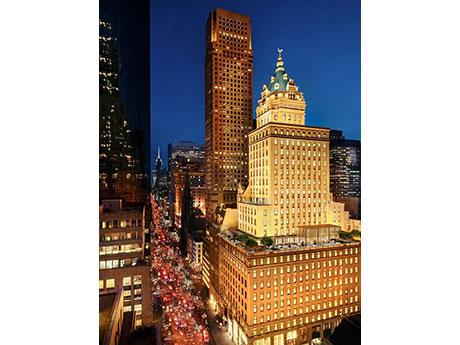

NEW YORK CITY — Walker & Dunlop Inc. has arranged $754 million in financing for Aman New York, a luxury hotel and condo development in Midtown Manhattan. Aman New York occupies the top 20 floors of the 100-year-old Crown Building at the corner of 57th Street and Fifth Avenue, across the street from Trump Tower. OKO Group was the developer. The 95,000-square-foot residential portion includes 22 units, while the 117,000-square-foot hotel section contains 83 guest rooms and suites. The rooms are among New York’s largest, and the hotel is the only one in New York to offer working fireplaces in each room. The lower floors of the building remain retail space. The hotel portion is scheduled to open on Tuesday, Aug. 2. Reservations will be available beginning Monday, July 25. The development is Aman’s first U.S. urban residence project and provides special features for owners such as private entrances, plus access to three dining venues, a jazz club, wine room and 25,000-square-foot Aman Spa. Nearly all of the condos are pre-sold, with one of the units selling for $55 million, marking one of the priciest residential transactions in New York so far this year. Originally built in 1921, the Crown …

Multifamily

TAMPA, FLA. — JLL has provided a $76.7 million Freddie Mac loan for the refinancing of Hamilton Point on Egypt Lake, a 638-unit apartment community located at 6900 Concord Drive in west Tampa. Elliott Throne and Kenny Cutler of JLL originated the 10-year, floating-rate loan on behalf of the undisclosed borrower. Situated near several public beaches and Hyde Park Village, Hamilton Point on Egypt Lake features one-, two- and three-bedroom units that average 858 square feet in size. Amenities include two swimming pools, a lakefront sand volleyball court, clubhouse that can be reserved for events, fitness center, two tennis courts, reserved covered parking, a children’s playground and an onsite laundry facility.

LINCOLNTON, N.C. — A joint venture between Magma Equities and Prudent Growth Partners has purchased The Oaks Apartment Homes, a 111-unit multifamily community located in the Charlotte suburb of Lincolnton. The duo purchased the property from the undisclosed seller in an off-market transaction for $17.8 million. Built in 2002, The Oaks comprises one-, two- and three-bedroom apartments located on an 11.7-acre site. Community amenities include a fitness center, basketball court, grilling area, playground and a dog park. The community was 97 percent occupied at the time of sale.

HOUSTON — Berkadia has brokered the sale of The Life at Spring Estates, a 372-unit apartment community in Houston’s North View neighborhood. The Life at Spring Estates features one-, two- and three-bedroom units ranging from 1,017 to 1,332 square feet. Amenities include a pool, fitness center, business center, clubhouse, bark park, picnic areas and parcel lockers. Chris Young, Joey Rippel, Kyle Whitney, Jeffrey Skipworth, Todd Marix and Chris Curry of Berkadia represented the seller, New York City-based Olive Tree Holdings, in the transaction. The buyer, Nashville-based Inman Equities, purchased the asset for an undisclosed price.

LEAGUE CITY, TEXAS — Memphis-based investment firm Fogelman Properties has acquired The Moorings, a 201-unit apartment complex in League City, a southeastern suburb of Houston. The Moorings, which was 95 percent occupied at the time of sale, offers recently upgraded units in one- and two-bedroom floor plans. Amenities include a pool, fitness center, game room, outdoor lounge areas and Amazon package lockers. The seller and sales price were not disclosed.

MOORE, OKLA. — Northmarq has arranged a $9.2 million bridge loan for the acquisition of Mansions South Apartments, a 146-unit multifamily property in Moore, a southern suburb of Oklahoma City. Built in 1972, the property comprises 12 two-story buildings that house one-, two- and three-bedroom units. Amenities include a pool, fitness center, clubhouse, volleyball and basketball courts and a playground. Bob Harrington of Northmarq arranged the loan, which features two years of interest-only payments. The borrower and direct lender were not disclosed.

ADA, MICH. — Syndicated Equities has sold Stone Falls of Ada, a 210-unit luxury apartment complex in Ada, about 10 miles east of Grand Rapids. The sales price was $71.5 million. Syndicated acquired the property with Highgate Capital Group LLC in 2018 for $45.8 million. Built in 2008, the property at 330 Stone Falls Drive is comprised of 21 two-story buildings. Syndicated and Highgate invested $1.5 million in renovations, including upgrades to the unit interiors and clubhouse amenities. Village Green was the property manager. The seller was undisclosed.

GREEN, OHIO — Metropolitan Holdings has received approval from the Green City Council to build a 298-unit luxury multifamily project. The 49-building property will include amenities such as a heated pool, outdoor area and fitness center. The average monthly rent is expected to be $1,700, while the average for premium units will be $2,495. Metropolitan plans to break ground later this year. A timeline for completion was not provided. Green is located about 13 miles south of Akron.

CHAMPLIN, MINN. — Northmarq has arranged a $40 million loan for the refinancing of The Bowline at Mississippi Crossings in Champlin, a northern suburb of Minneapolis. The 212-unit luxury apartment community is located at 220 E. River Parkway. The property features views of the Mississippi River along with a pool, theater, coworking lounge, coffee bar and fitness studio. The Bowline is part of the larger master-planned development known as Mississippi Crossings. Monthly rents at The Bowline, which opened this year, average $1,905, according to Apartments.com. Patrick Minea of Northmarq arranged the fixed-rate, seven-year loan. A life insurance company provided the loan for the borrower, Minneapolis-based Greco.

New York Life Provides $55M Acquisition Loan for The Ridge Apartments Near Salt Lake City

by Amy Works

MIDVALE, UTAH — New York Life Investors has provided a $55 million loan to MAXX Properties for the purchase of The Ridge, a Class A multifamily property in Midvale. The fixed-rate loan features 10 years of interest-only payments. Built in 2017, The Ridge features 261 apartments. The property is located at 7611 S. Union Park Ave. Robert Prouty, Jordi DeHoyos and Katie Thompson of Colliers Mortgage advised the buyer on the financing. Rawley Nielsen, Darren Nielsen and Mark Jensen of Colliers International Salt Lake City brokered the transaction. MAXX Properties is a privately held, 86-year-old real estate firm consisting of multifamily, commercial and cooperatives. The firm’s portfolio includes 39 communities, consisting of 9,351 owned multifamily units in six states.