual buildings were in poor condition, as some had stood vacant since the 1970s. But the project team was able to salvage original walls, doors and windows, entryways and staircases in many of them. Buildings requiring a more extensive structural overhaul were rebuilt to historical standards. Getting the project off the ground took years and the combined efforts of a public-private partnership that included the site’s owner, the Minnesota Department of Natural Resources, the National Park Service, Hennepin County, Minneapolis Park and Recreation Board and the Minnesota Historical Society, which operated the historic fort. Low-Income Housing Tax Credits contributed $70 million of the project’s $160 million total cost, making the below-market-rate rents …

Commercial property conversions can offer significant advantages over conventional ground-up real estate developments. Conversions can provide a head start on construction with established entitlements, existing structures, in-place utilities and entry to choice locations in otherwise built-out submarkets. Consider the Universal Buildings, Post Brothers’ conversion of two 1960s-era office buildings into more than 600 residential units and ground-floor retail just north of the District of Columbia’s Dupont Circle. The 15-story complex will feature a two-level, glass-walled fitness and recovery center with more than 10,000 square feet of training zones, equipment and classrooms. The developer is housing the fitness center and other amenities in a new atrium that replaces the upper levels of structured parking originally built within one of the former office buildings. “The location is incredible — there is probably no greater location in any major city in the country for conversion,” says Josh Guelbart, Post Brothers’ Co-Chief Operating Officer. “Having the entire block means we have light, air and hilltop views of Kalorama, Adams Morgan and Dupont Circle, three of the finest residential neighborhoods in the District. There isn’t room for new buildings of scale in those neighborhoods, and that really made this existing, large building attractive to us.” …

— By Carina Mills and Maura Schafer — In 2017, partner design firms RDC and Studio One Eleven (RDC-S111) relocated from a high-rise office to a former 25,000-square-foot Nordstrom Rack at 245 E. Third Street in downtown Long Beach, Calif. The store was located in a 1980s-era shopping center that had fallen into serious decline. On the plus side, the location was consistent with Studio One Eleven’s mission of urban repair, allowing for a pedestrian-level interaction with the neighborhood, while strengthening the city fabric. Soon enough, the retail space was converted into a modern creative office that added 130 design professionals to the neighborhood’s daytime population. This higher-use conversion occurred alongside other public and private investments that brought restaurants into the area. These included Ammatoli (a Los Angeles Times Top 100 restaurant), Beachwood Brewery, Rainbow Juices and Michael’s Pizzeria, among others. The adjacent Harvey Milk Park garnered grants for a reinvigoration by Studio One Eleven, and developers started working on housing development around the immediate neighborhood. This move and project was not only a chance for RDC and Studio One Eleven to create urban impact, but to design an environment for staff that instills creativity, collaboration and wellness. The office achieved …

The term “adaptive reuse” in real estate circles typically conjures images of repurposing old, obsolete commercial buildings. Meanwhile, academic buildings, administrative offices and other properties on college campuses rarely come to mind. But NAI has noted a growing need among higher learning institutions with vacant or underused assets, particularly as a result of growing online learning options, says Larry Gautier, senior vice president of NAI Miami | Fort Lauderdale. As a result, the brokerage is focused on finding solutions for schools. “NAI hasn’t historically been involved with higher institutions of learning — we’ve typically focused on conventional real estate transactions,” Gautier acknowledges. “But a few years ago, when students weren’t going in to class, colleges and universities were facing a challenge: what do you do with facilities — that were built for thousands of students — in a remote-learning setting? For many schools, remote learning is here to stay.” Options include leasing buildings to commercial users or entering a joint venture with, for example, an aerospace or engineering company for educational programs, he adds. Colleges that suddenly have vast unused parking lots could also enter into long-term leases with multifamily, office or mixed-use developers. “Our position is to help these schools create …

Cornerstone Community Development to Break Ground on $51M Adaptive Reuse Project in Huntington, West Virginia

by John Nelson

HUNTINGTON, W.VA. — Cornerstone Community Development Corp. plans to convert the historic Prichard Hotel in downtown Huntington into an affordable seniors housing property. The $51 million renovation will comprise converting the former hotel rooms into 108 residential living spaces, as well as repositioning the first two floors for healthcare services and additional community resources. Cornerstone Community Development’s partners on the project include Christ Temple Church, Winterwood Development and CVS Health, which is investing more than $17 million in the project. The timeline for construction was not disclosed.

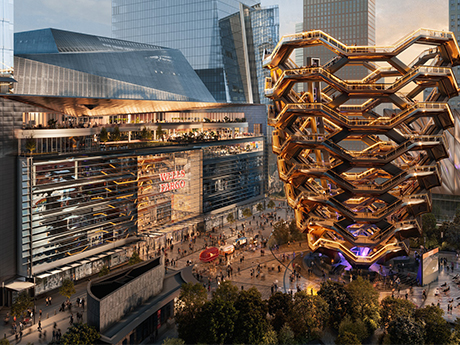

Wells Fargo Plans 400,000 SF Adaptive Reuse Office Project at Hudson Yards in Manhattan

by John Nelson

NEW YORK CITY — Wells Fargo & Co. (NYSE: WFC) has announced formal plans to expand its office footprint within Hudson Yards, a mixed-use district on Manhattan’s west side. The San Francisco-based banking giant, which already occupies space within the $25 billion Hudson Yards campus, has purchased additional space from Related Cos., the master developer behind Hudson Yards along with Oxford Properties Group. Multiple media outlets have reported that Wells Fargo purchased the space at 20 Hudson Yards, which formally housed a Neiman Marcus store, for $550 million. The bank plans to convert the 400,000 square feet of space to offices in synergy with its current 500,000-square-foot footprint at 30 Hudson Yards, according to Bloomberg News. Forbes reported that the Neiman Marcus location closed in summer 2020. Wells Fargo plans to begin moving employees from its existing office space at 150 E. 42nd St. to the new Hudson Yards office beginning in late 2026. The property is expected to house 2,300 Wells Fargo employees at full operation. The 11-story building will also include a dedicated entrance on 10th Avenue and naming rights to Wells Fargo for signage on the exterior of the property. “This investment further solidifies our longstanding commitment …

BWE Secures Financing for 362,710 SF Adaptive Reuse Industrial Facility in Fort Pierce, Florida

by John Nelson

FORT PIERCE, FLA. — BWE has secured an undisclosed amount of permanent financing for a converted industrial facility in Fort Pierce, a city midway between Orlando and Miami. Situated near I-95 and the Florida Turnpike, the 362,710-square-foot flex property was formerly Orange Blossom Mall. Now known as Renaissance Business Park, the property features loading docks, drive-in loading, private restrooms, HVAC, 18-foot clear ceilings, a fiber optic cable feed and a suite of interior and exterior security cameras and fire safety measures. The borrower and owner, Fort Lauderdale-based Prime Rock Real Estate Capital, recently made exterior improvements to the property, including a new roof, façade, irrigation system, sewer line, signage, overhead doors for tenant spaces, driveways for tenant entrances, outdoor lighting, overhauled landscaping and modern flood protection. Kevin Hicks and Michael Powell of BWE originated the loan through an unnamed life insurance company on behalf of Prime Rock.

UPPER DARBY, PA. — Dwight City Group, the investment arm of New York City-based lender Dwight Capital, has completed a multifamily adaptive reuse project in Upper Darby, a western suburb of Philadelphia. The project converted a 125,000-square-foot warehouse at 901 Quarry St. that was constructed in 1925 and had been dormant for three decades into an 84-unit apartment complex. The complex now features one- and two-bedroom units and amenities such as a playground and dog park. Rents start at roughly $1,500 per month for a one-bedroom apartment.