The U.S. industrial real estate market continues to sustain, with national vacancy rates steadily creeping toward 7 percent (6.8 percent at the time of this writing). Over the past three years, the industrial real estate market continued to set records and became known as the darling asset class within the commercial real estate community. However, the market is showing signs of reversion to historical velocity and vacancy rates. The industrial vacancy rate is steadily climbing in the Washington, D.C., metro area as demand softens for third-party logistics in second-quarter 2024. Vacancies are up to 6.5 percent after reaching an all-time low of 3.8 percent at the end of 2022. The market remains tight by historical measures. However, normalized leasing velocity, a few large tenant moveouts and reduced demand is expected to provide upward pressure on the vacancy rate in 2025. Subleasing activity trended upward in the past six to 12 months to over 1.3 million square feet. A few examples of large sublets include 393,000 square feet put on the market at Capital Gateway in Brandywine; Builders First Source moved out of 135,000 square feet at Plaza 500 in Alexandria; and in the second quarter, Western Express vacated 102,000 square …

Southeast Market Reports

The multifamily market in the Washington, D.C., metro area has experienced meaningful shifts in 2024, marked by moderate demand, consistent construction and evolving investment patterns. As a major urban hub, D.C. continues to attract both local and out-of-state investors eager to tap into its growing potential. Out-of-state capital A key trend in the D.C. multifamily market is the strong influx of out-of-state capital. This year, 44 percent of buyers in our DMV (D.C., Maryland and Virginia) listings came from outside the region, drawn by the area’s stability and long-term growth potential. These out-of-market investors often pay a premium over local buyers, keeping deal volume and pricing competitive even amid rising interest rates. This steady inflow of external capital has reinforced the market’s resilience, underscoring the perceived value of D.C. multifamily assets. The demand from out-of-state investors has also provided stability to the market, helping to sustain price levels and liquidity despite macroeconomic headwinds. By bolstering interest in multifamily properties, this capital flow supports continued growth and positions D.C. as a desirable destination for long-term investment. As this trend persists, the D.C. metro area is likely to remain a focal point for diverse capital sources, ensuring strength and adaptability in its …

Atlanta remains one of the most desirable markets in the country for investors due to its diverse economy, below-national average unemployment rate, steady increase in jobs and population growth. These market fundamentals have translated to a well-performing multifamily market that, despite short-term macro challenges, is in a unique favorable position due to its relatively low supply compared to other peer Sunbelt markets. Demand for multifamily has seen a rebound in 2024 and Atlanta has been resilient in the middle of a multi-year supply wave. Over the past two years, the market delivered approximately 35,000 units and that number is expected to drop to just 9,000 units in 2025 and less than 4,000 units in 2026. This will lead to tightening occupancies and strong rent growth. The city has already recorded its seventh consecutive quarter of net positive net absorption as of the second quarter of 2024, which is a quarterly high since mid-2021 at 5,799 units. New development, on the other hand, has been a bit more challenging due to the higher return on cost requirements, flat rent growth and a lack of meaningful relief on construction costs. Market valuations for newly constructed assets are near current replacement cost, which …

Atlanta’s office market feels like a story of winners and losers. Tenants continue to pay increasing rents for the best located, highest-quality spaces while the sector overall experiences negative office absorption. Those big, shiny objects, so to speak, offer quite a contrast to the results of continued office sector adversity brought on by reduced office attendance, a downsizing leasing trend and swelling sublet space. Who’s in the best position to win? Well-capitalized owners with stabilized debt (or none) that can meet the increasing tenant demands for skyrocketing tenant improvement costs and other rental concessions. With continued construction cost increases and downward pressure on base rental rates, fiscally sound landlords with longer-term business plans are in the best position to transact. And, of course, the newest buildings with the best location, amenity package and a reasonable commute for the majority of the workforce continue to thrive. CoStar Group reports that during the past 12 months, net absorption in office buildings completed before 2020 was negative 4 million square feet compared to 1.1 million for newer properties. The Atlanta office market has produced some sizable transactions this year, fueling some optimism among landlords with larger blocks of space for lease. The most …

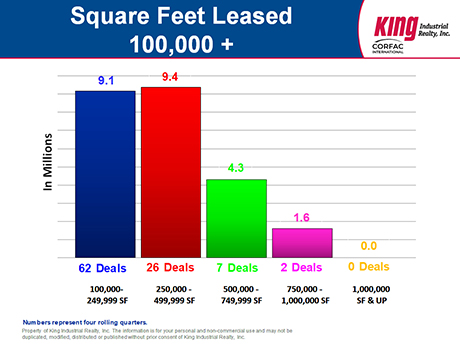

As the Atlanta industrial market continued its slowdown as of the end of the second quarter in 2024, there were three main stories to consider. First, the biggest news was that the Atlanta industrial market experienced four quarters of negative net absorption of 8.8 million square feet during this past year (we have had five quarters in a row.) At the same time in 2023, we reported 17.2 million square feet of positive net absorption, and in 2022, we reported 42.7 million square feet of positive net absorption, so these latest negative absorption numbers were a huge drop from the previous positive absorption numbers. The second biggest news story was that the Atlanta industrial market saw a dramatic slowdown in big-box deals. There were only nine transactions that were consummated over the past four quarters that were 500,000 square feet or larger, and none of those deals were over 1 million square feet. In contrast, in 2023, 21 big-box transactions were completed that were over 500,000 square feet, and 11 of those deals were 1 million square feet or larger. The year-over-year decline was 15 million square feet less. The third biggest news story was that the new construction …

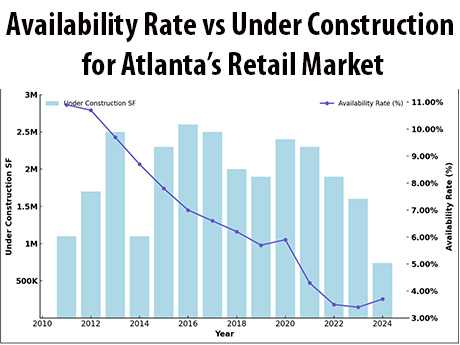

The Atlanta retail market continues to thrive with significant growth driven by a combination of strong demand, minimal new construction and low inventory levels. Long regarded as a key hub for commerce in the Southeast, metro Atlanta has seen its population increase rapidly over the years, which has, in turn, bolstered retail demand. As a result, Atlanta’s retail availability has hit record lows and has created a competitive market for tenants looking to secure high-quality spaces. Rental rates have increased, and investment sales volume has continued at a healthy pace as tenants vie for a limited amount of inventory. Rising rents, investment sales One of the standout trends in Atlanta’s retail market is the consistent increase in rental rates. Retail rents in the metro area have grown steadily over the past few years, with average rents rising from $21.07 per square foot in first-quarter 2023 to $22.83 per square foot by third-quarter 2024. This represents an impressive 5.2 percent year-over-year growth, significantly outpacing the national average of 2.4 percent. The city’s growing population and economic development have spurred greater demand for retail spaces, especially in high-traffic areas. Retailers are willing to pay premium rates to secure space in desirable locations, …

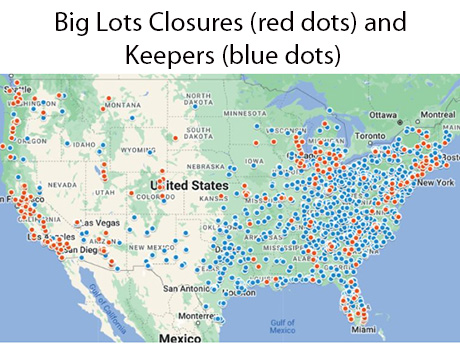

As someone who has closely observed retail trends in the Southeastern United States for decades, I’ve witnessed the inevitable ebb and flow of the industry. From periods of rapid expansion to challenging market corrections, and of course, global pandemics that disrupted every sector of real estate, it often feels as though I’ve ‘seen it all.’ Once again, I find myself watching the market adjust, particularly among big-box retailers, in high-growth areas like Raleigh. This ongoing shift signals both challenges and opportunities, reminding me of the resilience and adaptability required to thrive in this dynamic environment. When news broke in September that Big Lots Inc. had filed for Chapter 11 bankruptcy protection and that it would be closing more than 300 stores across the country, it wasn’t all that shocking, given the sheer number of Big Lots that one comes across just driving across their own towns. The Big Lots announcement follows similar moves by companies such as rue21, Express, The Body Shop, 99 Cents Only Stores, LL Flooring, Conn’s, and Red Lobster. Retailers like Rite Aid and Bed Bath & Beyond, which filed for bankruptcy last year, have closed hundreds of stores, causing vacancies in the retail real estate market. …

In our state of the market overview article in Southeast Real Estate Business October 2023, we defined three challenges in the metro New Orleans multifamily market. These are interest rates, inflation and insurance — or as we dubbed them “the three I’s.” Not to be redundant; however, a year later these elements are still very much factors in the current market and continue to define how multifamily assets are acquired, sold, financed and developed. There is, however, reason for optimism as each of these defining elements has diminished, albeit not completely, from where they were 12 months ago. Interest rates — On Sept. 18, the Federal Reserve reduced short-term rates by 50 basis points — the first reduction in four years. More importantly was the decline in the rate of the 10-year Treasury yield, which is what most multifamily loans are priced from. As of this writing, the 10-year Treasury yield was at 3.76 percent, the lowest it has been in the past 16 months. A further reason for optimism is the fact that the Fed has indicated the potential for four rate cuts next year. There is also the anticipation of further clarity in the capital markets once the …

Despite healthy local market dynamics, the greater New Orleans industrial market did not perform as strongly as insiders expected it to perform over the past 12 months, which is indicative of wider economic factors suppressing a market with pent-up demand. The Port of New Orleans and its access to major shipping routes along the Mississippi River has long been the principal component for industrial real estate in the area. The recent 2024 regular session of the Louisiana Legislature committed $230.5 million to Port of New Orleans infrastructure projects, including allocations to the Louisiana International Terminal, a $1.8 billion project in Violet, La., scheduled to be operational in 2028, which will be the Gulf South’s premier container shipping gateway able to accommodate New Panamax- and Post New Panamax-sized vessels. A bit further up the Mississippi River but still in the greater New Orleans region, Canadian company Woodland Biofuels announced a $1.35 billion investment at the Port of South Louisiana in Reserve, La., to establish the largest renewable natural gas plant in the world. The facility will take waste wood and sugar cane and turn it into natural gas. The process will be carbon-negative, leaving less carbon in the atmosphere than before …

A combination of short sales, declining occupancy rates, loan concerns and migration to suburban offices contribute to uncertainty in the New Orleans office market. As we approach the fourth quarter of this year and begin to reflect back on the market in 2024, the challenges unfortunately outweigh the opportunities. Two notable cases include The DXC Technology Center and The Energy Centre. The DXC Technology Center, located at 1615 Poydras St. in the Central Business District (CBD), a once-prized office tower anchored by Freeport McMoRan, sold for less than $37 per square foot. The building, over 500,000 square feet, traded for $18.5 million, significantly below the remaining debt on the property. The New Orleans Police Department recently signed a lease to occupy approximately 45,000 square feet in the building, which lessens the steep decline in the building’s value. The Energy Centre, located at 1100 Poydras St., is one of the most desirable and best-performing Class A towers in the CBD. It entered receivership, but the building is back on track and is rumored to be nearing a sale. The building owner, The Hertz Group, controls four additional Class A office towers on Poydras St. (400, 650, 701 & 909 Poydras St.), …