MINNEAPOLIS – CEDARst Cos., a national multifamily developer, has closed $170 million in capital with plans to develop 358 apartment units above 40,000 square feet of retail space along North Sixth Avenue in the North Loop neighborhood of Minneapolis. CEDARst has invested nearly $250 million of capital in the North Loop over the past two years, having successfully developed the Duffey, its first development in the submarket consisting of 188 apartment units, located at the corner of North Sixth and North Washington avenues. CEDARst’s second development, Duffey 2.0, consists of both an adaptive reuse and ground-up component. It is located within a landmark overlay and required approval from the National Park Service for the procurement of historic tax credits at the state and federal level. This represents CEDAR’s seventh tax credit development. In addition to syndicating over $30 million of tax credits, CEDARst partnered with ULLICO on a $101 million construction loan and Pearlmark on a $12 million structured finance investment. The remaining $27 million was CEDARst equity. Pat Minea and Dan Trebil of Northmarq arranged the financing on behalf of CEDARst. CEDARst has already broken ground and plans to complete the development by the end of 2023. BKV is …

Multifamily

INDIANA — Cushman & Wakefield has brokered the sale of a six-property multifamily portfolio totaling 2,103 units in Indiana for an undisclosed price. The portfolio includes Boardwalk at Westlake, Elliot at College Park, Lakeshore Reserve off 86th, Lakeside Crossing at Eagle Creek, Parkside at Castleton Square and Preserve at Allisonville. George Tikijian, Hannah Ott and Cameron Benz of Cushman & Wakefield represented the seller, a joint venture between Wilkinson Corp. and Torchlight Investors. Morgan Properties was the buyer. The seller renovated a number of units, and the buyer plans to continue doing so.

BELLEVILLE, ILL. — Southwestern Illinois Development Authority (SWIDA) and Bywater Development Group have completed the $14.2 million transformation of a 90-year-old building in Belleville into an affordable active adult community named Lofts on the Square. The building originally opened in 1931 as the Hotel Belleville. It was renovated in the early 1960s and converted into a residential community for seniors known as the Meredith Home. The building sat vacant for 10 years before SWIDA and Bywater acquired it from the city for $600,000. In 2018, the property earned a place on the National Register of Historic Places, making it eligible for federal and state historic tax credits. Holland Construction Services served as general contractor for the renovation project. Units are designated for residents age 55 and older who earn at or below 60 percent of the area median income. The six-story building is comprised of 47 units and more than 3,000 square feet of street-level commercial space. Amenities include a common room, library, computer lab, exercise room and storage facilities. Joining Holland on the construction team were Blank, Wesselink, Cook & Associates and Kaskaskia Engineering Group LLC, which handled the engineering; Louer Facility Planning Inc. for interior design; and WJW …

REDMOND, WASH. — CBRE has arranged the $35 million sale of a land parcel in downtown Redmond to an undisclosed buyer. Eli Hanacek, Jon Hallgrimson, Mark Washington and Kyle Yamamoto of CBRE represented the undisclosed seller in the deal. Located at 16135 NE 85th St., the 99,883-square-foot parcel is fully entitled for the development of 425 multifamily units. Initial plans proposed prior to the sale called for two nine-story apartment towers with one-, two- and three-bedroom floorplans and ground-floor retail space. The site is within walking distance of the future Downtown Redmond Link light rail station, which is slated for completion in 2024.

SPOKANE, WASH. — Kidder Mathews has arranged the combined $5.5 million sales of two multifamily properties in Spokane. Max Frame of Kidder Mathews represented the undisclosed separate buyers in each transaction. The Lloyd, a multifamily property located on the corner of West Mansfield Avenue and North Monroe Street in Spokane, sold for $4.3 million. Built in 1911, the property features 33 residential units and four commercial units. The buyer plans to renovate the entire building. Built in 1910, The Annie features two buildings offering a total of 11 units. The property, which is located at 1022 W. Sinto Ave., sold for $1.2 million.

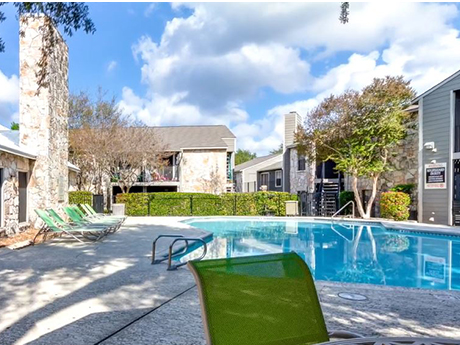

SAN ANTONIO — Walker & Dunlop has arranged a loan of an undisclosed amount for the refinancing of The Place at Castle Hills, a 680-unit apartment community located on the north side of San Antonio. Built in 1984, the garden-style property comprises 52 buildings that house one- and two-bedroom units with walk-in closets and private balconies/patios. Amenities include four pools, a fitness center, outdoor picnic areas and a Wi-Fi lounge. Alex Inman, Jon Hyduke, René Jaubert, Harrison Hoskins and Hannah Coen of Walker & Dunlop arranged the loan on behalf of the borrower, Arizona-based investment firm MC Cos.

JERSEY CITY, N.J. — JLL has brokered the $31.9 million sale of Solaris Lofts, a 72-unit apartment complex located within the Bergen-Lafayette neighborhood of Jersey City. Built in 2019, the property features one-, two- and three-bedroom units and amenities such as a fitness center, dog park, resident lounge, coworking areas and an onsite grocery store and deli. Michael Oliver, Jose Cruz, Steve Simonelli, Kevin O’Hearn and Josh Stein of JLL represented the seller, PERE Holdings, in the transaction. The buyer was New York City-based Beachwold Residential.

STORRS, CONN. — Locally based brokerage firm Chozick Realty has negotiated the $12.5 million sale of Orchard Acres, a 96-unit multifamily property in Storrs, home of the University of Connecticut. Built in 1963, the property is situated adjacent to the north end of campus and exclusively offers one-bedroom units. Tom Boyle of Chozick Realty represented the seller, a Massachusetts-based entity doing business as Orchard Acres Apartments LLC, in the deal. Steve Pappas with Chozick Realty represented the buyer.

Marcus & Millichap Brokers $49M Sale of Affordable Housing Community in Fort Myers, Florida

by John Nelson

FORT MYERS, FLA. — Marcus & Millichap has brokered the $49 million sale of The Brittany, a 320-unit affordable housing community located at 4050 Winkler Ave. in Fort Myers. Evan Kristol of Marcus & Millichap represented the seller, a private investment firm based in New York City, and procured the buyer, an entity doing business as Dominium Acquisition LLC. Built in two phases in 1999 and 2000, The Brittany features large floor plans ranging in size from 771 to 1,444 square feet, three-fourths of which are two-, three- and four-bedroom units. Amenities at the LIHTC property include a gated swimming pool with a large sundeck and cabanas, business center, fitness center, two playgrounds, basketball courts, a car wash and a community van. The new ownership will continue to operate The Brittany as affordable housing.

Bonaventure Breaks Ground on 133-Unit Seniors Housing Development in Alexandria, Virginia

by John Nelson

ALEXANDRIA, VA. — Bonaventure, a locally based multifamily developer and manager, has broken ground on a 133-unit seniors housing project in Alexandria’s Old Town West neighborhood. The six-story property will feature studio, one- and two-bedroom units, as well as underground parking, an onsite restaurant, 24-hour fitness center, club lounge, business center, media room, community garden and an outdoor gazebo. The unnamed property will be situated within walking distance of the Braddock Road Metro Station, as well as I-495, King Street and Ronald Reagan Washington National Airport. Bonaventure expects to complete construction and begin welcoming renters in late 2023.